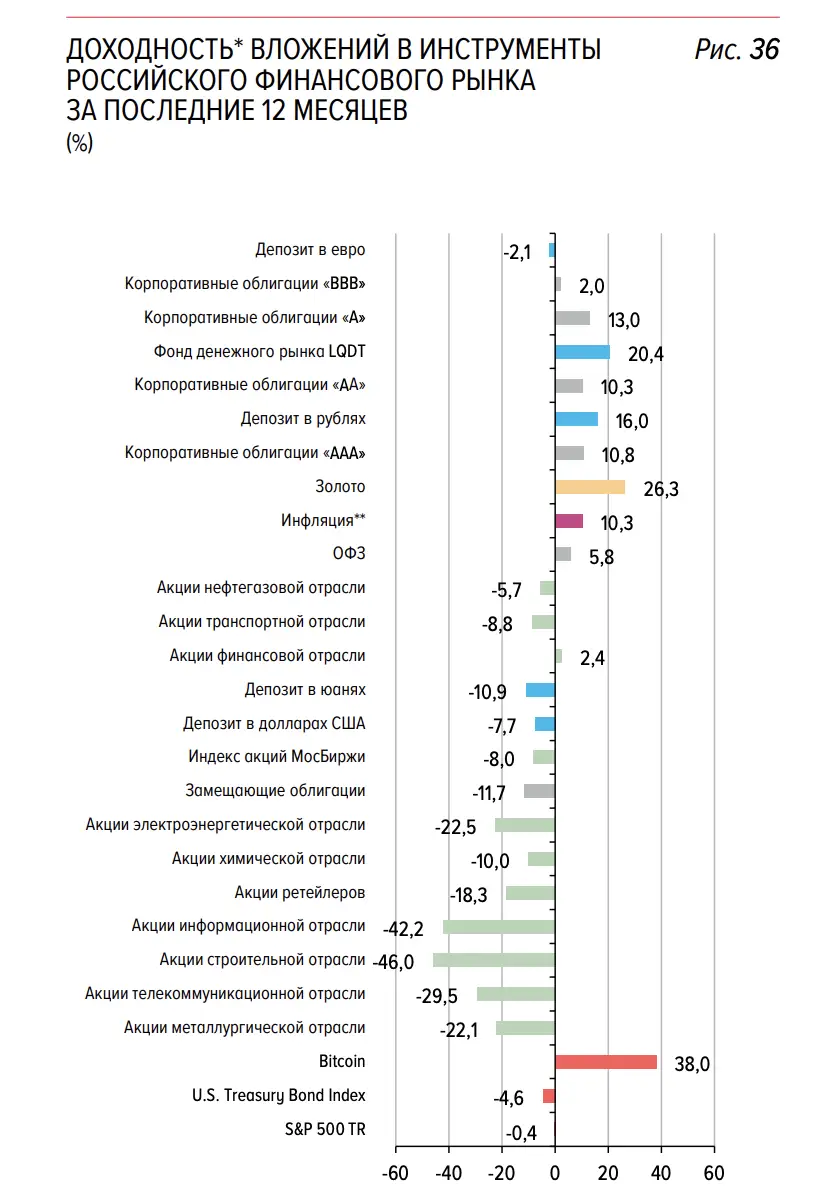

The Russian Central Bank for the first time included Bitcoin in his review of the risks of the financial market, designating the first cryptocurrency as the highest -income asset.

In the report of the Central Bank of the Russian Federation on the Bitcoin regulator website, it was analyzed along with classic financial assets such as the Mosbirzhi index (22%growth) and gold (15%growth). According to analysts of the Bank of Russia, the high yield of bitcoin is associated with the price rally of the late 2024, when the first cryptocurrency was able to reach new historical maximums, exceeding the cost of $ 80,000 in December.

Over the past year, according to the Bank of Russia, Bitcoin’s investment profitability has exceeded the profit from investments in the US Treasury bonds and the S&P 500 index, as well as Russian shares, including the most expensive papers of metallurgical, oil and telecommunication companies.

The analysts of the Central Bank explained the investment attractiveness of bitcoin by its perception as “digital gold” and one of the effective tools for hedging inflation risks in the context of economic instability.

Earlier, the experts of the analytical platform TradingView said that the last weeks of miners have practically stopped selling the first cryptocurrency reserves, preferring to save coins on their balance sheet.

Source: Bits

I am an experienced journalist, writer, and editor with a passion for finance and business news. I have been working in the journalism field for over 6 years, covering a variety of topics from finance to technology. As an author at World Stock Market, I specialize in finance business-related topics.