Cryptoes are preparing for a strong price movement. The US dollar index (DXY) has fallen to a two-year minimum, while onchain metrics indicate the hidden accumulation of bitcoin and a deficit of the sentence.

The dollar is losing position

For the first time since the beginning of 2022, DXY sank below the 98 mark. The weakening of the dollar traditionally creates a favorable environment for risky assets, including cryptocurrencies, said the senior Coindesk analyst James Van Straten.

The fall of the index is associated with new inflation data in the United States. The annual indicator amounted to 2.4%, which turned out to be lower than the forecasts of analysts of 2.5%. This strengthened the market expectations about the softening of the monetary policy of the US Federal Reserve.

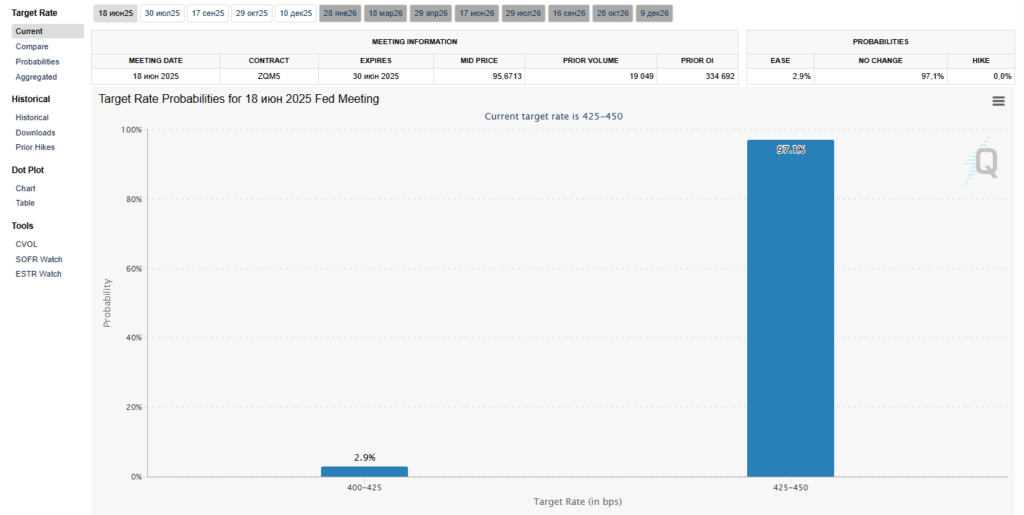

According to CME FedWatch, 97% of traders expect to preserve the previous key rate at the upcoming meeting of Federal Reserve.

Additional pressure on the American currency is talked about deadllarization and the uncertainty of the US trade policy.

Hidden phase of accumulation

Against the backdrop of a positive macroeconomic background, onchain-data bitcoin signals a reduction in a sentence. Despite the low activity of retail investors and recent negative financing rates, large players continue to accumulate the asset.

The number of coins on the wallets of centralized exchanges continues to fall. Since the beginning of 2025, the indicator has decreased by 14% and reached 2.5 million BTC – the minimum value since August 2022.

Reserves of OTC platforms at the bottom

Office platforms (OTC), which are used for large transactions, also experience a deficit. Their reserves fell to the historical minimum.

According to Cryptoquant, since January, the balances of wallets associated with the OTC segment of miners were reduced by 19% to 134.252 BTC.

Be in the know! Subscribe to Telegram.

Source: Cryptocurrency

I am an experienced journalist and writer with a career in the news industry. My focus is on covering Top News stories for World Stock Market, where I provide comprehensive analysis and commentary on markets around the world. I have expertise in writing both long-form articles and shorter pieces that deliver timely, relevant updates to readers.