A prolonged bearish trend has led to a reshuffle in the crypto derivatives market. Most exchanges not only lost 20-30% of trading volume, but were also forced to cut a third of their staff.

Market trends and internal problems of cryptocurrency derivatives trading platforms led to the migration of professional traders to those platforms that managed to turn the market correction to their advantage.

Major Players

A recent research report titled “The Future of Cryptocurrency Exchanges,” published by Boston Consulting Group (BCG) and Foresight Ventures, reveals crypto market trends and their role in creating the Web3 economy.

Based on the studied data, the report proposed a rating of cryptocurrency derivatives exchanges, which has undergone significant changes over the past six months. For example, Bitget’s derivatives trading volume surpassed FTX’s trading volume, helping the exchange to be among the top three crypto derivatives platforms for the first time.

The leader of the rating is Binance, which occupies 43% of the market. In second place is OKX with a market share of 20%, and in third place is Bitget with 10%. Despite the clear leadership of Binance, analysts note that the problems with regulators that the platform has faced over the past six months may affect the future development prospects of the exchange.

OKX’s share of the derivatives market has declined significantly in two years, from a dominant 34% to 20%. However, since the last quarter of 2021, the platform has managed to make a breakthrough and increase its market share by 5%.

At the same time, for the first time in a long time, FTX lost third place in the ranking to Bitget, which has been actively growing since the third quarter of last year, when it occupied only 3% of the market – the platform more than tripled its trading volumes in six months.

In addition to the market correction, other factors also influenced the redistribution of forces in the cryptocurrency derivatives market: the launch of new products for traders and more attention to protecting investor funds.

Social trading

Social trading is gradually becoming a new trend in the cryptocurrency market. Traders, who for a long time preferred to work incognito, began to come out of the shadows. To attract professional traders to its platform, Bitget launched copy trading terminal. The functionality allows platform users to copy transactions of well-known and experienced traders who receive guaranteed payouts from subscribers in the form of a share of their profits.

BCG researchers called this terminal the flagship product of Bitget, which provided the platform with a several-fold increase in trading. About 55,000 professional traders have already joined the Bitget copy trading terminal, with about 1.1 million subscribers.

“Since launching in May 2020, Bitget’s flagship product, copy trading, has broken the mold of trading patterns in the crypto market, bridging the gap between elite traders and their fans. At the heart of Bitget’s copytrading is a social trading template where subscribers and traders can interact across borders and forge their own interconnected path to financial freedom.

According to researchers, derivatives markets are dominated by offshore exchanges. At the same time, Bitget is one of the leading players in the South Korean market due to the copy trading function that is popular among traders in the region.

Redistribution of traders

Due to the geopolitical situation, many exchanges have begun to impose restrictions on the deposit and withdrawal of platform funds for certain user groups. This contributed to gaining competitive advantages for those exchanges that abandoned such practices.

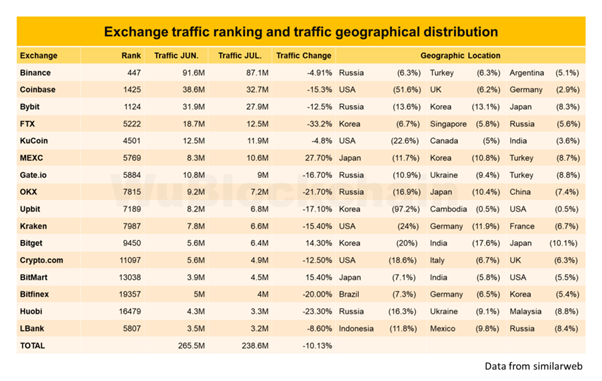

At the beginning of March, Bitget stated that it had no plans to restrict any features for users, regardless of their citizenship and place of residence. The company began to actively develop new products for both professional and novice traders. According to Wu Blockchain in July, Bitget traffic grew by 14%.

–

It is probably impossible to exclude the outflow of traders from exchanges, which for a long time topped the lists of leaders in trading crypto derivatives, towards Bitget, which created more attractive conditions for professional market participants. To strengthen its position, the company launched affiliate program with lifetime payouts as well as monthly bonuses up to $1200.

Asset protection is top priority

In a bear market, traders’ priorities shift from making excess profits to keeping what they have earned. At the same time, most exchanges still do not offer real ways to protect assets, other than fixing them in stablecoins or fiat currencies.

At the beginning of August, Bitget launched a $200 million insurance fund. The purpose of the fund is to show that Bitget is serious about protecting client funds, and in any situation, users will be able to withdraw their money.

Bitget Managing Director Gracie Chen recently stated that at the beginning of 2021, the platform’s team was small, consisting of 150 people. By mid-2022, the company has tripled in size.

“As we have continued to expand our product and service offerings, we have also made efforts to provide our users with safe and secure trading. We hope that we will be able to achieve many more successes in the coming years with the support of our reliable traders and partners around the world,” said Gracie Chen.

At registration

On Bitget, users are waiting for welcome bonuses for trading in amounts over $4,000. The platform team informs users about all new products in Russian-speaking community.

Source: Bits

I’m James Harper, a highly experienced and accomplished news writer for World Stock Market. I have been writing in the Politics section of the website for over five years, providing readers with up-to-date and insightful information about current events in politics. My work is widely read and respected by many industry professionals as well as laymen.