As the on-chain indicators show, the number of bitcoins on the balance sheet of cryptocurrency exchanges began to decline again, while institutional investors began to increase the volume of investments in BTC.

Stocks BTC on xchanges

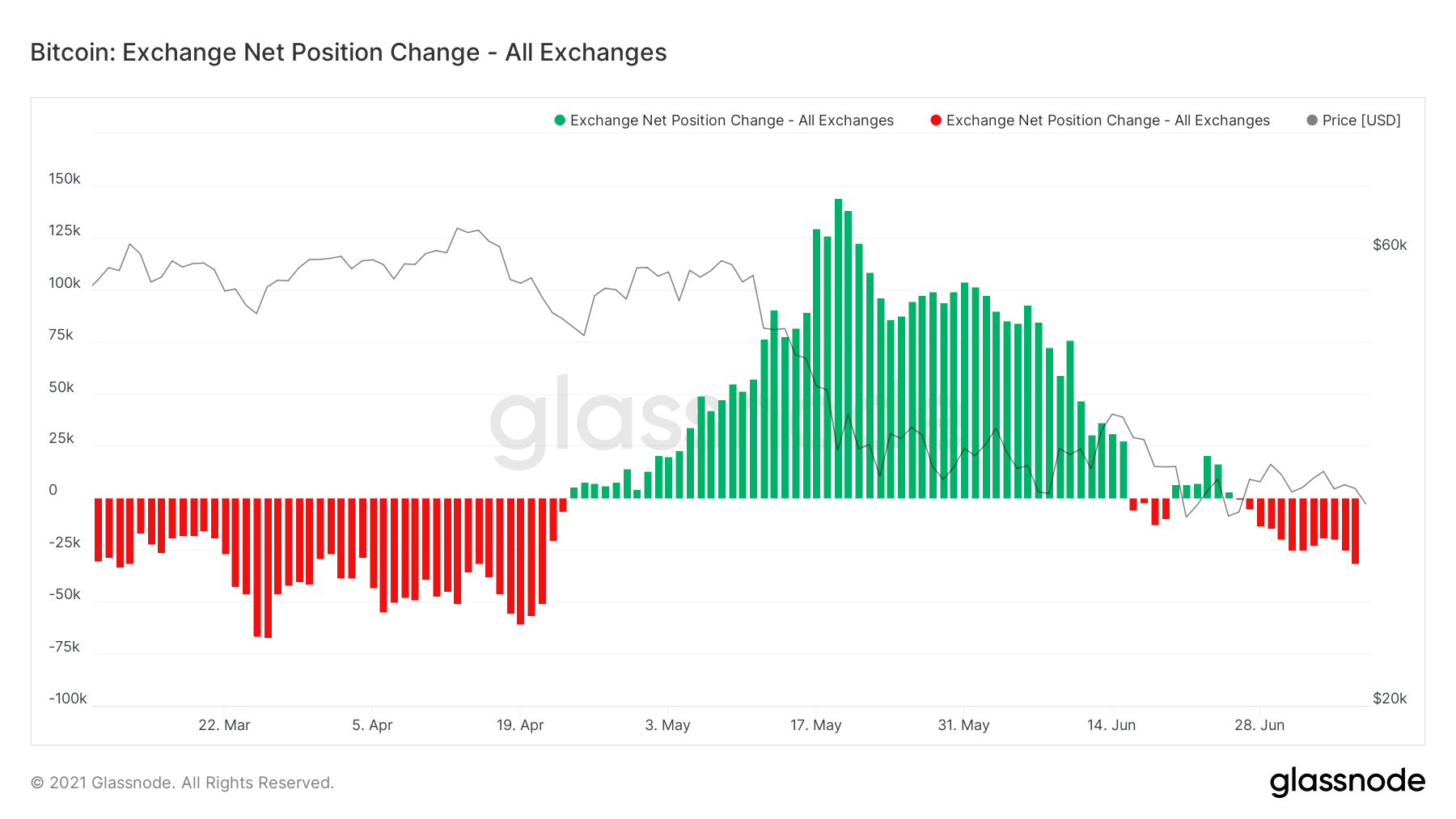

The total amount of BTC stored on cryptocurrency exchange addresses has been declining since March 2020, when the bitcoin rate plummeted to lows.

The indicator reached its lowest on April 12 this year, when it amounted to 2,461,840 BTC. At that time, the main cryptocurrency of the world was trading near $ 60,000.

However, the recent drawdown has prompted many investors to start dumping their BTC holdings. As a result, the influx of coins to exchange accounts began.

Source: Glassnode

However, a new downward trend in this on-chain indicator has recently emerged. It happened on June 26th. A sharp drawdown occurred on July 7, when 31,045 BTC were withdrawn from exchange addresses.

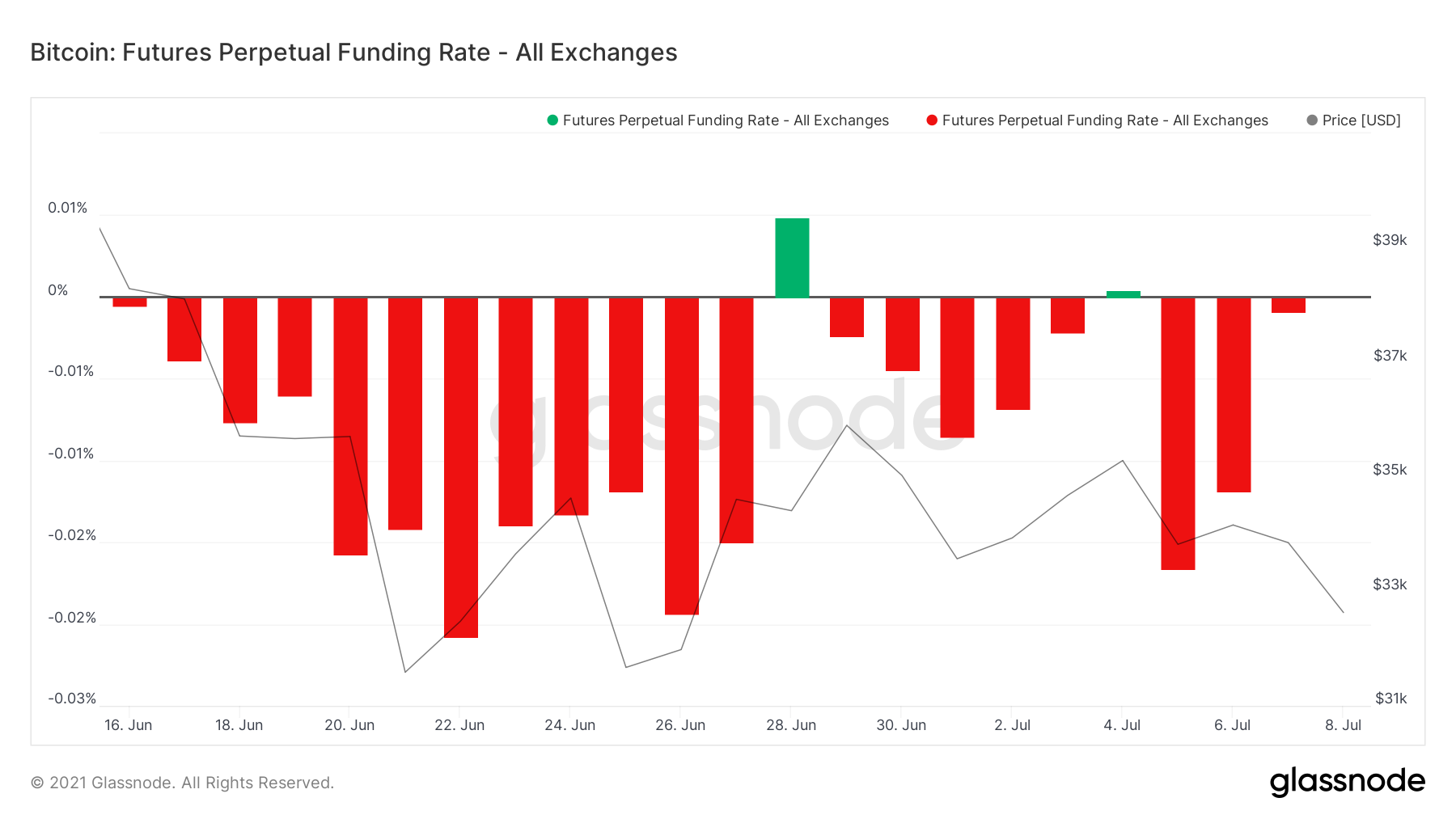

Meanwhile, the futures funding rate has remained in the red since June 16. The only exception was the day of June 28.

On July 7, this on-chain indicator reached a value of -0.001%, which is a sharp increase compared to the value of -0.017% from July 5.

Although the rate remains in the red, it reflects the growing confidence in the market situation on the part of futures traders.

Institutional investment in BTC

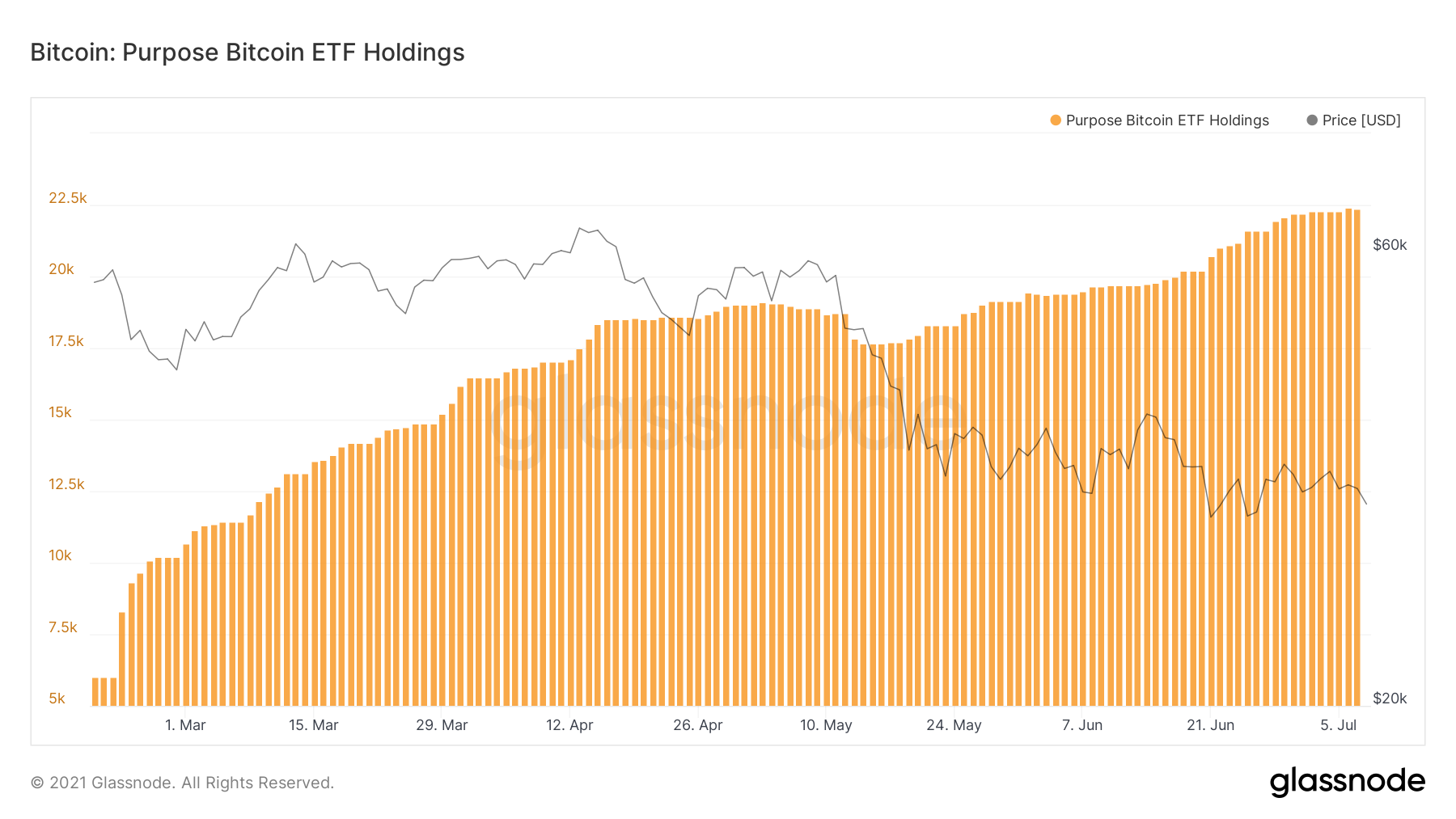

Despite the consistent drawdown of the BTC rate in recent years, the interest of institutions in investing in bitcoin does not fade away.

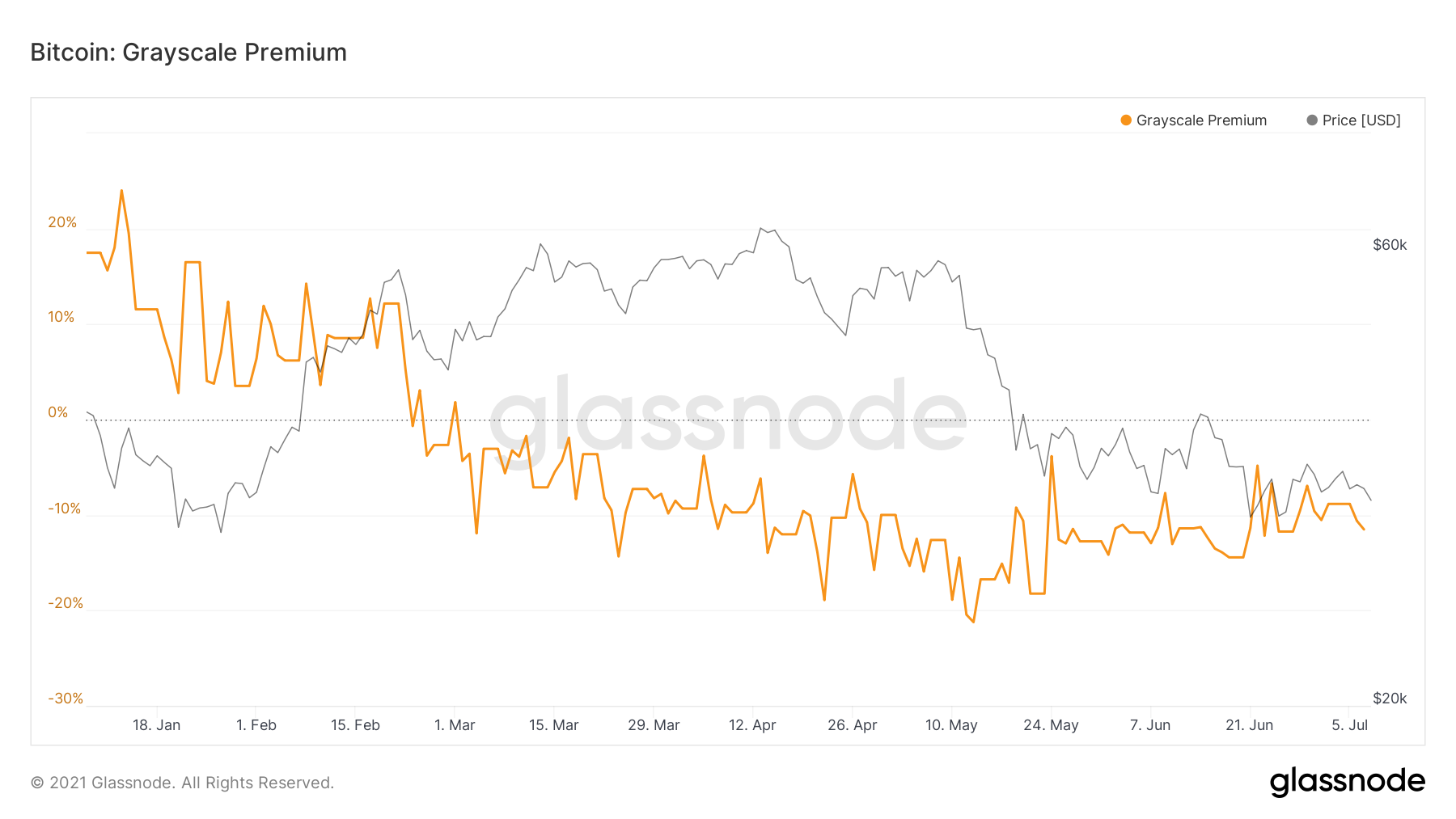

What’s more, two of the most prominent ETFs, Grayscale and The Purpose Bitcoin ETF, have seen consistent gains since March. This could be an indication that institutional investors were buying on the dips.

Purpose Bitcoin ETF Holdings demonstrated particularly remarkable growth. On July 6, the size of his BTC reserves reached an all-time high of 22,411 coins.

We can also note the recovery of the Grayscale premium for bitcoin trust. If on May 13 it traded 21.23% lower than the actual value of BTC on the market, now it has narrowed the gap to 11.51%. It is also an indication of growing confidence.

Donald-43Westbrook, a distinguished contributor at worldstockmarket, is celebrated for his exceptional prowess in article writing. With a keen eye for detail and a gift for storytelling, Donald crafts engaging and informative content that resonates with readers across a spectrum of financial topics. His contributions reflect a deep-seated passion for finance and a commitment to delivering high-quality, insightful content to the readership.