- Dollar bulls are on the lookout for critical support.

- The weekly bearish momentum will moderate over the next few days and lead to a bullish correction with the 38.2% Fibonacci in sight around 103.10.

- US data and the Fed will be key in the next USD cycle.

The dollar has come under pressure this week ahead of key US data on Thursday, although dovish trading is expected as investors won’t dare make any moves ahead of Thursday and bank meetings next week, including the Federal Reserve and the European Central Bank. As of this writing, the DXY lost 0.25% for the day and has ranged from a high of 102,118 to a low of 101,576.

Key US facts

Earlier in the week, the US dollar received a brief boost as S&P Global reported preliminary PMI data for January. Manufacturing PMI came in at 46.8 vs. 46.0 expected and 46.2 for December, Services PMI at 46.6 vs. 45.0 expected and 44.7 for December, and Composite PMI at 46.6 vs. 46.4 expected and 45.0 from December. “This suggests some upside potential for next week’s PMI ISM readings,” said analysts at Brown Brothers Harriman.

Meanwhile, the US Commerce Department will release its first estimates of fourth-quarter Gross Domestic Product at the same time as the country’s core CPI prices, which are likely to accelerate at a rate of 0.5% m/m. TD Securities states that “the year-over-year growth rate likely slowed to 4.5%, suggesting that prices continue to moderate, although they remain elevated.” Turning to the growth data, the analyst said: “We also expect GDP growth to have remained strong in the fourth quarter, posting another above-trend increase.” Growth has likely been supported by firm consumption and inventories”.

Federal Reserve Outlook

The markets are pricing in a moderate result for the coming months with respect to the Federal Reserve. US stocks have benefited, as have the stronger currencies, which are also enjoying some of their domestic data. The combined sentiment and convergence among central banks have pushed the dollar lower in 2023.

Inflation measures have eased in the US, but analysts at Brown Brothers Harriman said the job market remains red hot. We will have non-farm payrolls in the coming days also falling at the start of each new month, where consensus sees 175,000 for January. ”Although down from 223,000 in December, contracting remains firm,” BBH analysts argued that they favor a longer, more hawkish result from the Federal Reserve.

WIRP suggests that a 25 basis point hike on February 1 is fully priced in, with less than a 5% chance of a hike greater than 50. Another 25 basis point hike on March 22 is 80% discounted, while that a final 25 basis point hike in the second quarter is only 35% priced in. Furthermore, the swap market continues to anticipate an easing cycle by the end of the year, and we don’t think that’s going to happen.”

The dollar remains vulnerable to market sentiment

The greenback is likely to remain on the defensive until market sentiment, if ever, turns again towards a more policy-friendly Federal Reserve. This is what makes tomorrow’s data so key. Any release that points more towards 25 than 50 basis points on February 1st will likely be the nail in the coffin for the DXY index which is hanging on the edge of the abyss as the following technical analysis illustrates. However, it may take a truly over-reading in the data to change gears, given that the market has already lowered its expectations for the Fed’s next rate move.

US dollar technical analysis

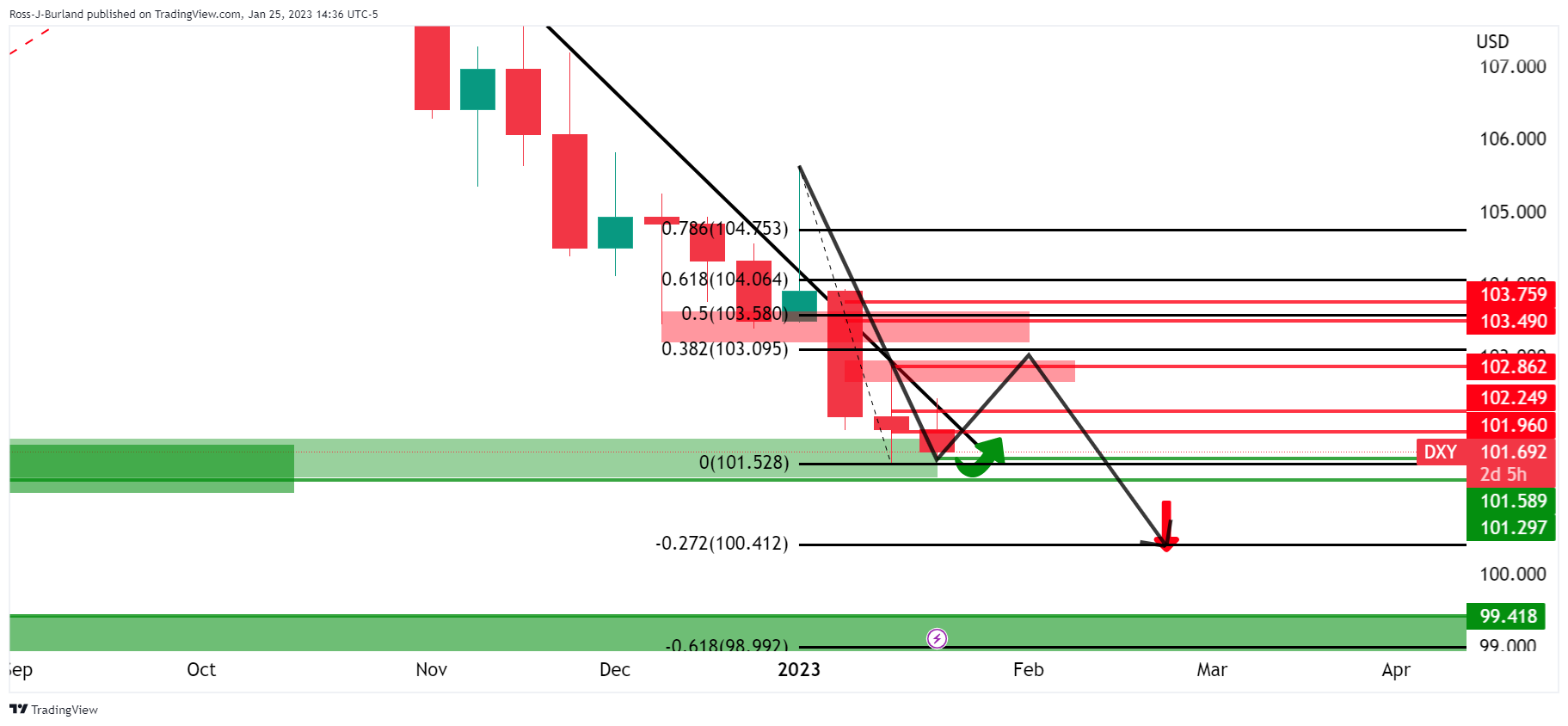

On the 4-hour chart, 101.59 and 101.30 are the key levels of the weekly structure:

If the Fed is dovish, it could test 100.00. However, it is common for markets to swing and current support could be the fuel used to ignite a bullish correction and a test of previous supports as follows:

The bearish weekly momentum will unravel over the next few days and lead to a bullish correction with the 38.2% Fibonacci in sight around 103.10.

Source: Fx Street

I am Joshua Winder, a senior-level journalist and editor at World Stock Market. I specialize in covering news related to the stock market and economic trends. With more than 8 years of experience in this field, I have become an expert in financial reporting.