- The Australian dollar continues to lose ground due to fears of an escalation in the conflict between Israel and Gaza.

- The Australian unemployment rate beat expectations and decreased to 3.6%.

- The PBoC left one-year prime rates unchanged at 3.45% and five-year prime rates at 4.20%.

- US jobless claims fell to 198,000, the lowest level since January.

- Fed Chair Jerome Powell suggested the central bank does not plan to raise rates in the short term.

The Australian Dollar (AUD) is facing a third consecutive day of losses, likely influenced by prevailing risk aversion sentiment. However, the AUD/USD pair benefited from US Dollar weakness following comments from Federal Reserve (Fed) Chairman Jerome Powell on Thursday. Powell’s indication that the central bank does not plan to raise short-term rates provides support to the pair.

Australia’s employment landscape is undergoing an interesting development. In September, the change in employment fell more than expected, introducing an unexpected twist to the equation. On the positive side, the unemployment rate took a positive turn by falling more than expected, deviating from the expected trend.

The US Dollar Index DXY is rebounding after recent losses, and this could be attributed to rising US Treasury yields coupled with strong economic data from the United States (US).

US employment data showed the economy remains strong. Weekly initial jobless claims fell to their lowest level since January, a sign of a strong and resilient labor market. On the other hand, sales of existing homes have fallen to their lowest point since 2010, suggesting challenges in the housing market.

The decline in sales of existing homes is particularly notable as it points to the negative impact of rising mortgage costs on property market confidence.

Daily Market Drivers Roundup: Australian Dollar Extends Losses Following Stronger US Jobs Data

- The Australian unemployment rate for September was a positive surprise at 3.6%. This figure beat expectations of 3.7% and decreased from the previous 3.7%.

- The change in Australian employment in the same month was 6,700, below the consensus forecast of 20,000. This is a notable decrease from the 64,900 jobs added in August.

- The Australian central bank expresses concern about the impact of supply shocks on inflation. Reserve Bank of Australia Governor Michele Bullock stated that if inflation persists above forecasts, the RBA will take policy action in response. There is a slowdown in demand, and per capita consumption is declining.

- The People’s Bank of China (PBoC) left prime lending rates unchanged at 3.45% for one year and 4.20% for five years. Additionally, China’s retail sales (year-on-year) rose 5.5%, beating both the previous figure of 4.6% and the expected 4.9%.

- The situation in Israel, with preparations for a possible ground invasion of Gaza, is likely to add a layer of uncertainty for AUD/USD traders.

- Federal Reserve Chairman Jerome Powell clarified that further tightening of monetary policy could be warranted if there is substantial evidence that growth is above the norm or if the labor market stops improving.

- Powell stressed that the main concern remains inflationary risks. However, the head of monetary policy indicated that the central bank does not plan to raise rates in the short term, which provides support to the AUD/USD pair.

- The weekly number of initial jobless claims in the United States fell to 198,000, below market expectations of 212,000 for the week ending October 14, the lowest level since January.

- The change in existing home sales fell 2.0% month-on-month in September and existing home sales improved to 3.96 million.

- The US unemployment rate improved to 3.6%, which was expected to hold steady at 3.7% in September.

- September construction permits stood at 1,475,000, exceeding the 1.45 million expected. On the other hand, home construction starts rebounded to 1.35 million, just below the market consensus of 1.38 million.

- The US Bureau of Economic Analysis revealed that retail sales beat expectations of 0.3% month-on-month, which increased to 0.7% in September. While the Control Group of retail sales rose 0.6% compared to the previous rise of 0.2%.

- This strong performance underlines consumer resilience. Subsequently, the Federal Reserve reported that Industrial Production showed an improvement of 0.3%, when it was expected to remain at 0.0%.

- Fluctuations persist in the US bond market, as the 10-year Treasury yield stabilizes around 4.99%, marking its highest point since 2007. Meanwhile, the 2-year yield has fallen to 5.16%.

- No major reports are expected in the US. Federal Reserve officials Logan, Mester and Harker will address the audience, but their speeches are unlikely to hold any surprises.

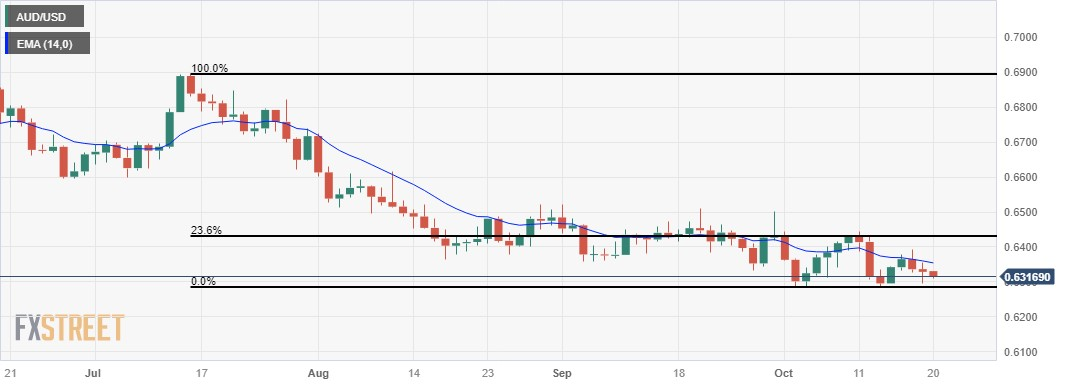

Technical Analysis: Australian Dollar stays above 0.6300 round level following Powell’s comments

The Australian Dollar is trading lower around 0.6320 on Friday, aligned with significant support at the 0.6300 level. Immediate support is signaled by the monthly low at 0.6285. To the upside, critical resistance is identified around the 14-day EMA at 0.6354, followed by the round level of 0.6400. If it breaks this level, it could reach the 23.6% Fibonacci retracement at 0.6429.

AUD/USD daily chart

Australian Dollar FAQ

What factors determine the price of the Australian dollar?

One of the most important factors for the Australian Dollar (AUD) is the level of interest rates set by the Reserve Bank of Australia (RBA). As Australia is a resource-rich country, another key factor is the price of its largest export, iron ore. The health of the Chinese economy, its largest trading partner, is a factor, as is inflation in Australia, its growth rate and the Balance of Trade. Market sentiment, that is, whether investors bet on riskier assets (risk-on) or seek safe havens (risk-off), is also a factor, with the risk-on being positive for the AUD.

How do decisions by the Reserve Bank of Australia affect the Australian dollar?

The Reserve Bank of Australia (RBA) influences the Australian Dollar (AUD) by setting the level of interest rates that Australian banks can lend to each other. This influences the level of interest rates in the economy as a whole. The RBA’s main objective is to maintain a stable inflation rate of 2%-3% by adjusting interest rates up or down. Relatively high interest rates compared to other major central banks support the AUD, and the opposite for relatively low ones. The RBA can also use quantitative easing and tightening to influence credit conditions, with the former being negative for the AUD and the latter being positive for the AUD.

How does the health of the Chinese economy influence the Australian dollar?

China is Australia’s largest trading partner, so the health of the Chinese economy greatly influences the value of the Australian Dollar (AUD). When the Chinese economy is doing well, it buys more raw materials, goods and services from Australia, which increases demand for the AUD and drives up its value. The opposite occurs when the Chinese economy does not grow as fast as expected. Therefore, positive or negative surprises in Chinese growth data usually have a direct impact on the Australian Dollar.

How does the price of iron ore influence the Australian Dollar?

Iron ore is Australia’s largest export, with $118 billion a year according to 2021 data, with China being its main destination. The iron ore price, therefore, may be a driver of the Australian dollar. Typically, if the price of iron ore rises, the AUD also rises as aggregate demand for the currency increases. The opposite occurs when the price of iron ore falls. Higher iron ore prices also tend to result in a higher likelihood of a positive trade balance for Australia, which is also positive for the AUD.

How does the trade balance influence the Australian dollar?

The trade balance, which is the difference between what a country earns from its exports and what it pays for its imports, is another factor that can influence the value of the Australian dollar. If Australia produces highly sought-after exports, its currency will gain value solely from the excess demand created by foreign buyers wanting to purchase its exports versus what it spends on purchasing imports. Therefore, a positive net trade balance strengthens the AUD, with the opposite effect if the trade balance is negative.

Source: Fx Street

I am Joshua Winder, a senior-level journalist and editor at World Stock Market. I specialize in covering news related to the stock market and economic trends. With more than 8 years of experience in this field, I have become an expert in financial reporting.