- Canadian inflation is expected to consolidate in May.

- The consumer index (CPI) is expected to rise 1.7% compared to the previous year.

- In recent days, the sales pressure on the Canadian dollar has intensified.

This Tuesday, the Canada Statistics Office will publish the May Consumer Price Index (CPI). This will capture market attention because it will provide new information on inflation trends that the Canada Bank (BOC) uses to make decisions about interest rates. Economists think that general inflation will coincide with the annual increase of 1.7% in April. But in monthly terms, inflation could have risen 0.5%, which is much more than the 0.1% drop in April.

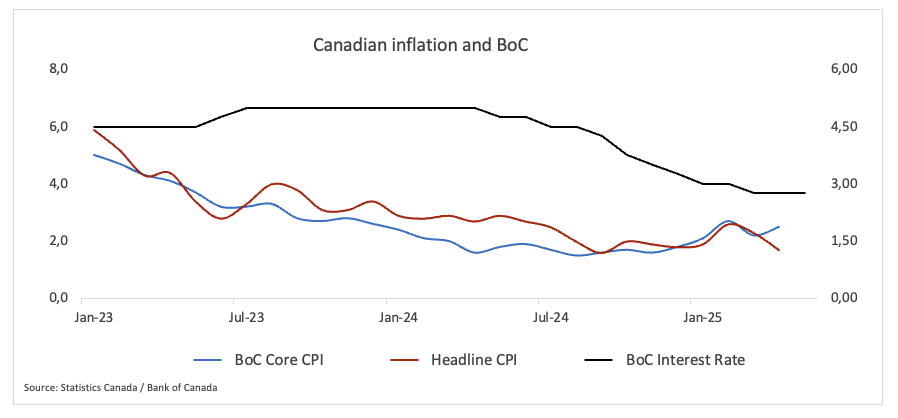

The Bank of Canada will also publish its underlying inflation measures, which exclude unstable price oscillations to show the underlying impulse. These main indicators rose 2.6% compared to the same month of last year.

Analysts remain on a maximum alert with respect to the possible transfer of internal inflation due to the impact of US tariffs, although there are signs that the pressure on prices is decreasing. Because inflation prospects are now less true, it is expected that both investors and policy responsible are cautious in the coming weeks.

What can we expect from Canada’s inflation rate?

The Bank of Canada maintained its reference rate at 2.75% earlier this month, a decision that was largely expected. The Central Bank has chosen to evaluate the complete effects of US tariffs before considering additional stimulus measures. Since June 2024, the Central Bank has reduced indebtedness costs by 225 basic points. However, Governor Tiff Macklem has indicated that more cuts could be necessary if commerce -related challenges intensify.

Market participants now assign approximately 45% probability to a rate cut in July, with nighttime indices swaps involving around 36 basic relief points by the end of the year.

In his press conference after the meeting, Governor Macklem recognized the challenge of isolating the effects of tariffs on the figures of the general CPI, pointing out the growing dependence of the bank in business surveys and soft data, which already point to an increase in input costs.

When will the Canadian CPI data be published and how could they affect USD/CAD?

April inflation data will be published on Tuesday at 12:30 GMT, and markets are prepared for a possible increase in inflationary pressure.

If inflation exceeds expectations, it could confirm the belief that the pressure on prices induced by tariffs is beginning to manifest, leading to the Bank of Canada to adopt a more cautious approach, which could strengthen the Canadian dollar (CAD) and possibly reinforce the expectations of additional cuts of rates, thus exerting some pressure on the loonie.

That said, an unexpected increase in inflation is not necessarily good news. An abrupt increase in inflation could generate concerns about the health of the Canadian economy and, paradoxically, such a surprise could also negatively impact the currency. In summary, the markets are observing closely, not only the general number, but the broader message that it sends about where politics and growth are directed.

Senior analyst Pablo Piovano of FXSTRET said that the Canadian dollar has given part of its recent profits, raising the USD/CAD from levels last viewed in early October 2024 about 1,3540 to the limits of 1,3800, the figure at the beginning of the week or new four -week maximums.

“The resurgence of the bearish tone could motivate the USD/CAD to review its minimum of 2025 in 1,3538, marked on June 16,” said Piovano. “That would be followed by the minimum of September 2024 of 1,3418 and the weekly base of 1,3358 reached on January 31, 2024.”

“A strongest conviction of the bullies could push the spot towards its provisional barrier in the 55 -day SMA in 1,3827, before the weekly maximum of 1,3860 established on May 29 and then its May peak in 1,4015 reached on May 12,” he added.

“Looking at the widest panorama, more losses are foreseen below its 200 -day key in 1,4030,” Piovano added.

“In addition, the USD/CAD is currently showing a marked recovery, since the relative force index (RSI) approaches the 56 mark, while the average directional index (ADX) is softening towards 26, indicating some loss of impetus in the current trend.

Economic indicator

Decision of the interest rate of the Bank of Canada (Boc)

He Bank of Canada (BOC) announces his decision on interest rates at the end of his eight meetings scheduled per year. If the Boc believes that inflation will be above the target (hard line), it will increase interest rates to reduce it. This is up to CAD, since higher interest rates attract greater foreign capital entries. Similarly, if Boc sees that inflation falls below the objective (Dovish), it will reduce interest rates to give an impulse to the Canadian economy in the hope that inflation will rise again. This is bassist for the CAD, since it deteries the entry of foreign capital into the country.

Read more.

Last publication:

MIÉ JUN 04, 2025 13:45

Frequency:

Irregular

Current:

2.75%

Dear:

2.75%

Previous:

2.75%

Fountain:

Bank of Canada

Economic indicator

Underlying Consumer Price Index of the Bank of Canada (Yoy)

Statistics Canada It is the entity responsible for publishing the underlying consumer price index. The underlying IPC includes fruits, vegetables, gasoline, oil, natural gas, mortgage interests, urban transport and tobacco. These eight volatile products are considered as key indicators about inflation in Canada. A high reading anticipates a firm posture of the Bank of Canada, and is bullish for the Canadian dollar.

Read more.

Next publication:

Mar Jun 24, 2025 12:30

Frequency:

Monthly

Dear:

–

Previous:

2.5%

Fountain:

Statistics Canada

Source: Fx Street

I am Joshua Winder, a senior-level journalist and editor at World Stock Market. I specialize in covering news related to the stock market and economic trends. With more than 8 years of experience in this field, I have become an expert in financial reporting.