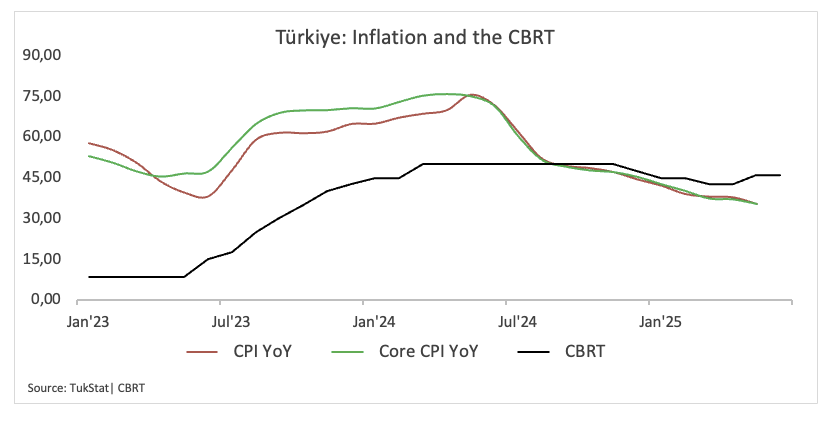

The Central Bank of Türkiye (CBRT) maintained its repo rate one week in 46% on Thursday, coinciding with the general consensus. However, he also maintained the upper limit of his rates corridor at 49% (night loan rate), which was not what many expected. The night loan rate remained at 44.50%, in line with the forecast.

The CBRT said that inflation is likely to continue falling, but that growth will probably slow down. The last decision to adopt a relatively hard line position on interest rates effectively extends a period of pause in politics, raiding the way for a possible resumption of expected rates decreases for this summer.

The Bank’s Policy Committee reiterated what it has said before: that restrictive monetary policy will be maintained until price stability is achieved through a constant fall in inflation.

The CBRT also said that the policy rate will carefully change, evaluating each meeting separately and prioritizing inflation forecast.

Market reaction

After the decision of interest rates of the CBRT, the Turkish lyre (Try) is proven weaker, taking the USD/try to reach its highest level since mid -March, around 39,5500.

FAQS inflation

Inflation measures the rise in prices of a representative basket of goods and services. General inflation is often expressed as an intermennsual and interannual percentage variation. The underlying inflation excludes more volatile elements, such as food and fuel, which can fluctuate due to geopolitical and seasonal factors. The underlying inflation is the figure on which economists focus and is the objective level of central banks, which have the mandate of maintaining inflation at a manageable level, usually around 2%.

The consumer price index (CPI) measures the variation in the prices of a basket of goods and services over a period of time. It is usually expressed as an intermennsual and interannual variation. The underlying IPC is the objective of the central banks, since it excludes the volatility of food and fuels. When the underlying IPC exceeds 2%, interest rates usually rise, and vice versa when it falls below 2%. Since higher interest rates are positive for a currency, higher inflation usually translates into a stronger currency. The opposite occurs when inflation falls.

Although it may seem contrary to intuition, high inflation in a country highlights the value of its currency and vice versa in the case of lower inflation. This is because the Central Bank will normally raise interest rates to combat the greatest inflation, which attracts more world capital tickets of investors looking for a lucrative place to park their money.

Formerly, gold was the asset that investors resorted to high inflation because it preserved their value, and although investors often continue to buy gold due to their refuge properties in times of extreme agitation in the markets, this is not the case most of the time. This is because when inflation is high, central banks upload interest rates to combat it. Higher interest rates are negative for gold because they increase the opportunity cost to keep gold in front of an asset that earns interest or place money in a cash deposit account. On the contrary, lower inflation tends to be positive for gold, since it reduces interest rates, making bright metal a more viable investment alternative.

Source: Fx Street

I am Joshua Winder, a senior-level journalist and editor at World Stock Market. I specialize in covering news related to the stock market and economic trends. With more than 8 years of experience in this field, I have become an expert in financial reporting.