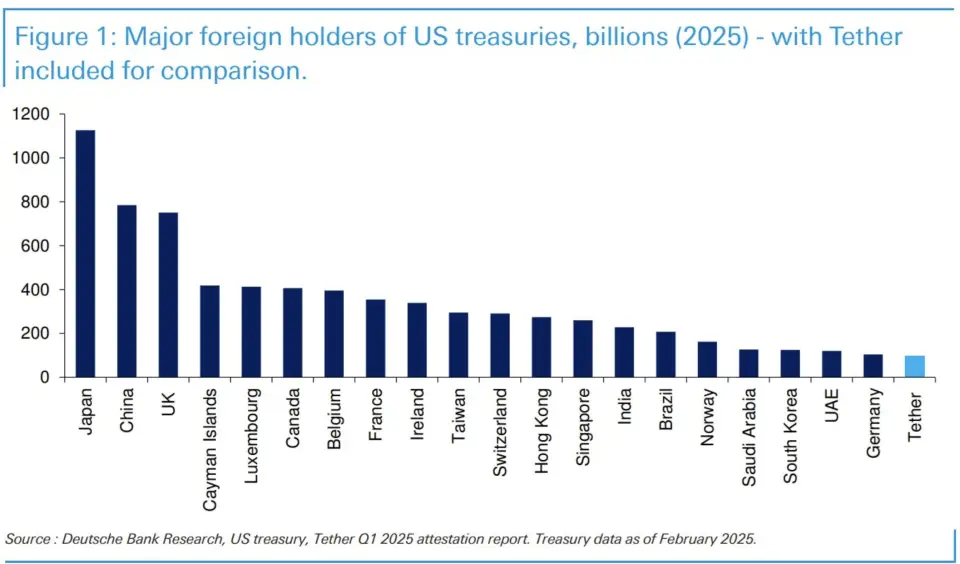

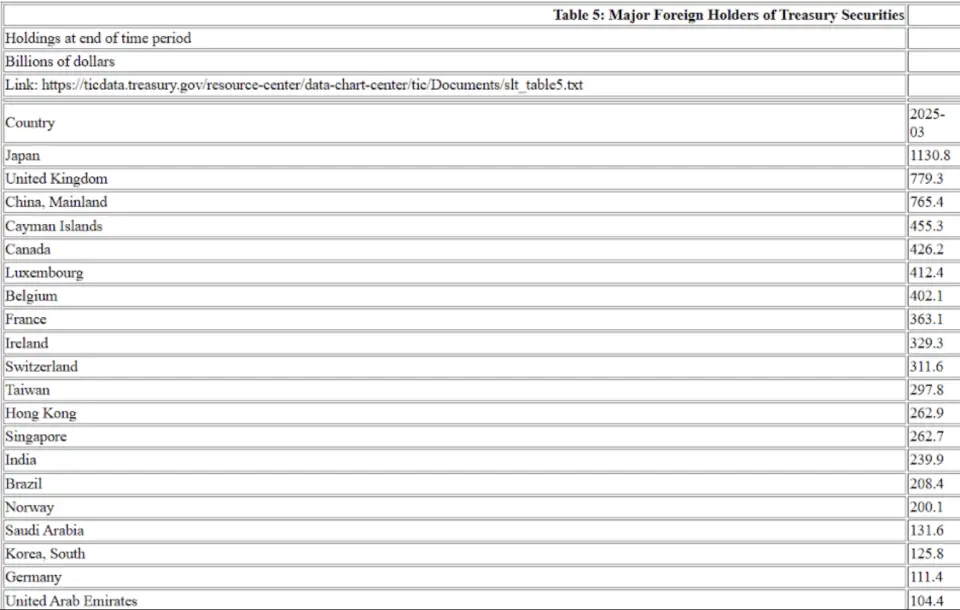

In early May, USDT issuer Reported The achievement of a new financial border, and also reported a record quarterly operating profit that exceeded $ 1 billion. According to Deutsche Bank, Tether is now ahead of Germany, the UAE and South Korea in terms of investment in the US Treasury bonds.

In his post on the platform X CEO of Paolo Ardoino (Paolo Ardoino) declared:

“In fact, I think we have already walked around Germany. The next goal is South Korea! ”

Ardinino statement confirmed The data of the US Department of Finance, which demonstrate that Tether has invested $ 120 billion in sovereign debt securities (compared with $ 111.4 billion in Germany).

Ardoino said that Tether’s growth in operating income was possible thanks to a sustainable demand for USDT, where US treasury bonds act as one of the strategic reserve assets, along with gold and some financial assets. Tether assured that the company’s gold reserves “almost completely compensated” the losses associated with the volatility of the cryptocurrency market.

Earlier, Tether reported on the purchase of 4812.2 bitcoins in the amount of $ 458.7 million for the Twenty One Capital, which is waiting for a merger with Cantor Equity Partners.

Source: Bits

I am an experienced journalist, writer, and editor with a passion for finance and business news. I have been working in the journalism field for over 6 years, covering a variety of topics from finance to technology. As an author at World Stock Market, I specialize in finance business-related topics.