- The Canadian dollar revolved around 1.43 on Tuesday.

- The inflation of the Canadian IPC accelerated faster than expected in February.

- Despite the increase in inflation, the CAD remains stable as the expectations of trim cuts of the BOCs decrease.

The Canadian dollar (CAD) found support against the US dollar (USD) on Tuesday, ranging from the level of 1,4300 after the inflation of the Canadian consumer price index (IPC) was accelerated even faster than expected in February. Although inflation reappeared in the Canadian data, the body found some support in the market as the IPC increase decreases the probabilities of more rates cuts by the Bank of Canada (BOC).

The last trim of Boc rates last week is demonstrating to be as badly timed as most market participants waited. Inflationary pressures are again above the annualized inflation target of 2% of the Canadian Central Bank and show serious acceleration signs. The Boc has trimmed interest rates seven times since the second semester of 2024, presumably in an effort to try to control the prices of uncontrolled housing, a really strange strategy in a country where most mortgage rates are linked to the yields of Canadian bonds instead of correlation directly with interest rates.

As the Boc cuts rates while falling directly into a new inflation hole, the markets, already shaken by a growing commercial war between Canada and the USA, have pushed the yields of the bonds even higher while investors fight to understand what they are trying to achieve the governor of the BOC, TIFF MACKLEM. The Boc is now in the unbalanceable position of having few remaining rate cuts in the gunpowder bag to boost the Canadian economy if it continues to get worse, along with high inflation and housing costs still too high with which to deal with.

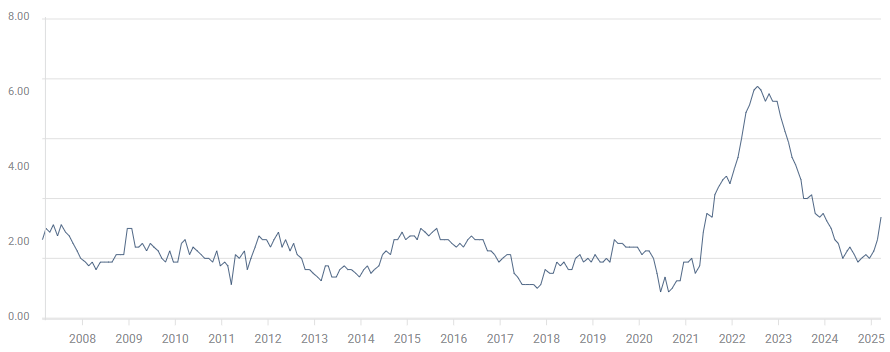

Underlying consumer price index of the BOC (year -on -year)

What moves the market today: the Canadian dollar remains stable after the increase in inflation

- The Canadian dollar remains stable near the key level of 1,4300 against the US dollar on Tuesday.

- The general inflation of the Canadian IPC accelerated to 2.6% year -on -year in February, well above the average market forecast of 2.1% and drastically increasing from 1.9% of the previous period.

- The underlying inflation metric of the IPC of the BOC also accelerated, jumping to 2.7% year -on -year from 2.1%.

- Market bets for another Boc feat cut at the next meeting of the Canadian Central Bank have joined a new round of inflationary pressures within the Canadian economy. The rates swaps now see a 30% probability of another cut of a quarter quarter in April, compared to 45% before the CPI data.

- Canadian economic data is still limited during the rest of the week of operations, however, Canadian retail sales of medium level for Friday.

Prognosis of the price of the Canadian dollar

The stubborn maintenance of the Canadian dollar near the level of 1,4300 against the US dollar has left the USD/CAD stagnant near the lower end of a lateral channel too familiar. The pair continues to turn near the 50 -day exponential (EMA) mobile average while a long -term trend remains absent.

The immediate challenge for an upward CAD

USD/CAD DAILY GRAPH

Canadian dollar faqs

The key factors that determine the contribution of the Canadian dollar (CAD) are the level of interest rates set by the Bank of Canada (BOC), the price of oil, the main export product of Canada, the health of its economy, inflation and commercial balance, which is the difference between the value of Canadian exports and that of its imports. Other factors are market confidence, that is, if investors bet on riskier assets (Risk-on) or seek safe assets (Risk-Off), being the positive risk-on CAD. As its largest commercial partner, the health of the US economy is also a key factor that influences the Canadian dollar.

The Canada Bank (BOC) exerts a significant influence on the Canadian dollar by setting the level of interest rates that banks can provide with each other. This influences the level of interest rates for everyone. The main objective of the BOC is to maintain inflation between 1% and 3% by adjusting interest rates to the loss. Relatively high interest rates are usually positive for CAD. The Bank of Canada can also use quantitative relaxation and hardening to influence credit conditions, being the first refusal for CAD and the second positive for CAD.

The price of oil is a key factor that influences the value of the Canadian dollar. Oil is the largest export in Canada, so the price of oil tends to have an immediate impact on the value of the CAD. Generally, if the price of oil rises, the CAD also rises, since the aggregate demand of the currency increases. The opposite occurs if the price of oil drops. The highest prices of oil also tend to give rise to a greater probability of a positive commercial balance, which also supports the CAD.

Although traditionally it has always been considered that inflation is a negative factor for a currency, since it reduces the value of money, the opposite has actually happened in modern times, with the relaxation of cross -border capital controls. Higher inflation usually leads to central banks to raise interest rates, which attracts more capital of world investors who are looking for a lucrative place to save their money. This increases the demand for the local currency, which in the case of Canada is the Canadian dollar.

The published macroeconomic data measure the health of the economy and can have an impact on the Canadian dollar. Indicators such as GDP, manufacturing and services PMIs, employment and consumer confidence surveys can influence the CAD direction. A strong economy is good for the Canadian dollar. Not only attracts more foreign investment, but it can encourage the Bank of Canada to raise interest rates, which translates into a stronger currency. However, if the economic data is weak, the CAD is likely to fall.

Source: Fx Street

I am Joshua Winder, a senior-level journalist and editor at World Stock Market. I specialize in covering news related to the stock market and economic trends. With more than 8 years of experience in this field, I have become an expert in financial reporting.