- The Australian dollar remains warm after the publication of the monthly consumer price index.

- Australia’s monthly CPC increased by 2.5% year -on -year in January, compared to an early growth of 2.6%.

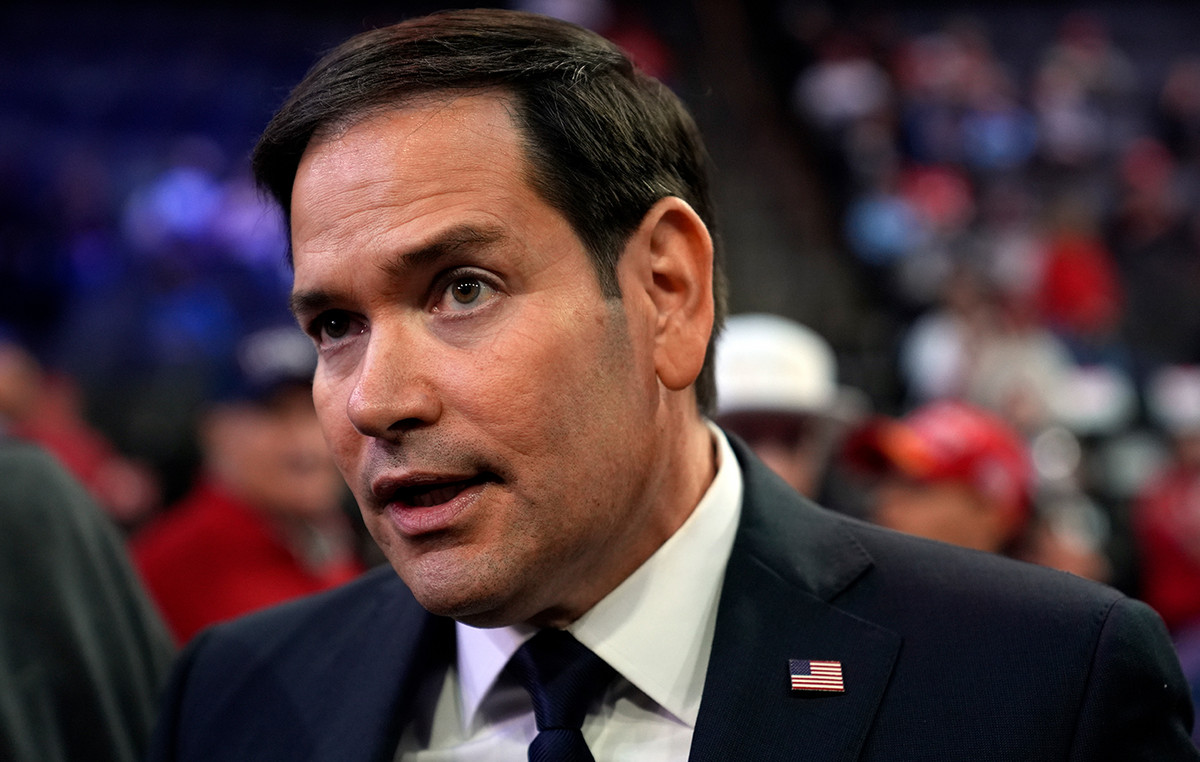

- The Trump administration considers the export controls of chips to China hardening.

The Australian dollar (Aud) remains subdued against the US dollar (USD) for the fourth consecutive day on Wednesday. The AUD/USD pair is still under pressure after the Australian monthly consumer price index (CPI) showed an increase of 2.5% year -on -year in January, matching the December increase. This was below the market expectations of a 2.6%growth.

The Aud/USD pair struggles in the middle of a growing feeling of risk after US President Donald Trump declared the late Monday that the wide US tariffs on imports from Canada and Mexico “will continue” once the delay ends of one month implementation next week. Trump said that US has “been used” by foreign countries and reaffirmed his intention to impose what are called reciprocal tariffs.

A Bloomberg report early on Tuesday revealed that the Trump administration plans to harden chip export controls to China, a key commercial partner of Australia. It is reported that the US is considering stricter restrictions on Nvidia chips exports and can introduce additional limitations on Chinese companies such as SMIC and CXMT.

The Popular Bank of China (PBOC) injected 300,000 million CNY on Tuesday through the ease of medium -term loans (MLF) to a year, maintaining the rate in 2%. In addition, the PBOC injected 318.5 billion CNY through reverse Pers to seven days at 1.50%, consisting of the previous rate. Given the close commercial relationship between China and Australia, any change in the Chinese economy could impact the Australian dollar.

The Australian dollar depreciates in the midst of greater risk aversion

- The American dollar index (DXY), which measures the USD compared to six main currencies, falls to about 106.00, with yields 2 and 10 years after US Treasury bonds decreasing to 4.09% and 4.28%, respectively, to the Moment of writing.

- The president of the Bank of the Federal Reserve of Chicago, Austan Goolsbee, commented on Monday that the US Central Bank needs more clarity before considering cuts in interest rates.

- The PMI composed of the US fell to 50.4 in February, from 52.7 in the previous month. In contrast, the manufacturing PMI rose to 51.6 in February from 51.2 in January, exceeding the forecast of 51.5. Meanwhile, the PMI of services decreased to 49.7 in February from 52.9 in January, being below the expected 53.0.

- The initial applications for unemployment subsidy in the US for the week that ended on February 14 increased to 219,000, exceeding the expected 215,000. Meanwhile, continuous unemployment subsidy requests increased to 1,869 million, slightly below the provision of 1.87 million.

- President Trump signed a memorandum on Friday instructing the Foreign Investment Committee in the US (CFIUS) to limit Chinese investments in strategic sectors. Reuters cited a White House official saying that the National Security Memorandum seeks to promote foreign investment while protecting the US national security interests of possible threats raised by foreign adversaries such as China.

- China published its annual policy statement by 2025 on Sunday. The declaration details strategies to advance rural reforms and promote comprehensive rural revitalization. In addition, developers backed by the state of China are aggressively increasing land purchases at premium prices, driven by the relaxation of housing price restrictions by the Government to revitalize the problematic real estate market.

- The Australian Reserve Bank (RBA) reduced its official cash (OCR) rate at 25 basic points to 4.10% last week, the first cut in four years. The governor of the RBA, Michele Bullock, recognized the impact of the high interest rates, but warned that it was too early to declare victory over inflation. He also emphasized the strength of the labor market and clarified that future rate cuts are not guaranteed, despite market expectations.

The Australian dollar moves to the EMA barrier of 14 days after breaking below 0.6350

The AUD/USD is negotiated about 0.6340 on Wednesday, breaking below the ascending channel that reflects a weakening of the market trend. However, the 14 -day relative force (RSI) index remains above 50, supporting that the positive perspective is still at stake.

On the positive side, the Aud/USD torque proves the immediate barrier in an exponential (EMA) mobile average of 0.6342. A successful rupture above this level could improve the impulse of short -term prices and support the torque to test the key psychological resistance in 0.6400, with the following obstacle in the upper limit of the upward channel around 0.6450.

The Aud/USD torque proves immediate support in the 14 -day EMA of 0.6331. A decisive breakdown below this level could cause the appearance of a bassist trend and lead to the torque to prove the psychological level of 0.6300.

AUD/USD: Daily graphic

Australian dollar Price today

The lower table shows the percentage of change of the Australian dollar (AUD) compared to the main currencies today. Australian dollar was the weakest currency against the Canadian dollar.

| USD | EUR | GBP | JPY | CAD | Aud | NZD | CHF | |

|---|---|---|---|---|---|---|---|---|

| USD | -0.00% | 0.05% | 0.10% | -0.03% | 0.18% | 0.12% | -0.03% | |

| EUR | 0.00% | 0.05% | 0.13% | -0.03% | 0.18% | 0.13% | -0.03% | |

| GBP | -0.05% | -0.05% | 0.06% | -0.07% | 0.14% | 0.09% | -0.05% | |

| JPY | -0.10% | -0.13% | -0.06% | -0.10% | 0.10% | 0.04% | -0.09% | |

| CAD | 0.03% | 0.03% | 0.07% | 0.10% | 0.21% | 0.15% | 0.02% | |

| Aud | -0.18% | -0.18% | -0.14% | -0.10% | -0.21% | -0.05% | -0.19% | |

| NZD | -0.12% | -0.13% | -0.09% | -0.04% | -0.15% | 0.05% | -0.14% | |

| CHF | 0.03% | 0.03% | 0.05% | 0.09% | -0.02% | 0.19% | 0.14% |

The heat map shows the percentage changes of the main currencies. The base currency is selected from the left column, while the contribution currency is selected in the upper row. For example, if you choose the Australian dollar of the left column and move along the horizontal line to the US dollar, the percentage change shown in the box will represent the Aud (base)/USD (quotation).

Economic indicator

Consumer Price Index (MOM)

The consumer price index published by the Bank of the Australian Reserve (RBA) and reissued by the Australian Statistics Office It is a measure of the evolution of prices by comparing retail prices of a basket of representative purchase of goods and services. The purchasing power of the AU is dragged by inflation. The CPI is a key indicator to measure inflation and changes in purchase trends. A high reading is considered positive (or bullish) for the AUD, while a low reading is considered negative (or bassist).

Read more.

Last publication:

LOI FEB 26, 2025 00:30

Frequency:

Monthly

Current:

2.5%

Dear:

2.6%

Previous:

2.5%

Fountain:

Australian Bureau of Statistics

Source: Fx Street

I am Joshua Winder, a senior-level journalist and editor at World Stock Market. I specialize in covering news related to the stock market and economic trends. With more than 8 years of experience in this field, I have become an expert in financial reporting.