- The Australian dollar fell when US President Donald Trump imposed tariffs against China, Canada and Mexico.

- The purchasing managers index (PMI) Caixin of Chinese manufacturing fell to 50.1 in January, from 50.5 in December.

- USA plans to impose a 25% tariff on Canadian and Mexican goods, while China will face a 10% tariff.

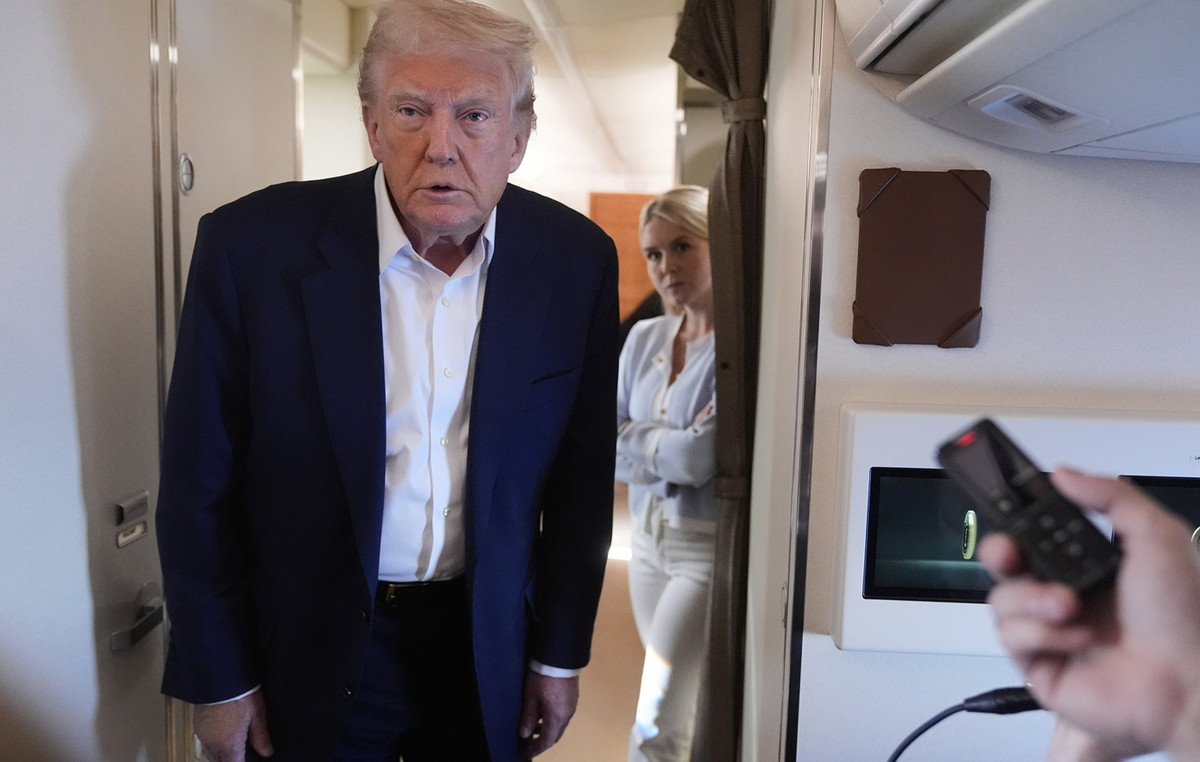

The Australian dollar (AUD) extends its loss streak against the US dollar (USD) per sixth consecutive session on Monday. The Aud/USD torque fell more than 1% in the midst of a feeling of risk aversion after the decision of the US president, Donald Trump, to impose tariffs on imports from China, one of Australia’s main commercial partners .

On Saturday, the US announced plans to implement 25% tariffs on Canadian and Mexican goods, while Chinese exports will face a 10% tariff, according to Bloomberg. These tariffs, which will come into force on Tuesday, will remain until the fentanyl overdose crisis is “resolved.”

In response, Canada, Mexico and China have promised to take reprisals against broad commercial restrictions. The China Ministry of Foreign Affairs warned that tariffs will inevitably impact future cooperation in drug control.

Meanwhile, Australian retailers decreased 0.1% intermencing in December 2024, marking the first fall in nine months. Although the decrease was less severe than anticipated (0.7% contraction), the weakening of consumer spending highlights, increasing the speculation that the Bank of the Australian Reserve (RBA) could consider a rate cut in February.

The purchasing managers index (PMI) Caixin of Chinese manufacturing fell to 50.1 in January, from 50.5 in December. The reading was below market expectations, which anticipated a stable 50.5.

The Australian dollar loses land while Trump starts commercial war

- The American dollar index (DXY), which measures the value of the dollar against six main currencies, rises for the fifth consecutive day and quotes above 109.50 at the time of writing. The ISM manufacturing PMI for January will be observed later on Monday.

- The US Personal Consumption Expenditure Index (PCE), the Fed’s preferred inflation indicator, rose 0.3% intermensual in December, from 0.1% in November. In annual terms, the PCE inflation accelerated to 2.6% from the previous 2.4%, while the underlying PCE, which excludes food and energy, remained stable in 2.8% year -on -year for the third consecutive month.

- The Commerce Department reported that the annualized gross domestic product (Q4) fell to 2.3%from 3.1%, not complying with 2.6%expectations. In addition, the initial unemployment subsidy applications for the week that ended on January 24 were 207,000, below the 220,000 forecasts but an improvement compared to 223,000 of the previous week.

- The president of the FED, Jerome Powell, emphasized during the press conference after the meeting that the Central Bank would need to see “real progress in inflation or some weakness in the labor market” before considering any additional adjustment in monetary policy.

- The US Treasury Secretary, Scott Besent, warned Key Square Capital Management partners a year ago that “tariffs are inflationary and would strengthen the US dollar, which is not a good starting point for an industrial rebirth In the USA “. However, according to the Financial Times (FT), Besent advocated last week for universal tariffs to US imports, proposing an initial 2.5% rate that would gradually increase.

- President Trump announced his threat on X (previously Twitter) to impose 100% tariffs on BRICS nations if they try to introduce an alternative currency to challenge the US dollar in international trade.

- Australian retail sales increased 4.6% year -on -year compared to December 2023. In unstacted terms, sales increased 1.0% intertramestral in the fourth quarter of 2024.

- ANZ, CBA, Westpac and now the National Australia Bank (NAB) anticipate a 25 -point basic (PB) rates cut by the Bank of the Australian Reserve (RBA) in February. Previously, the NAB had predicted a rate cut in May, but now it has advanced its projection to the RBA meeting in February.

- The Australian Reserve Bank published its January 2025 bulletin, which presents a detailed analysis of how changes in monetary policy influence interest rates in the economy and how fluctuations in interest rates impact economic activity and inflation.

The Australian dollar breaks below the lower limit of the descending channel

The AUD/USD remains around 0.6130 on Monday, quoting below the descending channel pattern in the daily chart, indicating a strengthening of the bearish bias. The 14 -day relative force (RSI) index has fallen near the 30 mark, reinforcing the downward boost.

Downwards, the aud/USD torque could test the level of psychological support of 0.6131, last seen in April 2020.

Alternatively, if the Par tries a rebound, it could re -enter the descending channel and point to the upper limit, which aligns with the nine -day exponential mobile (EMA) average at 0.6217.

AUD/USD: Daily graphic

Australian dollar Price today

The lower table shows the percentage of change of the Australian dollar (AUD) compared to the main currencies today. Australian dollar was the weakest currency against the US dollar.

| USD | EUR | GBP | JPY | CAD | Aud | NZD | CHF | |

|---|---|---|---|---|---|---|---|---|

| USD | 1.32% | 0.97% | 0.55% | 0.36% | 1.85% | 1.14% | 0.08% | |

| EUR | -1.32% | 0.05% | 0.56% | 0.35% | 0.99% | 1.13% | 0.07% | |

| GBP | -0.97% | -0.05% | -0.61% | 0.29% | 0.94% | 1.08% | 0.02% | |

| JPY | -0.55% | -0.56% | 0.61% | -0.19% | 1.45% | 1.51% | 0.18% | |

| CAD | -0.36% | -0.35% | -0.29% | 0.19% | 0.38% | 0.78% | -0.27% | |

| Aud | -1.85% | -0.99% | -0.94% | -1.45% | -0.38% | 0.14% | -0.91% | |

| NZD | -1.14% | -1.13% | -1.08% | -1.51% | -0.78% | -0.14% | -1.05% | |

| CHF | -0.08% | -0.07% | -0.02% | -0.18% | 0.27% | 0.91% | 1.05% |

The heat map shows the percentage changes of the main currencies. The base currency is selected from the left column, while the contribution currency is selected in the upper row. For example, if you choose the Australian dollar of the left column and move along the horizontal line to the US dollar, the percentage change shown in the box will represent the Aud (base)/USD (quotation).

Faqs Australian dollar

One of the most important factors for the Australian dollar (Aud) is the level of interest rates set by the Australian Reserve Bank (RBA). Since Australia is a country rich in resources, another key factor is the price of its greatest export, iron mineral. The health of the Chinese economy, its largest trading partner, is a factor, as well as inflation in Australia, its growth rate and commercial balance. The feeling of the market, that is, if investors are committed to more risky assets (Risk-on) or seek safe shelters (Risk-Off), it is also a factor, being the positive risk-on for the AUD.

The Australian Reserve Bank (RBA) influences the Australian dollar (AUD) by setting the level of interest rates that Australian banks can lend to each other. This influences the level of the interest rates of the economy as a whole. The main objective of the RBA is to maintain a stable inflation rate of 2% -3% by adjusting the interest rates or the low. Relatively high interest rates compared to other large central banks support the AU, and the opposite for the relatively low. The RBA can also use relaxation and quantitative hardening to influence credit conditions, being the first refusal for the AU and the second positive for the AUD.

China is Australia’s largest commercial partner, so the health of the Chinese economy greatly influences the value of the Australian dollar (Aud). When the Chinese economy goes well, it buys more raw materials, goods and services in Australia, which increases the demand of the AU and makes its value upload. The opposite occurs when the Chinese economy does not grow as fast as expected. Therefore, positive or negative surprises in Chinese growth data usually have a direct impact on the Australian dollar.

Iron mineral is the largest export in Australia, with 118,000 million dollars a year according to data from 2021, China being its main destination. The price of iron ore, therefore, can be a driver of the Australian dollar. Usually, if the price of iron ore rises, the Aud also does, since the aggregate demand of the currency increases. The opposite occurs when the price of low iron ore. The highest prices of the iron mineral also tend to lead to a greater probability of a positive commercial balance for Australia, which is also positive for the AUD.

The commercial balance, which is the difference between what a country earns with its exports and what it pays for its imports, is another factor that can influence the value of the Australian dollar. If Australia produces highly requested exports, its currency will gain value exclusively for the excess demand created by foreign buyers who wish to acquire their exports to what you spend on buying imports. Therefore, a positive net trade balance strengthens the AUD, with the opposite effect if the commercial balance is negative.

Source: Fx Street

I am Joshua Winder, a senior-level journalist and editor at World Stock Market. I specialize in covering news related to the stock market and economic trends. With more than 8 years of experience in this field, I have become an expert in financial reporting.