The analytical platform Arkham Intelligence erroneously showed a sharp drop in the assets of the Bybit cryptocurrency exchange. The crypto community immediately sounded the alarm.

A graphics error on the Arkham website sparked rumors of Bybit's insolvency. Representatives of the trading platform denied all this.

Stop panicking

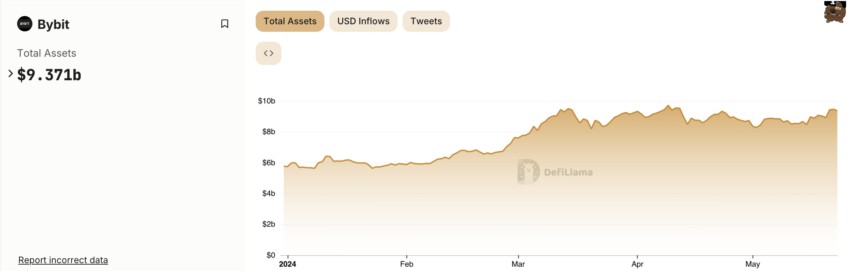

Initially fueled the rumors alarming schedule a sharp drop in user balances on Bybit. The quickly spreading news led to a significant outflow of funds from the crypto exchange. According to estimates from DefiLlama co-founder 0xngmi on X (formerly Twitter), users withdrawn more than $50 million.

However, according to the expert, such an outflow is still insignificant compared to the total assets under management by Bybit.

The marketplace said the rumors were baseless and were being spread by individuals who disagree with the strict compliance measures the platform promotes.

The trading platform team also urged all its clients to trust only information that comes directly from Bybit. The crypto platform publishes every month reserve confirmation reports. They can be found on the company's official website.

Other reputable analytics platforms such as Nansen and DefiLlama show that Bybit's reserves are now healthy. The site manages more than $9 billion.

Bybit's total assets. Source: DefiLlama

Bybit's total assets. Source: DefiLlama

After the collapse of FTX and the bankruptcy of Celsius, the crypto community reacts sharply to any news or rumors regarding the insolvency of a particular crypto exchange. For the peace of mind of users, trading platforms have begun publishing reserve confirmation reports, which show how secure clients' assets are.

In December 2023, similar concerns arose regarding MEXC. The CEO of the crypto exchange suddenly deleted his account in X, which provoked rumors about the bankruptcy of the site. Representatives of the crypto platform had to write a huge post explaining the situation.

Source: Cryptocurrency

I am an experienced journalist and writer with a career in the news industry. My focus is on covering Top News stories for World Stock Market, where I provide comprehensive analysis and commentary on markets around the world. I have expertise in writing both long-form articles and shorter pieces that deliver timely, relevant updates to readers.