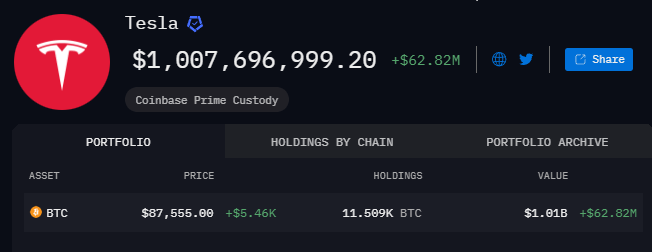

- Tesla holds 11,509 BTC worth more than $1 billion.

- El Salvador’s Bitcoin assets exceed $500 million.

- Unrealized profits from investments in MicroStrategy’s first cryptocurrency exceeded $10 billion.

- The German government lost $1.6 billion in profit by selling 50,000 BTC in the summer.

The value of digital gold on Tesla’s balance sheet has exceeded $1 billion as a result of its price increase. The company holds 11,509 BTC, Arkham data shows.

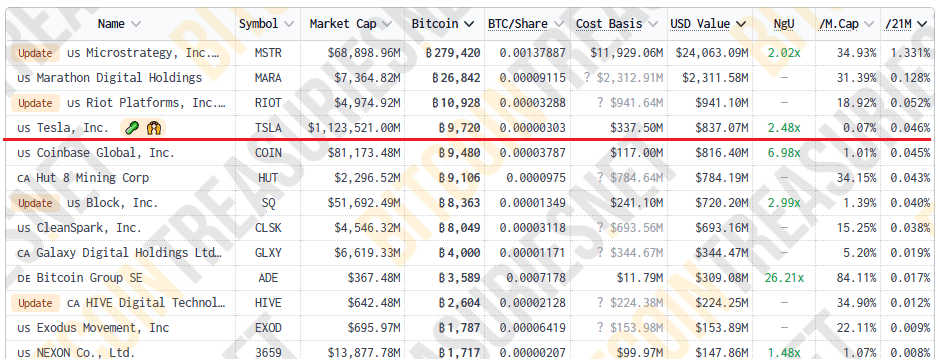

According to BitcoinTreasuriesthe electric vehicle maker is the fourth-largest corporate holder of the first cryptocurrency by reserves. According to the service, the company owns 9,720 BTC.

Rating of companies holding digital gold. Data: BitcoinTreasuries.

Rating of companies holding digital gold. Data: BitcoinTreasuries.

In February 2021, it became known that Tesla had invested $1.5 billion in Bitcoin. Musk called these investments “quite risky.”

In the spring of the same year, the company began selling electric cars for digital gold, but subsequently abandoned this option.

By the end of the second quarter of 2022, Tesla had converted approximately 75% of its cryptocurrency into fiat, bringing it $936 million.

The largest Bitcoin holder among public companies is MicroStrategy – it holds 279,420 BTC, acquired for $11.9 billion at an average rate of $42,692. At the time of writing, assets are valued at $23.75 billion. Unrealized profits exceeded $10 billion.

Salvador

The value of El Salvador’s Bitcoin assets has exceeded $500 million. The country holds 5,932 BTC, according to data Arkham.

In 2021, El Salvador recognized Bitcoin as legal tender on a par with the US dollar. Businesses are required to accept cryptocurrency for payment if they have the technical capabilities.

Subsequently, the country’s President Nayib Bukele announced purchases of digital gold, mining and other Bitcoin initiatives.

The state applies the DCA strategy by purchasing 1 BTC every day.

Bitcoin sellers in “paper loss”

The German government lost $1.6 billion in potential profit by selling 50,000 BTC for $2.88 billion in the summer of 2024. The average price of coins sold was $57,600.

In July, Bundestag member Joana Cotard criticized the sale of bitcoins confiscated by the authorities and called these actions counterproductive.

The German government is not the record holder for lost profits. The US government sold 195,091 BTC for $366.5 million as a result of 11 auctions, data shows tracker. At the current price of about $85,000, the US could gain $16.5 billion.

The strategy of the US authorities will probably change with the arrival of Donald Trump.

Stay informed! Subscribe to World Stock Market in Telegram.

Source: Cryptocurrency

I am an experienced journalist and writer with a career in the news industry. My focus is on covering Top News stories for World Stock Market, where I provide comprehensive analysis and commentary on markets around the world. I have expertise in writing both long-form articles and shorter pieces that deliver timely, relevant updates to readers.