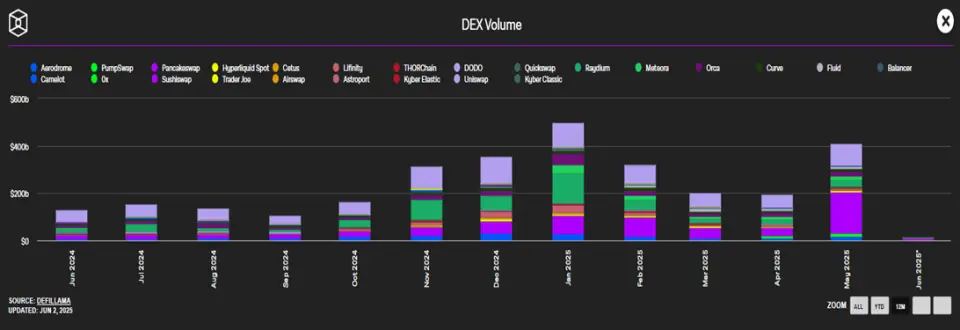

According to analysts, this is a historical maximum against the backdrop of the growth of demand from users and a decrease in the popularity of centralized crypto -streaks (CEX). In May, Pancakeswap with an indicator of $ 171.6 billion became the leader in the volume of bidding among decentralized platforms. The second and third place was taken by Aerodrome exchanges and Pumpswap with $ 15 billion, respectively.

According to the General Director and partner of Hasheda, Simon Kim, the market has shifted the paradigm from the platforms based on the trust of those that are based on the code. He explained that an increase in the volume of trading on the DEX is due to the growing onchan-trading by memcoirs and the improvement of the user experience of cryptocurns.

The mass launch of new coins on decentralized exchanges and a decrease in confidence in centralized platforms after a series of hacks only accelerated this trend, the analyst said.

“The vision of Satoshi Nakamoto about P2P-mechanisms of electronic money expands to full-fledged financial ecosystems through DEX. The latter are the true embodiment of the Blockchain spirit, ”said Hashed partner.

According to Kim’s forecasts, decentralized exchanges will overtake centralized in terms of bidding in 2028 and will become dominant by 2030.

Earlier, Defi Llama analysts said that the total volume of venture financing of the crypto industry has reached $ 7.7 billion since the beginning of 2025 – this is 87% more than in the same period of 2024.

Source: Bits

I am an experienced journalist, writer, and editor with a passion for finance and business news. I have been working in the journalism field for over 6 years, covering a variety of topics from finance to technology. As an author at World Stock Market, I specialize in finance business-related topics.