Bitcoin

Bitcoin fell in price by 4.44% from December 13 to December 20, 2024. As the week progressed, the largest cryptocurrency by capitalization updated its historical maximum several times. As a result, the current peak value is $108,364. However, BTC failed to stay above $100,000. Reason: correction in the second half of the week.

Source: tradingview.com

The main news of the past seven days was the speech of the head of the US Federal Reserve, Jerome Powell. The discount rate was lowered by 0.25%, which was fully consistent with the consensus forecast. Now the rate on short-term loans is in the range between 4.25% -4.5%.

Typically, lowering interest rates is good for the crypto market. However, this time the situation was reversed. The thing is that Powell opposed the creation of a strategic reserve in bitcoins, which Donald Trump recently promised to create during the election campaign. According to the head of the Federal Reserve, the regulator has neither the rights to own BTC nor the desire to change the law. Naturally, such words

called skepticism on the part of crypto investors.

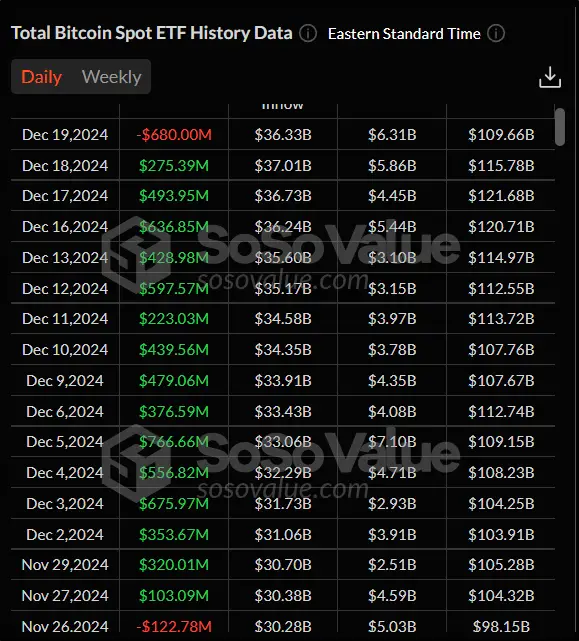

Exchange-traded crypto funds also did not add positive results. A streak of fifteen trading sessions in which bitcoin spot ETFs saw inflows came to an end on December 19th. On this day, $680 million was immediately withdrawn from exchange-traded funds on BTC. This figure was a record since the launch of spot BTC-ETFs. The previous largest cash outflow occurred on November 4, 2024, when $541.07 million was withdrawn.

Source: sosovalue.com

But during the crypto market correction, the number of discussions on the Internet about the buy the dip strategy increased. According to the analytical platform Santiment, such

discussions Happening more and more often lately:

“With Bitcoin falling to $95,500, the level of discussion around buy the dip has reached its highest level in eight months. The last time we saw crowd enthusiasm for buying nearly as strong was during the big crash on August 4th. Since then, Bitcoin’s market capitalization has increased by 81%.

According to technical analysis, indicators give multidirectional signals. On the one hand, the price is above the 50-day moving average (indicated in blue), which speaks in favor of the bulls. On the other hand, the RSI continues to fall and has already dropped below 50. This indicates the strength of the bears. The fall risks continuing if the support level of $90,742 fails to hold. The resistance level is the historical high of $108,364.

Source: tradingview.com

Index

fear and greed compared to last week decreased by two points. The current value is 74. This indicates the predominance of greed over fear in the sentiments of crypto investors.

Ethereum

Ethereum fell in price by 13.57% over the past week. ETH was unable to gain a foothold above $4,000, and ultimately fell below $3,400. As in the case of Bitcoin, in the first half of the week the bulls ruled the roost, and in the second, power passed to the bears.

Source: tradingview.com

Ether also began to fall in price after Jerome Powell’s speech. Not only retail investors, but also large market players (whales) began to get rid of their positions. There were several interesting cases

marked Analytical platform Lookonchain:

“The current price decline has forced whales to sell ether to pay off debts. One whale transferred 22,746 ETH ($77.7 million) to the Binance exchange in the last five hours and withdrew stablecoins from there to pay debts on Spark and Aave. In total, this whale transferred 31,968 ETH ($122.3 million) to Binance over the past two days.”

Or something like this

message:

“Keith transferred 49,910 ETH ($170 million) to Binance and withdrew $137.8 million in stablecoins from the same exchange in the last eight hours.”

It’s interesting that while some are selling, others are buying. Company

World Liberty Financewhich is engaged in earning interest through decentralized protocols and is directly related to Donald Trump,

acquired more than 700 ETH tokens on the decline:

“After the price of ether dropped, Trump’s World Liberty spent 2.5 million USDT buying another 722 ETH in the last two hours.”

Note that all operations were carried out by major players on December 20.

By the way, spot ETFs for ether also showed negative dynamics on December 19. After 18 consecutive trading sessions where cash inflows were observed, there was an outflow of $60.47 million. This is the first such case since November 21. Then the cash outflow amounted to $9.05 million.

Source: sosovalue.com

From a technical analysis point of view, Ethereum is currently in a downward trend. The price has already dropped below the 50-day moving average (indicated in blue). This is a strong bearish signal. In addition, the MACD histogram is falling, which indicates convergence, indicating further decline. Current support and resistance levels: $3,005.8 and $3,447.6, respectively.

Source: tradingview.com

Hedera

Hedera fell by 14.27% in the seven days from December 13 to December 20, 2024. Unlike Bitcoin and Ethereum, this cryptocurrency began to correct from the very beginning of December. Which is not surprising, since Hedera reached its three-year highs in November.

Source: tradingview.com

The decrease in the value of the HBAR token is also associated with the speech of the head of the US Federal Socialist Fund. However, the rest of the news background is quite positive. On December 19, it became known that tech giants Nvidia and Intel are going to implement Hashgraph (a unique Hedera solution similar to blockchain) when developing their chips. They will do this so that

correspond new EU regulatory standards in the field of artificial intelligence.

Company Valora cryptocurrency investment specialist, has listed an ETP (exchange traded product) for Hedera staking on the Euronex platform in Amsterdam. According to representatives of the organization, such a step should become part of the company’s mission to connect traditional finance and decentralized technologies.

It’s worth noting that this is not the first ETP for Valour. Previously, the company listed similar Ether products on the London Stock Exchange and on Near Protocol on the Swedish Spotlight Stock Market. But on Euronex before ETP for staking Hedera Valour

was not presented.

And the Swiss company The Hashgraph Group, which is behind the cryptocurrency, received a fund management license in the United Arab Emirates (UAE) through its division Hashgraph Ventures Manager. As planned, the fund will make strategic investments in advanced technologies: artificial intelligence, Internet of things, blockchain, distributed ledger technologies (DLT), robotics and quantum computers. Volume of fund funds

must make up $100 million

From the point of view of technical analysis, Hedera is undergoing a correction. At the same time, if you look at the indicators, the situation does not look so dire. The price is still above the 50-day moving average (in blue). And stochastic came close to the oversold zone. So a quick reversal is quite likely. It is worth noting that this will only become possible if it is possible to stay above the support level of $0.23335. Otherwise, the decline will continue. Resistance level = $0.3905.

Source: tradingview.com

Conclusion

The crypto market has started to decline. Investors are no longer tempted by the 0.25% change in the US Federal Reserve interest rate. But the prospect of losing a major buyer of bitcoins in the person of the American authorities caused sales of major players.

This material and the information contained herein do not constitute individual or other investment advice. The opinion of the editors may not coincide with the opinions of analytical portals and experts.

Source: Bits

I am an experienced journalist, writer, and editor with a passion for finance and business news. I have been working in the journalism field for over 6 years, covering a variety of topics from finance to technology. As an author at World Stock Market, I specialize in finance business-related topics.