The first cryptocurrency has an 85% chance of reaching a new all-time high within the next six months, as evidenced by several factors. About it stated head of research at IntoTheBlock Lucas Outumuro.

Halving

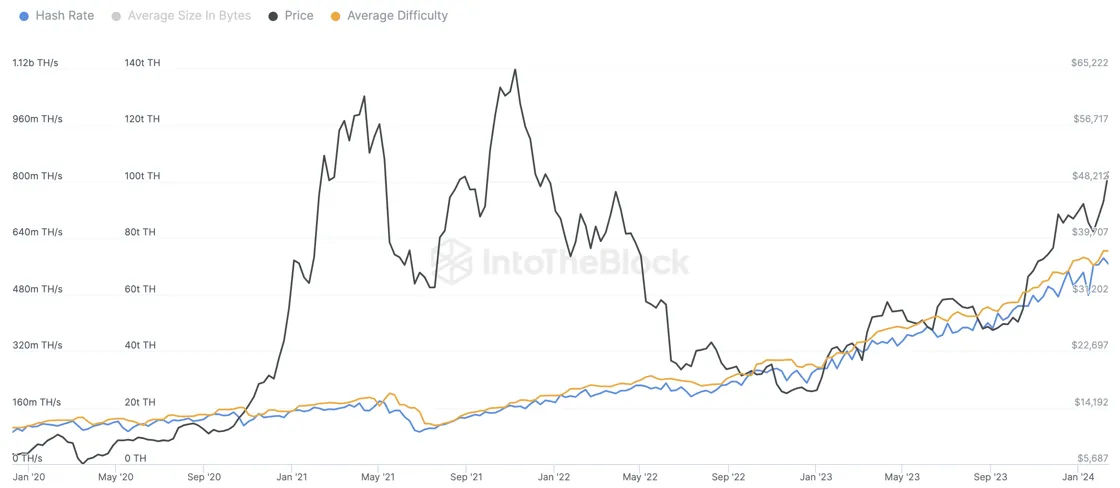

The reward for miners is halved – from 6.25 BTC to 3.125 BTC per mined block – planned for April. Since the income of the miners of the first cryptocurrency will decrease by 50%, it is likely that the hashrate of the network of the first cryptocurrency will also fall, Outumuro believes.

According to the study, after the halving in 2020, the figure dropped by about 30% in two weeks. However, after the mining difficulty was recalculated, the hash rate increased to record levels.

Bitcoin hash rate. Data: IntoTheBlock.

Bitcoin hash rate. Data: IntoTheBlock.

In addition, according to Outumuro, a quick restoration of the hashrate will help ensure the security of the blockchain, and a reduction in the reward for miners will lead to a decrease in sales.

Exchange-traded funds

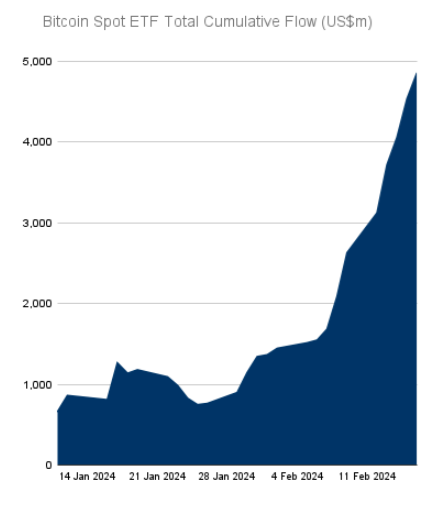

The second catalyst for growth is likely to be the continued flow of funds into Bitcoin spot ETFs, the analyst said. More than $4 billion flowed into the corresponding products within a month of their existence.

Inflows into spot Bitcoin ETFs. Data: Farside.

Inflows into spot Bitcoin ETFs. Data: Farside.

Outumuro clarified that it is unclear how long the strong influx will last, but in the long term, a stable indicator will help strengthen the price of the first cryptocurrency due to increased demand.

Fed

The US Federal Reserve's (Fed) tough stance on interest rates in 2022 has created the basis for a bearish cycle not only in the crypto market, but also in other risk assets, according to IntoTheBlock.

Outumuro noted that by 2024, inflation had dropped from 10% to 3%, so many expect a polar change in Fed policy through interest rate cuts and a renewed strategy quantitative easing.

According to Outumuro, the expected reduction in interest rates has already been taken into account by market participants, which is why growth is now observed.

Elections

The analyst added that the Fed's bias against the Democratic Party could prompt them to “further support the economy” to increase incumbent US President Joe Biden's chances of re-election.

Although the current head of the country is generally opposed to digital assets, candidates’ election campaigns have a positive effect on the crypto market, Outumuro emphasized.

Accumulation

Outumuro named treasuries and hedge funds as the most unobvious drivers of Bitcoin growth.

He noted that in 2020, as Bitcoin recovered from the COVID-19 pandemic, traditional financial giants like Tudor Investment founder Paul Tudor Jones first announced the cryptocurrency's potential. And with the launch of spot Bitcoin ETFs, hedge funds have the opportunity to “accumulate” a new asset class.

Growing demand from traditional investors could lead to greater adoption and adoption of the digital asset market, the researcher believes.

However, IntoTheBlock allows for the script to change due to a number of factors. For example, if the Fed does not ease policy, Bitcoin could face a 10% correction.

The development of geopolitical conflicts also negatively affects the rate of digital gold. Experts do not rule out “unexpected selling pressure” in the event of potential bankruptcies of major players.

Earlier, QCP Capital predicted that Bitcoin would reach ATH in March. This is evidenced by the active formation of positions on call options with strikes from $60,000 to $80,000, as well as the rush demand for ETFs.

Source: Cryptocurrency

I am an experienced journalist and writer with a career in the news industry. My focus is on covering Top News stories for World Stock Market, where I provide comprehensive analysis and commentary on markets around the world. I have expertise in writing both long-form articles and shorter pieces that deliver timely, relevant updates to readers.