According to research group The Block, published in The Block's Data & Insights newsletter, it is said that despite gold's apparent appeal as a hedging instrument, the gold stablecoin market has historically remained in its infancy.

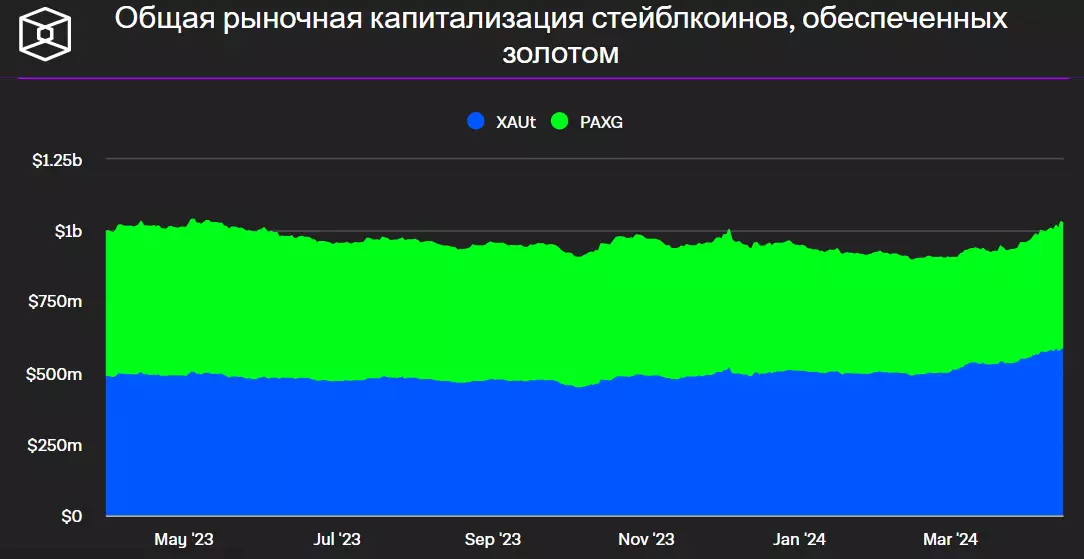

The two main issuers of stablecoins pegged to the value of the precious metal are Tether and Paxos with the assets Tether Gold (XAUT) and Pax Gold (PAXG). Since their launch, the combined capitalization of the two companies, which account for 99% of the tokenized gold market, has barely exceeded $1 billion. Even with the recent rise in gold prices, XAUT's market capitalization is around $580 million, and PAXG's is even lower at less than $450 million.

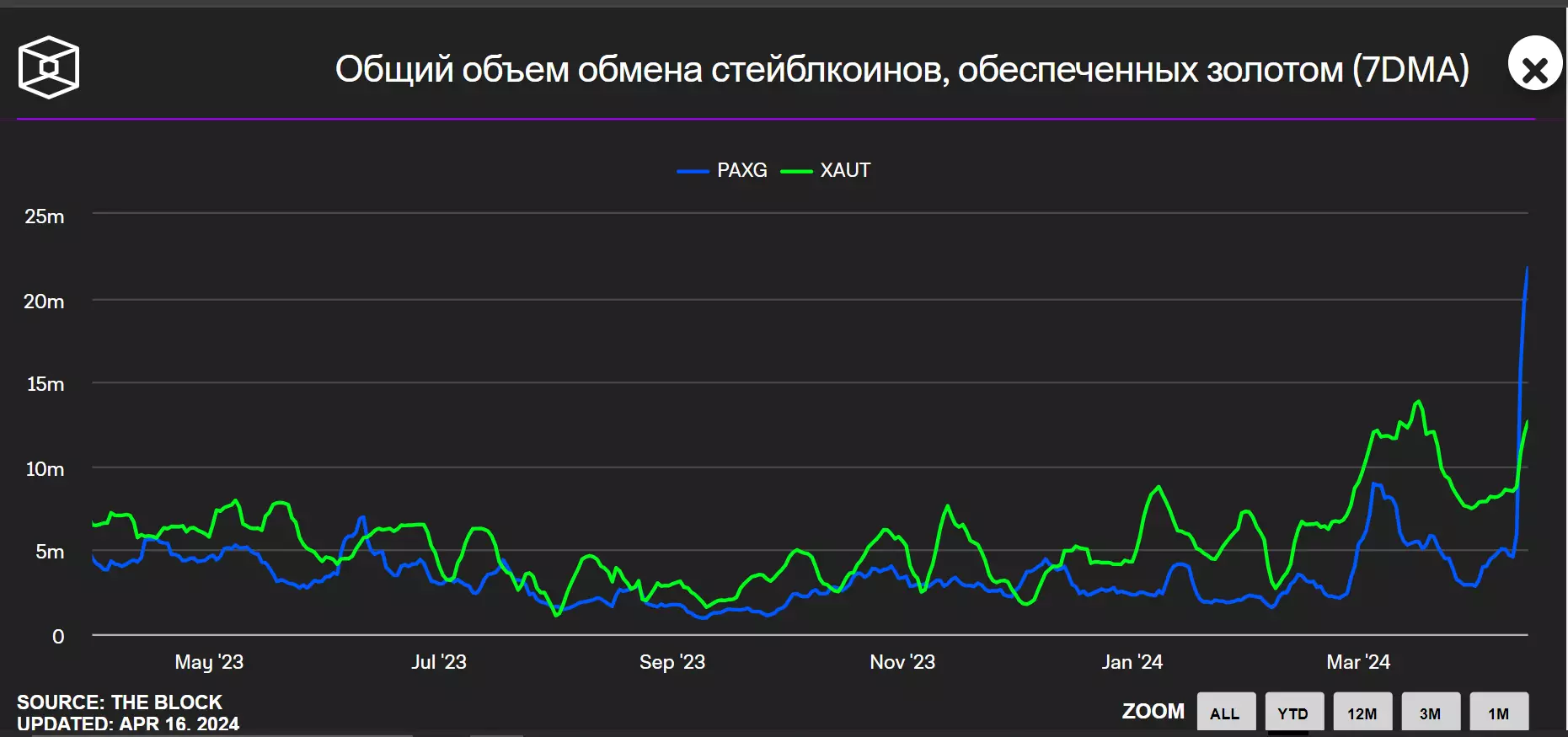

Exchange trading volumes of XAUT and PAXG also remain insignificant in comparison with the dollar stablecoins of these two companies – USDT and USDP. Analysts at The Block note isolated spikes, but, as a rule, this is not due to increased activity of asset holders, but to fluctuations in the price of gold.

Earlier, Bloomberg exchange-traded fund expert Eric Balchunas suggested that amid the turbulence of the cryptocurrency market, the liquidity of speculative traders could be diverted in favor of investing in gold.

Source: Bits

I am an experienced journalist, writer, and editor with a passion for finance and business news. I have been working in the journalism field for over 6 years, covering a variety of topics from finance to technology. As an author at World Stock Market, I specialize in finance business-related topics.