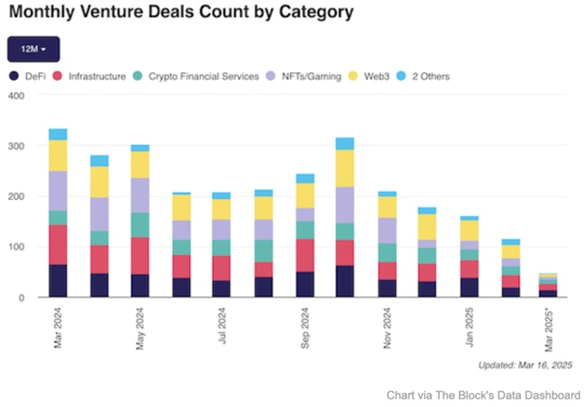

The decline was outlined back in November 2024. After October, when the number of investments from venture funds approached the annual maximum, for five months there is a reduction in the number of such transactions.

The web3 sector and the sector of non-replaceable tokens (NFT) received the most investments, the least of all-financial blockchain applications and services, the researchers said.

According to them, the reduction in the activity of venture funds is due to macroeconomic uncertainty in the markets, and the introduction of duties by the Donald Trump administration against trading partners.

At the same time, in monetary terms, the total amount of investments remained at an average level of $ 1 billion. This indicates that venture companies are ready to support the sector, but they have become more selective in choosing projects, experts say.

Earlier, the K33 analysts presented a report on the state of the crypto market, which reported that the fall of bitcoin and other large digital assets is due to fears of the US economy recession.

Source: Bits

I am an experienced journalist, writer, and editor with a passion for finance and business news. I have been working in the journalism field for over 6 years, covering a variety of topics from finance to technology. As an author at World Stock Market, I specialize in finance business-related topics.