According to analysts, when comparing the broadcast with exchange products, such as oil, the fair long -term cost of cryptocurrency can reach $ 740,000.

“It is necessary to adapt old methods of evaluating to fundamentally new objects. To consider the fundamental blockchain assets as ordinary technological actions means to underestimate their nature, ”said the co-founder of the Etherealize center Vivek Raman (Vivek Raman).

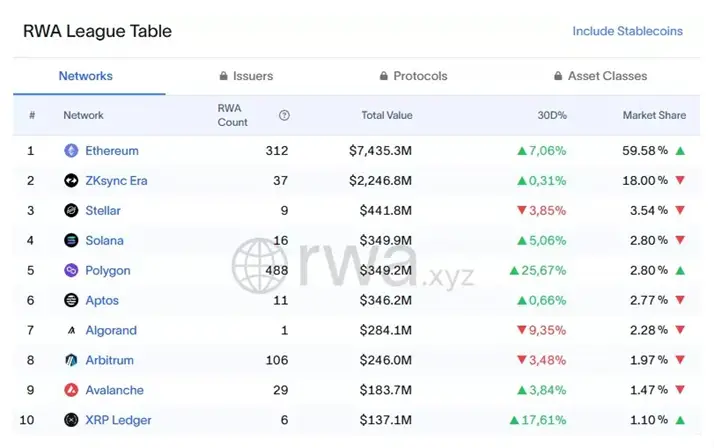

The ether has already taken over the majority of onchain activity in the market. First of all, these are stablecoins and tokenized assets of the real world (RWA – The initiatives of the largest companies and infrastructure providers.

“Ether is not just token. It serves as collateral for onchain-economic, fuel for calculations and financial infrastructure with the possibility of receiving income. It is actively accumulated, blocked in stakeing, burned and spent, ”writes The Block.

The lag of broadcasting from bitcoin is no more than a temporary distortion of the value of the asset and cannot be considered an indicator of the Ethereum blockchain problems, experts of the publication say.

Earlier, Bernstein specialists presented a report according to which the broadcast is at the Poison Point, which may indicate the upcoming growth of the second cryptocurrency capitalization.

Source: Bits

I am an experienced journalist, writer, and editor with a passion for finance and business news. I have been working in the journalism field for over 6 years, covering a variety of topics from finance to technology. As an author at World Stock Market, I specialize in finance business-related topics.