On Friday, July 18, the capitalization of the cryptocurrency market reached $ 4.033 trillion, almost equal to the market value of one of the largest technological companies in the world of NVIDIA, estimated at $ 4.2 trillion.

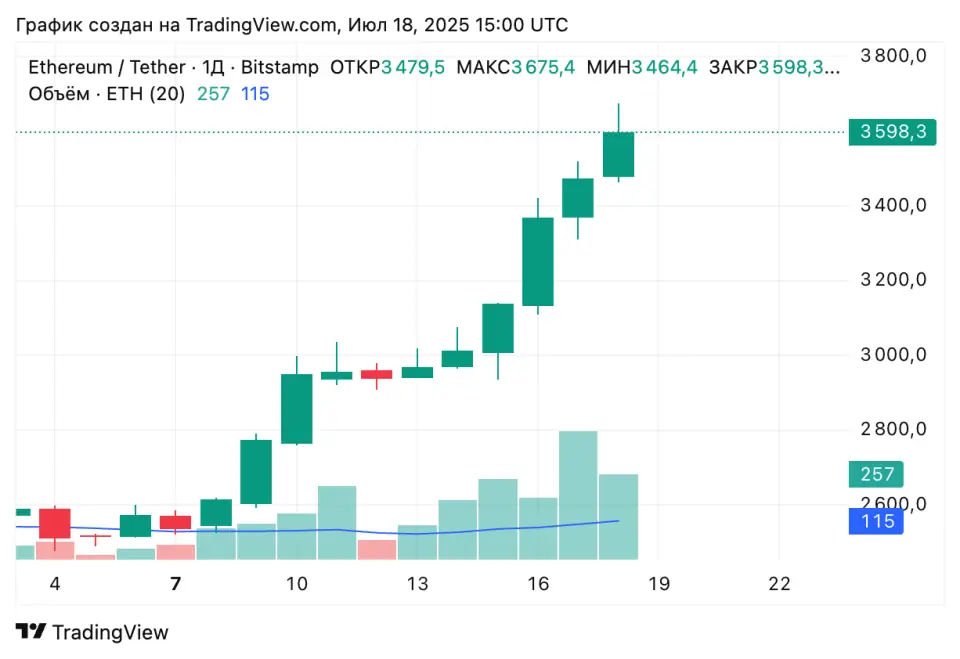

The growth of the crypto is due to an increase in prices for leading digital assets, such as Bitcoin ($ 119,000) and broadcast ($ 3500), as well as an influx of corporate capital on the ETF funds. All this happened against the backdrop of approval by the House of US representatives of draft three laws that change the rules of market regulation.

By data CoinmarketCap, at the time of the reached the new maximum, the dominance of bitcoin was about 61%, despite the short -term decrease by 0.27% per day. The total trading volume of digital assets in 24 hours amounted to more than $ 260 billion.

Sosovalue experts brought dataAccording to which over the past week, a net inflow of assets in ETF on Bitcoin amounted to about $ 3 billion, and on ETF on air – almost $ 1 billion. In just seven days, the total flow of all spinal cryptocurrency ETFs amounted to $ 54.4 billion, with an average of daily operations in the region of $ 3.7 billion.

Cryptoquant analysts have announced a positive forecast for the growth of crypto capitalization for the near future. Experts Expected The growth of bitcoin capitalization up to $ 5 trillion – thanks to the plans of the Donald Trump administration, open the US pension market for crypto investments.

Earlier, Binance, BitWise and Standard Chartered have agreed that over the next decade, Bitcoin will demonstrate steady growth of $ 200,000 to $ 500,000 thanks to the influx of institutional investments.

Source: Bits

I am an experienced journalist, writer, and editor with a passion for finance and business news. I have been working in the journalism field for over 6 years, covering a variety of topics from finance to technology. As an author at World Stock Market, I specialize in finance business-related topics.