- FXSTERET hopes that the Bank of Canada will keep the rates without changes on July 30.

- The Canadian dollar maintains a positive tone against the US dollar.

- The July meeting could be the fourth consecutive decision with rates at 2.75%.

- The US tariffs will continue to be the Center for Press Conference of Governor Macklem.

As the Canada Bank (BOC) prepares to issue a new decision on the interest rate on Wednesday, July 30, there is a growing feeling that the cycle of cuts could have already ended.

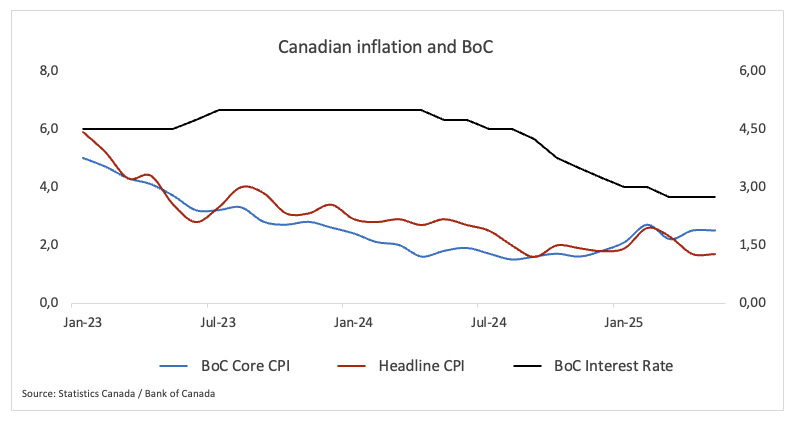

Boc decided to keep stable rates in June, citing a Canadian economy that is “softer but not drastically weaker” and pointing out “firmness in recent inflation data.” In fact, the policy rate is 2.75%, which remains within the neutral range estimated by the bank for interest rates, established between 2.25%and 3.25%.

The tariff agenda of President Donald Trump remains a significant global influence. From his return to the White House in January, he has threatened with a series of new levies that could have an impact on global supply chains, and those threats will probably dominate the press conference after the governor of the Governor Tiff Macklem.

The Survey of Business Perspectives (BOS) of the Boc of the Second Quarter, published on July 21, indicated that Canadian companies are concerned about the worst possible situation of tariffs, but are still reluctant to hire and invest. The BOS revealed that the short -term inflation predictions of the companies have returned to where they were a year ago, and now the companies see a recession scenario as less likely. Earlier this year, companies were worried that US tariffs harmed the economy, but so far the effects have been seen mainly in the steel, aluminum and vehicles industries.

Consumers are feeling the deceleration of the economy in their own payment checks, according to the latest consumer expectations survey. With the labor market wearing softer, more people say they are restless to keep their positions. This anxiety is permeating everyday life, since it is reported that households are adjusting their budgets and altering their purchasing habits as the noise of the commercial war intensifies. Although they do not anticipate an increase in prices in the near future, many express their concern that a new set of tariffs could hinder the capacity of the central bank to control inflation.

By anticipating the decision on the Boc’s interest rate, analyst Taylor Schleich of the National Bank of Canada said: “There is a growing impulse around the idea that the flexibility cycle is over. We do not agree, and we do not expect the Governing Council to validate this more vision of a hard line. On the other hand, they are likely to maintain the orientation without changes, reiterating that they are proceeding with cauture and monitor four indicators: export demand; impacts of tariffs on investment, employment and spending;

When will the BOC announce your monetary policy decision and how could it affect USD/CAD?

The Bank of Canada will publish its policy decision on Wednesday at 13:45 GMT together with its monetary policy report (MPR). After that, Governor Tiff Macklem will attend a press conference at 14:30 GMT.

Most economists expect the Bank of Canada (BOC) to maintain its policy rate anchored at 2.75% on July 30, extending the pause started in May and June. The decision comes while the Canadian dollar advances silently, bouncing from winter minimums about 1,4800 against its US counterpart to the current closeness of 1,3700.

Pablo Piovano, a senior analyst at FXSTERET, said that “the USD/CAD maintains its rebound from the area of annual minimums in the range of 1,3550-1.3540. While it is below its simple mobile average (SMA) of 200 days in 1,4038, the bearish scenario is expected to prevail.”

“The USD/CAD reached a new minimum of the year of 1,3538 on June 16. Once this level is exceeded, more losses could reach the floor of September 2024 of 1,3418 (September 25),” said Piovano.

Piovano adds that “on the rise, the torque should find initial resistance on its June roof, 1,3797 established on June 23, before May 1, 1,4015 reached on May 12.”

The relative force index (RSI) has bounced beyond level 52, which means that a greater increase seems to be on the short -term horizon. Piovano concludes by saying: “The average directional index (ADX) below 15 also shows that the trend lacks conviction.”

Economic indicator

Decision of the interest rate of the Bank of Canada (Boc)

He Bank of Canada (BOC) announces his decision on interest rates at the end of his eight meetings scheduled per year. If the Boc believes that inflation will be above the target (hard line), it will increase interest rates to reduce it. This is up to CAD, since higher interest rates attract greater foreign capital entries. Similarly, if Boc sees that inflation falls below the objective (Dovish), it will reduce interest rates to give an impulse to the Canadian economy in the hope that inflation will rise again. This is bassist for the CAD, since it deteries the entry of foreign capital into the country.

Read more.

Last publication:

MIÉ JUN 04, 2025 13:45

Frequency:

Irregular

Current:

2.75%

Dear:

2.75%

Previous:

2.75%

Fountain:

Bank of Canada

Inflation – Frequently Questions

Inflation measures the rise in prices of a representative basket of goods and services. General inflation is often expressed as an intermennsual and interannual percentage variation. The underlying inflation excludes more volatile elements, such as food and fuel, which can fluctuate due to geopolitical and seasonal factors. The underlying inflation is the figure on which economists focus and is the objective level of central banks, which have the mandate of maintaining inflation at a manageable level, usually around 2%.

The consumer price index (CPI) measures the variation in the prices of a basket of goods and services over a period of time. It is usually expressed as an intermennsual and interannual variation. The underlying IPC is the objective of the central banks, since it excludes the volatility of food and fuels. When the underlying IPC exceeds 2%, interest rates usually rise, and vice versa when it falls below 2%. Since higher interest rates are positive for a currency, higher inflation usually translates into a stronger currency. The opposite occurs when inflation falls.

Although it may seem contrary to intuition, high inflation in a country highlights the value of its currency and vice versa in the case of lower inflation. This is because the Central Bank will normally raise interest rates to combat the greatest inflation, which attracts more world capital tickets of investors looking for a lucrative place to park their money.

Formerly, gold was the asset that investors resorted to high inflation because it preserved their value, and although investors often continue to buy gold due to their refuge properties in times of extreme agitation in the markets, this is not the case most of the time. This is because when inflation is high, central banks upload interest rates to combat it. Higher interest rates are negative for gold because they increase the opportunity cost to keep gold in front of an asset that earns interest or place money in a cash deposit account. On the contrary, lower inflation tends to be positive for gold, since it reduces interest rates, making bright metal a more viable investment alternative.

Source: Fx Street

I am Joshua Winder, a senior-level journalist and editor at World Stock Market. I specialize in covering news related to the stock market and economic trends. With more than 8 years of experience in this field, I have become an expert in financial reporting.