Contrary to the expectations of experts, the increase in the key rate in the United States did not have any negative impact on the crypto world. At some point, the market even grew. But what exactly is happening now and what, theoretically, can be expected in the near future?

bitcoin

Over the past week, the first cryptocurrency has grown in price by 1.6%, from $23,083 to $23,454. The absence of sharp jumps in value is largely due to the fact that investors were in anticipation of the Fed’s decision on the size of the key rate. As a result, the value of this important indicator for the US economy was 4.5-4.75%, i.e.

the rate has risen by 0.25 percentage points.

Initially, the news was met with a boom in bitcoin. On February 2, it even momentarily crossed the $24,200 mark. However, it failed to stay there, and by the end of the day, BTC returned to below $23,500.

Source: tradingview.com

In general, the market reacted to the news about the rate hike in line with expectations. This fact must have greatly upset Jim Cramer, who predicted the collapse of BTC. It is worth noting that further rate cuts from the Fed should not be expected, as inflation in the US is still above the target values.

So far, nothing critical for bitcoin has happened, there is a lateral movement, which we talked about in one of the previous articles. And yet, many experts are wary of the prospects of the historically first cryptocurrency.

For example, Peter Brandt believes that BTC is still in a bearish trend. To change the situation, according to the expert, it is necessary to reach the level of $25,500 and break through the two-hundred-week moving average.

Last week, we already talked about the fact that Bitcoin broke through the 200-day weighted moving average. The crossover of the 200-week weighted moving average is still far away (marked by the blue line in the chart below), but the simple 200-day moving average is within reach (marked by the orange line).

A source: tradingview.com

Billionaire Ray Dalio is not exactly making any predictions about the price of bitcoin, he simply doubts the ability of BTC to replace money.

Support and resistance levels have not changed since last week and amount to $22,781 and $25,212, respectively.

Source: tradingview.com

The index of fear and greed continues to grow. Now its value is 60. This indicates the prevalence of greed, although not extreme.

Ethereum

Over the week, Ethereum added a little more than Bitcoin – 2.6%. On February 2, another attempt was made to reach the $1,676.8 mark – a strong resistance level. However, it once again turned out to be unsuccessful, although at the moment the coin was worth more than $1,700.

A source: tradingview.com

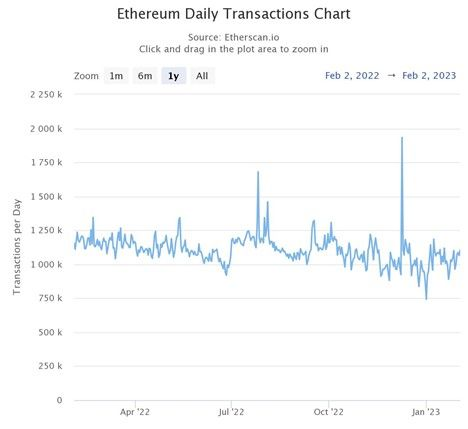

In general, we can say that the ether is in the sideways. Nothing extraordinary happens in the platform network either: the number of daily transactions ranges from 900,000 to 1.1 million. The last abnormal volume of transfers was made on December 9, when their number exceeded 1.9 million.

A source: etherscan.io

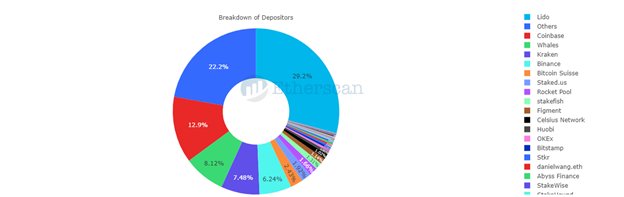

The growth of Ethereum is hindered by the upcoming Shanghai fork. In addition, a number of investors, after switching to PoS, still have questions about the management and decentralization of this cryptocurrency. According to Etherscan, four holders account for 55.89% of all deposits: Coinbase, Lido, Kraken, and Binance.

A source: etherscan.io

After changing the consensus algorithm, the question of whether the network is closer to decentralization or to something like an “oligopoly” remains open among many users.

From the point of view of technical analysis, the resistance level is $1,676.8, and the support level is $1,501.4.

Source: tradingview.com

Avalanche

If you had invested in Avalanche on December 31, 2022, you would have doubled your capital by February 2, 2023. The price rose from $10.83 to $23.12 in 33 days. True, during the preparation of this material, it fell to $21.2. But even so, the AVAX token has gained more than 95% in value since the December low.

If we talk about the results of the last week for Avalanche, they look less impressive: there was no growth as such. At the close on Friday, January 27, AVAX closed at $21.2, exactly the same price as on February 3. At the same time, the price broke through this barrier four times in a week, but failed to gain a foothold in new positions.

Source: tradingview.com

The breakthrough that Avalanche showed on February 2 can be associated with the upcoming

update online – Banff 8. It is designed to improve customer support in previous versions, cover p2p interaction, expand functionality and facilitate

optimization search for a P-Chain validator.

From the point of view of technical analysis, a decrease in volume with a continuing rise in price is striking. The largest numbers were shown relatively long ago: from January 11 to 13. What does it say? The fact that investors buy the coin in smaller quantities. This is understandable, because she has already grown a lot. On the other hand, volume is also created by sales, and therefore, no one is in a hurry to sell.

Source: tradingview.com

The current resistance level is the February 2 high at $22.79. Support is at $20.6. True, we must take into account that it was already broken this week. Therefore, it is also worth keeping an eye on the mark of $ 18.72 – the minimum of the past week.

A source: tradingview.com

As a result, the growth of cryptocurrencies in the last week of January / the first week of February turned out to be modest – within 3%. All coins are at strong resistance levels. The increase in Fed rates expected by investors did not have a significant impact on the crypto market.

This material and the information in it does not constitute individual or other investment advice. The opinion of the editors may not coincide with the opinions of the author, analytical portals and experts.

Source: Bits

I am an experienced journalist, writer, and editor with a passion for finance and business news. I have been working in the journalism field for over 6 years, covering a variety of topics from finance to technology. As an author at World Stock Market, I specialize in finance business-related topics.