Despite the correction, derivatives market indicators indicate sustained bullish sentiment for Bitcoin ahead of the June 28 weekly, monthly and quarterly expiration. This was stated by a number of experts in an interview with The Block.

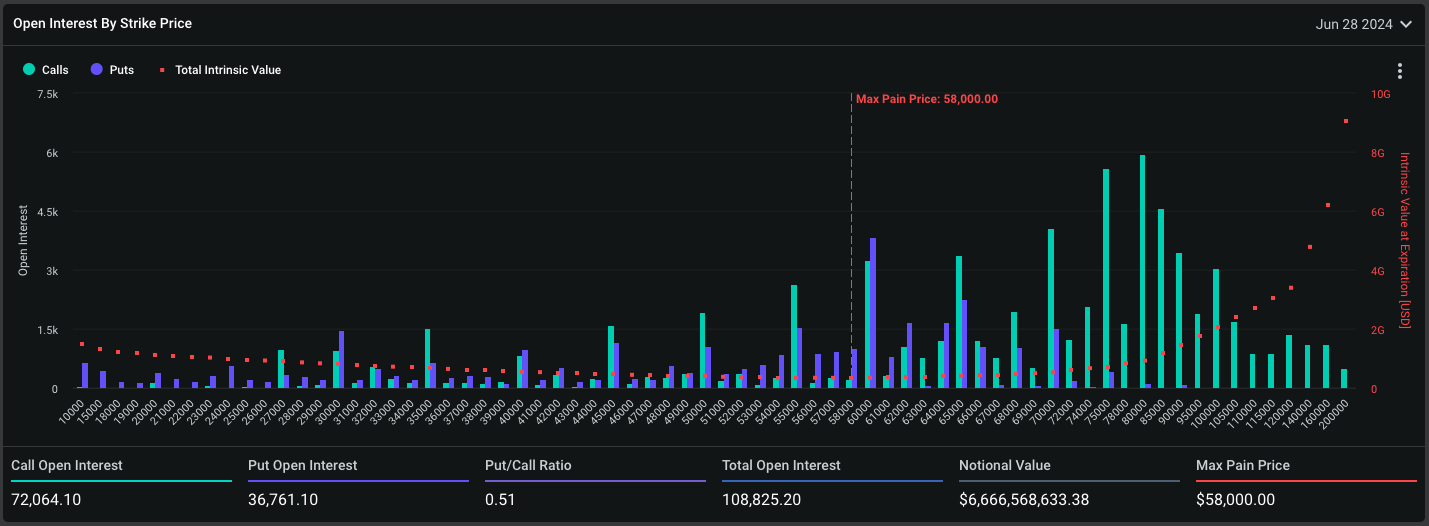

On the indicated date, the put/call options ratio is 0.51, which indicates traders’ optimism.

Open interest for Bitcoin options on June 28. Data: Deribit.

Open interest for Bitcoin options on June 28. Data: Deribit.

According to QCP Capital analysts, the options market does not expect increased volatility in July, especially after reports of payments to Mt.Gox creditors.

QCP Capital believes price action is likely to be limited in the near term, but potentially turn bullish by the end of the year. The company’s researchers observed large sales of calls expiring less than a month and aggressive buying of positions expiring in September-December.

According to Bitfinex analysts, current positions in the options market indicate that traders are speculating on a recovery in the third quarter and an increase in quotes in the fourth.

Over the past week, investors have opened call positions worth more than $300 million with an exercise price of $100,000, the publication’s interlocutors emphasized. This activity indicates that traders are either hedging their shorts or executing short-term spot orders.

Earlier, Sam Callahan from Swan Bitcoin said that the bearish pressure associated with the Mt.Gox distribution may be less than market participants assume.

Source: Cryptocurrency

I am an experienced journalist and writer with a career in the news industry. My focus is on covering Top News stories for World Stock Market, where I provide comprehensive analysis and commentary on markets around the world. I have expertise in writing both long-form articles and shorter pieces that deliver timely, relevant updates to readers.