Bitcoin

Shortly after Bitcoin hit its all-time high ($99,800) on November 22, a correction began. At the end of seven days, the value of the largest cryptocurrency decreased by slightly less than 3%. It has not yet been possible to overcome the coveted $100,000 mark.

Source: tradingview.com

In addition to the obvious desire of some investors to lock in part of their profits, other factors could also have contributed to the decline in the price of Bitcoin.

For example, on Wednesday, November 27, statistics on consumer spending were released in the United States. It turned out to be slightly worse than expected – the figure increased by 0.4% against the predicted 0.3%. In addition, American inflation has increased slightly. If in September it was 2.1%, it has now risen to 2.3%. In any case, both indicators, although slightly, are higher than the target of 2%.

Such news, as well as the desire of the newly elected US President Donald Trump to introduce a series of new tariffs on imported goods, reduce the US Federal Reserve’s desire to reduce interest rates. And if so, then the appetite for investment risk, which investments in cryptocurrencies certainly represent, may decrease. This is reflected in the dynamics of BTC

last week.

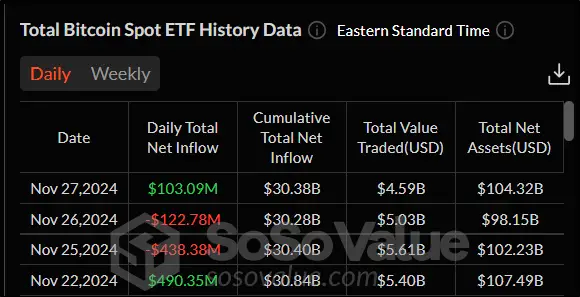

Spot Bitcoin ETFs did not add any positive results either. The dynamics for them turned out to be mixed. Days of inflows and outflows of funds followed each other. At the same time, the volume of injections has decreased. If on November 21 the influx of funds amounted to $1 billion, then in the past week not even $500 million could be reached on any day. On November 28, trading was not held in the United States due to the holiday – Thanksgiving Day.

Source: sosovalue.com

Despite some slowdown in BTC by the end of November, experts from the analytical platform CryptoQuant

convinced: The bullish rally is not over yet. They have several arguments for this:

- First, new investors now only hold just over 50% of total cryptocurrency investments. During previous bull cycles in 2017 and 2021, the rate was 90% and 80%, respectively. This state of affairs is explained by the low activity of retail investors. They have reduced their savings by 41,000 BTC since October, while large capitalists have increased their assets by 130,000 BTC. CryptoQuant notes that previous bull cycles ended when retail investors bought aggressively, which is not the case now.

- Secondly, the CryptoQuant Bitcoin Bull-Bear Market Cycle Indicator has been in bullish territory since early November and is far from overheated.

- Thirdly, the P&L index, which is the result of such metrics as MVRV,

didn’t arrive to the overbought zone.

From a technical analysis point of view, Bitcoin continues to be in an upward trend. The price is still well above the 50-day moving average (in blue). However, the strength of the trend has decreased somewhat. This is supported by the fall of the ADX indicator to 48.07 from 54.31 on November 24. Current support and resistance levels: $90,742 and $99,800 respectively.

Source: tradingview.com

Fear and Greed Index

fell up 16 points compared to last week. The current value is 78. This indicates the predominance of extreme greed in the sentiments of crypto investors.

Ethereum

Ethereum showed better dynamics compared to Bitcoin from November 22 to November 29. The growth was more than 7.5%. Having surpassed $3,600 on November 27, ETH reached its highest level since June 20. Interestingly, although Ether rose in price, the week was marked by a large number of negative trading sessions.

Source: tradingview.com

ETH’s rise coincided with open interest—the number of active derivatives—reaching an all-time high. The current value exceeds $24 billion. The growth of the indicator itself does not indicate a bullish trend (in fact, it does not indicate a bearish one), but does indicate an increase in investment interest in the second cryptocurrency.

Source: coinglass.com

On November 25, Ethereum developers announced the start of Attackathon, an event in which participants look for vulnerabilities in the code of the cryptocurrency network. Attackathon is competitive in nature: participants will search for bugs according to predetermined instructions. The event will last until January 20, 2025. The prize fund is $1.5 million. Attackathon is supported by the company

Immunefiwho deals

Web3 security.

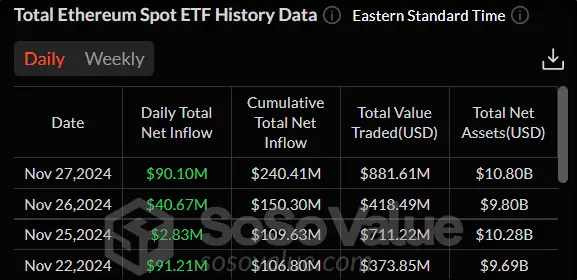

Well, one cannot help but note the positive dynamics in spot ETFs for ether. Unlike Bitcoin exchange-traded funds, there have been inflows of funds all week. True, their total amount turned out to be quite modest compared to spot Bitcoin ETFs – just over $224 million.

Source: sosovalue.com

From a technical analysis perspective, Ethereum is in bullish territory. This fact is supported by the price exceeding the 50-day moving average and the RSI indicator being above 50. The resistance level is the high of the past week – $3,688, the support level – $3,447.6.

Source: tradingview.com

Avalanche

The price of the Avalanche cryptocurrency remained virtually unchanged from November 22 to November 29. On the 25th, the level of $47.8 was reached. The last time Avalanche was this expensive was April 10, 2024. In other words, the cryptocurrency updated its seven-month maximum this week.

Source: tradingview.com

The main news that shook the Avalanche community was the rollout of the Avalanche9000 update to the testnet on Monday, November 25th. It carries, for example, the ACP-77 proposal, which will contribute to greater mobility of validators. And ACP-125 will reduce base network fees by 96%.

In addition, along with the launch of the update, a grant program was launched on the test network – Retro9000. As a result of its implementation, developers of first-level blockchain solutions will receive $40 million, $2 million of which is intended for referrals. Separately, it is worth noting the reduction in the cost of deploying first-level networks by 99.9% after implementation

Avalanche9000 into life.

By the way, the Avalanche developers are in perfect order. In November, the cryptocurrency entered the top 20 based on their activity, which is calculated by actions on Github. Avalanche’s score was 262.77, which is quite far from the leader, Internet Computer (ICP) with 808.4. If we talk about the results over the last week, they

even better. Based on the results of seven days, Avalanche is in eleventh place in terms of developer activity.

Source: cryptometheus.com

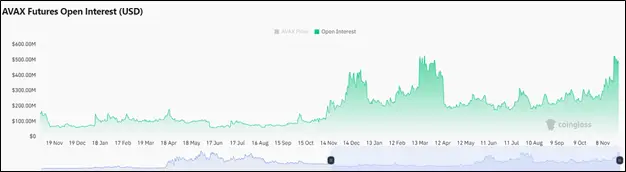

Against the backdrop of such successes, the cryptocurrency showed growth in a number of other indicators. Open interest remained above $500 million for several days during the week. This has not been observed since March 2024. The growth in the indicator clearly indicates increased interest in Avalanche from investors.

Source: coinglass.com

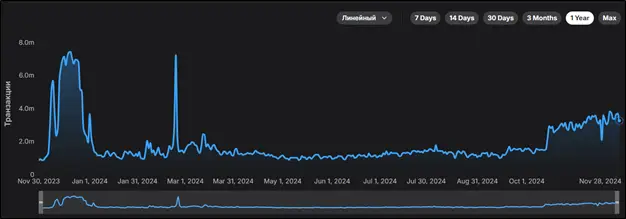

And the number of transactions continues to increase in the Avalanche first-tier networks. The trend began on September 14, when the last time the figure was less than 1 million. In November, the number did not fall below 2 million, and since November 18, there has not been a day below 3 million.

Source: subnets.avax.network

According to technical analysis, Avalanche looks quite promising. Since the beginning of November, the cryptocurrency has more than doubled. At the moment, everything speaks in favor of continuing the bullish trend. On November 22, a strong signal formed on the chart – a golden cross, the intersection of the fast 50-day moving average (marked in blue) with the slow 200-day moving average (marked in orange) from bottom to top. This is a strong signal to buy. The nearest support and resistance levels are $37.72 and $47.8, respectively.

Source: tradingview.com

Conclusion

Cryptocurrencies showed mixed movements in the last week of November. Bitcoin retreated slightly from its maximum values, ether, on the contrary, grew significantly, and, for example, Avalanche showed near-zero dynamics.

This material and the information contained herein do not constitute individual or other investment advice. The opinion of the editors may not coincide with the opinions of analytical portals and experts.

Source: Bits

I am an experienced journalist, writer, and editor with a passion for finance and business news. I have been working in the journalism field for over 6 years, covering a variety of topics from finance to technology. As an author at World Stock Market, I specialize in finance business-related topics.