- With ADP and NFP publications, it will be another key week for the US labor market.

- The US private sector is expected to add 95,000 new jobs in June.

- The American dollar index is sailed in an area not seen since February 2022.

This week, the US labor market is ready to occupy the center of the stage, adding to the combination of factors that boost the feeling of the market lately, namely geopolitical tensions mitigated in the Middle East, growing hope of greater progress in the commercial front and perspectives of a resurgence of the relief of the Fed in the third quarter, as well as the renewed analysis of President Donald Trump Trump Towards the president of the Federal Reserve (Fed), Jerome Powell.

Although concerns about a possible economic slowdown in the US have not disappeared, they seem to have remained in the background at the moment.

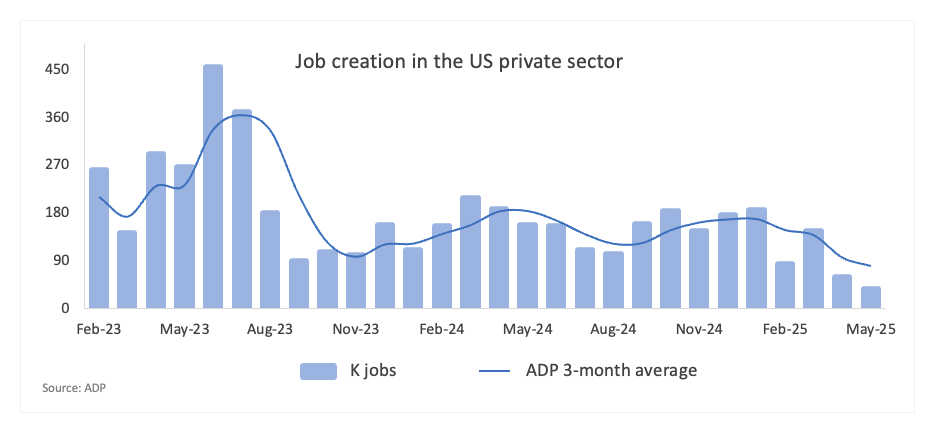

The ADP Research Institute is prepared to publish its June employment change report on Wednesday, and will explore the dynamics of employment profits in the private sector.

The ADP survey is typically published a few days before the official non -agricultural payroll data (NFP) and is frequently considered an early indicator of possible trends that can be reflected in the employment report of the Office of Labor Statistics (BLS), although the two reports do not always coincide.

Employment, inflation and strategy of the Fed

Employment serves as a fundamental element of the dual mandate of the Federal Reserve, together with the aim of maintaining price stability.

The recent months have indicated an attempt in inflationary pressure, which has led to a change of focus to the US labor market. This change follows the consistent approach of the Fed during its meeting from June 17 to 18 and the recent relatively moderate comments of President Powell in Congress.

Currently, market participants anticipate a relief of 50 basic points by the Fed in the second half of the year, a possibility that could gain additional support from certain Fed officials.

In the light of the recent optimism regarding the White House commercial strategy, together with a resistant economy and consumer price pressures in decline, the next ADP report – especially the NFP report on Friday – has gained increasing importance, which probably influences the subsequent actions of the Fed.

When will the ADP report be published and how could the US dollar index affect?

The ADP employment change report for June is scheduled to be published on Wednesday at 12:15 GMT, with projections that indicate an increase of 95,000 new jobs after the disappointing gain of 37,000 in May. The American dollar index (DXY) is currently adopting a fairly negative position while navigating minimum of several years amid somewhat better conditions in trade and continuous speculation about a potentially more accommodating Fed on the medium -term horizon.

If ADP figures exceed expectations, they could relieve some concerns about possible economic slowdown, thus supporting the cautious approach of the Fed. On the other hand, if the figures do not meet expectations, it could increase concerns about the impulse of the economy, which could lead to the Fed to reassess the moment of the resumption of their relief cycle.

Pablo Piovano, a senior analyst at FXSTERET, argued that when the minimum of several years is broken in 96.37 (July 1), the index has the potential to reach the floor of February 2022 of 95.13 (February 4), which is somewhat higher than the minimum of 2022 of 94.62 (January 14).

“On the positive side, we could expect to find some early resistance around the June ceiling, 99.42 (June 23), which is supported by the proximity of the provisional simple mobile average (SMA) of 55 days. The maximum weekly maximum of 100.54 (May 29) appears, which precedes the monthly of 101.97 (May 12),” Piovano added.

It also emphasizes that while the index is maintained below its 200 -day SMA in 103.78 and the 200 -week SMA in 102.99, its decline is likely to continue.

“In addition, the Momentum indicators still inclined to the negative side: the relative force index (RSI) has fallen to the overall region around 28, and the average directional index (ADX) remains above 17, so the trend is not exactly intense,” Piovano concludes.

(This story was updated on July 2 at 08:51 GMT to reflect a last minute consensus change at 95k.)

EMPLOYMENT – FREQUENT QUESTIONS

The conditions of the labor market are a key element to evaluate the health of an economy and, therefore, a key factor for the assessment of currencies. A high level of employment, or a low level of unemployment, has positive implications for consumer spending and, therefore, for economic growth, which drives the value of the local currency. On the other hand, a very adjusted labor market – a situation in which there is a shortage of workers to cover vacancies – can also have implications in inflation levels and, therefore, in monetary policy, since a low labor supply and high demand lead to higher wages.

The rhythm to which salaries grow in an economy is key to political leaders. A high salary growth means that households have more money to spend, which usually translates into increases in consumer goods. Unlike other more volatile inflation sources, such as energy prices, salary growth is considered a key component of the underlying and persistent inflation, since it is unlikely that salary increases will fall apart. Central banks around the world pay close attention to salary growth data when deciding their monetary policy.

The weight that each central bank assigns to the conditions of the labor market depends on its objectives. Some central banks have explicitly related mandates to the labor market beyond controlling inflation levels. The United States Federal Reserve (Fed), for example, has the double mandate to promote maximum employment and stable prices. Meanwhile, the only mandate of the European Central Bank (ECB) is to maintain inflation under control. Even so, and despite the mandates they have, labor market conditions are an important factor for the authorities given its importance as an indicator of the health of the economy and its direct relationship with inflation.

American dollar today

The lower table shows the percentage of US dollar change (USD) compared to the main coins today. US dollar was the strongest currency against the Canadian dollar.

| USD | EUR | GBP | JPY | CAD | Aud | NZD | CHF | |

|---|---|---|---|---|---|---|---|---|

| USD | -0.04% | 0.06% | -0.44% | 0.24% | 0.06% | -0.04% | -0.29% | |

| EUR | 0.04% | 0.12% | -0.49% | 0.29% | 0.19% | -0.01% | -0.24% | |

| GBP | -0.06% | -0.12% | -0.49% | 0.20% | 0.08% | -0.12% | -0.34% | |

| JPY | 0.44% | 0.49% | 0.49% | 0.74% | 0.51% | 0.39% | 0.17% | |

| CAD | -0.24% | -0.29% | -0.20% | -0.74% | -0.20% | -0.32% | -0.54% | |

| Aud | -0.06% | -0.19% | -0.08% | -0.51% | 0.20% | -0.20% | -0.43% | |

| NZD | 0.04% | 0.01% | 0.12% | -0.39% | 0.32% | 0.20% | -0.22% | |

| CHF | 0.29% | 0.24% | 0.34% | -0.17% | 0.54% | 0.43% | 0.22% |

The heat map shows the percentage changes of the main currencies. The base currency is selected from the left column, while the contribution currency is selected in the upper row. For example, if you choose the US dollar of the left column and move along the horizontal line to the Japanese yen, the percentage change shown in the box will represent the USD (base)/JPY (quotation).

Source: Fx Street

I am Joshua Winder, a senior-level journalist and editor at World Stock Market. I specialize in covering news related to the stock market and economic trends. With more than 8 years of experience in this field, I have become an expert in financial reporting.