- The Bank of England is expected to reduce its official interest rate at 4.25%.

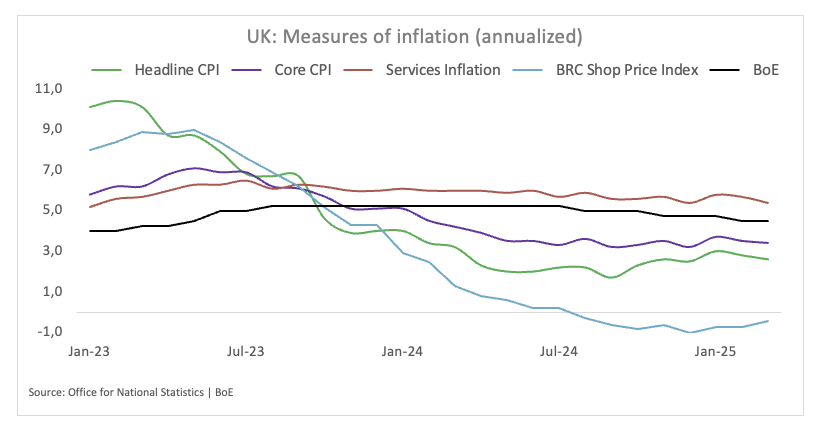

- The inflation figures of the United Kingdom remain well above the target of the BOE.

- The GBP/USD backed away from the recent peaks, around the 1,3300 area.

The Bank of England (BOE) will announce its last monetary policy decision on Thursday, in which it marks its third rate establishment of 2025.

The markets expect that the Central Bank reduces its reference interest rate at 25 basic points to 4.25% after staying out at its meeting on March 20.

The decision of the Monetary Policy Committee (CPM) will be accompanied by the minutes of the meeting and the monetary policy report (IPM), offering a window to the internal debate, while Governor Andrew Bailey will go to journalists at a press conference after the decision. Their comments will be analyzed in search of any change in the tone, particularly around the risks of inflation, the potential of tariffs and the probable moment of future rate reductions.

With the movement of rates to a large extent already discounted, the attention now focuses on the future guide of the bank and its updated economic perspective, key signals that could mold expectations for the coming months.

United Kingdom Economic Perspective: persistent inflation, tariffs, moderate growth

The Bank of England maintained the stable interest rates in March, as expected widely, with eight members of the monetary policy committee voting in favor of maintaining the reference rate. Swati Dhingra was the only dissident, supporting a cut of 25 basic points in a wink to the growing uninflationary pressure.

The decision occurred along with new inflation data that surprised down. The figures of the Office of National Statistics (ONS) showed that the annual general CPI was reduced to 2.6% in March, from 2.8% of the previous month. The underlying inflation, which excludes volatile food and energy prices, also decreased, falling to 3.4%, an additional sign that the underlying price pressure is gradually withdrawing.

The markets responded by increasing their bets on feat cuts. Interest rate futures now completely discount 100 basic stitches of relief by the end of the year, equivalent to four reductions in a quarter, a slight increase from the 94 basic points last week.

BOE officials have increasingly pointed out external risks as a factor in their perspective. Some policy responsible said that recent tariffs announced by US President Donald Trump could ultimately have an uninflationary effect on the United Kingdom. Governor Andrew Bailey, speaking during spring meetings of the International Monetary Fund, warned that the increase in commercial tensions could affect global growth.

The IMF echoed these concerns by reducing its growth forecast for the United Kingdom by 2025 to 1.1%, from 1.6%, reinforcing the case for a more moderate position by the Central Bank in the coming months.

That said, the operators will be attentive to the Bailey press conference in search of signs about whether the BOE is preparing to accelerate its cycle of feature cuts in the face of inflation in deceleration and global uncertainty.

How will the BOE rates to GBP/USD impact?

Investors are preparing for the BOE to reduce its reference rate to 4.25% on Thursday at 11:02 GMT. The decision on the interest rate will be slightly delayed to the light of the two minutes of national silence to commemorate the 80th anniversary of Victory Day in Europe.

While the decision itself is largely discounted, the attention will focus on the division of votes within the CPM and the comments of Governor Andrew Bailey in search of clues about the path of politics to follow.

With firmly established expectations, the sterling pound can show a moderate reaction to the announcement of fees, but could change direction depending on how moderate it turns out to be the tone.

In the prelude to the meeting, the GBP/USD seems to be in a consolidation phase around the 1,3300 region, further driven by the dynamics of the US dollar (USD) and the change of feeling around the US commercial policy than by internal catalysts.

“The cable was under pressure down after reaching maximums of more than three years around 1,3440 on April 28, although it seems to have found a good containment about 1,3260 so far,” said Pablo Piovano, a senior analyst at FXSTERET. He added that a clear rupture above 2025 could pave the way for a movement towards the 2022 peak in 1,3748 reached on January 13.

In the lower part, Piovano pointed out the Simple Mobile (SMA) of 200 days in 1,2849 as a key support, followed by the provisional SMA of 100 days in 1,2744, which precedes the floor of April 1,2707 (April 7). “If the sales pressure increases, a deeper support is found in the weekly minimums of 1,2558 (February 28) and 1,2332 (February 11),” he noted.

(This story was corrected on May 8 at 06:38 GMT to say that the decision will be announced at 11:02 GMT, not at 11:00 GMT, due to a last minute change in the schedule by the BOE.)

FAQS Central Banks

Central banks have a key mandate that consists in guaranteeing the stability of prices in a country or region. Economies constantly face inflation or deflation when the prices of certain goods and services fluctuate. A constant rise in the prices of the same goods means inflation, a constant decrease in the prices of the same goods means deflation. It is the Central Bank’s task to keep the demand online by adjusting its interest rate. For larger central banks, such as the US Federal Reserve (FED), the European Central Bank (ECB) or the Bank of England (BOE), the mandate is to maintain inflation about 2%.

A central bank has an important tool to raise or lower inflation: modify its reference interest rate. In precommunicated moments, the Central Bank will issue a statement with its reference interest rate and give additional reasons of why it maintains or modifies it (cut it or the SUBE). Local banks will adjust their savings and loan rates accordingly, which in turn will make it difficult or facilitate that citizens obtain profits from their savings or that companies ask for loans and invest in their businesses. When the Central Bank substantially rises interest rates, there is talk of monetary hardening. When it reduces its reference rate, it is called monetary relaxation.

A central bank is usually politically independent. The members of the Central Bank Policy Council go through a series of panels and hearings before being appointed for a position in the Policy Council. Each member of that council usually has a certain conviction on how the Central Bank should control inflation and the consequent monetary policy. Members who want a very flexible monetary policy, with low types and cheap loans, to substantially boost the economy, while comprising with inflation slightly greater than 2%, are called “pigeons.” Members who prefer higher types to reward savings and want to control inflation at all times are called “hawks” and will not rest until inflation is located at 2% or just below.

Normally, there is a president who directs each meeting, has to create a consensus between the hawks or the pigeons and has the last word when the votes must be divided to avoid a draw to 50 on whether the current policy must be adjusted. The president will pronounce speeches, which can often be followed live, in which he will communicate the current monetary position and perspectives. A central bank will try to boost its monetary policy without causing violent oscillations of the fees, the actions or their currency. All members of the Central Bank will channel their position towards the markets before a monetary policy meeting. A few days before a monetary policy meeting is held and until the new policy has been communicated, the members are prohibited from speaking publicly. It is what is called a period of silence.

Economic indicator

Decision on the BOE interest rate

He Bank of England Announce your decision on the interest rate at the end of your eight meetings scheduled per year. If the BOE adopts a hard line posture on the inflationary perspectives of the economy and elevates interest rates, it is generally bullish for sterling pound (GBP). Similarly, if the BOE adopts a moderate vision of the United Kingdom economy and keeps interest rates without changes, or reduces them, it is considered bassist for the GBP.

Read more.

Last publication:

Mar Mar 20, 2025 12:00

Frequency:

Irregular

Current:

4.5%

Dear:

4.5%

Previous:

4.5%

Fountain:

Bank of England

Source: Fx Street

I am Joshua Winder, a senior-level journalist and editor at World Stock Market. I specialize in covering news related to the stock market and economic trends. With more than 8 years of experience in this field, I have become an expert in financial reporting.