- The Dow Jones recovered in the 43,000 region after an optimistic inflation report of the IPP.

- Market expectations on Fed rates cuts at the end of this year have come to life again.

- Despite the low inflation data this week, the possible impacts of tariff price are still coming.

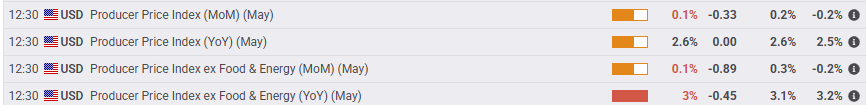

The Dow Jones Industrial Average (DJIA) received an upward offer on Thursday, driven by better than expected inflation data of the production price index (IPP) for May. Price pressures are still warm despite the best efforts of the Trump administration to make the US economy pay excessive international trade taxes, and the lack of immediate impacts of price volatility is rekindling the expectations of the market of a feature cut of the Federal Reserve (Fed) in September.

IPP inflation recovered in May, and the previous data saw a slight upward review, but the general figures were still below the medium market forecasts. Annualized underlying IPP inflation was softened to 3.0% year -on -year, while IPP general inflation increased to 2.6% year -on -year.

The general inflation data in general this week for both consumers and for producers have galvanized market bets for the start of the next cycle of Fed fees cuts. According to the Fedwatch tool of CME, the rates operators are valuing almost 80% probability of at least a 25 basic points when the Fed meets for its September rate call. Meanwhile, the Fed is expected to continue maintaining stable rates in the next two rates meetings.

The feeling of the consumer of the University of Michigan (UOM) for June will be presented in the markets on Friday to close the negotiation week, and the medium forecasts of the market await a general rebound in the results of the sentiment survey of the aggregate consumer. Investors will also maintain an attentive eye in consumer inflation expectations at 1 year and 5 years of the UOM, which remain uncomfortably high at 6.6% and 4.2%, respectively.

Dow Jones Price forecast

Thursday’s bullish impulse keeps the Dow Jones industrial average within the contact range of the main price zone of 43,000, but the significant impulse remains limited. The price action continues to get stuck in a recent congestion zone, and the main stock market index is struggling to put distance between the offers and the 200 -day exponential mobile (EMA) average about 41,780.

Dow Jones daily graphics

Dow Jones Faqs

The Dow Jones Industrial Avenge, one of the oldest stock market indexes in the world, consists of the 30 most negotiated values in the United States. The index is weighted by the price instead of capitalization. It is calculated by adding the prices of the values that compose it and dividing them by a factor, currently 0.152. The index was founded by Charles Dow, also founder of the Wall Street Journal. In recent years it has been criticized for not being sufficiently representative, since it only follows 30 companies, unlike broader rates such as S&P 500.

There are many factors that promote the Dow Jones Industrial Average (DJIA) index. The main one is the added performance of the companies that compose it, revealed in the quarterly reports of business benefits. The American and world macroeconomic data also contribute, since they influence investor confidence. The level of interest rates, set by the Federal Reserve (FED), also influences the DJia, since it affects the cost of credit, on which many companies depend largely. Therefore, inflation can be a determining factor, as well as other parameters that influence the decisions of the Federal Reserve.

Dow’s theory is a method to identify the main trend of the stock market developed by Charles Dow. A key step is to compare the direction of the Dow Jones Industrial Avenge (DJIA) and the Dow Jones Transportation Average (DJTA) and just follow the trends in which both move in the same direction. The volume is a confirmation criterion. The theory uses elements of maximum and minimum analysis. Dow’s theory raises three phases of the trend: accumulation, when intelligent money begins to buy or sell; Public participation, when the general public joins the trend; and distribution, when intelligent money abandons the trend.

There are several ways to operate with the DJ. One of them is to use ETF that allow investors to negotiate the DJ as a single value, instead of having to buy shares of the 30 companies that compose it. An outstanding example is the SPDR Dow Jones Industrial Avenge ETF (day). Future contracts on the DJ allow the specular operators about the future value of the index and the options provide the right, but not the obligation, to buy or sell the index at a predetermined price in the future. Investment funds allow investors to buy a part of a diversified portfolio of DJ values, which provides exposure to global index.

Source: Fx Street

I am Joshua Winder, a senior-level journalist and editor at World Stock Market. I specialize in covering news related to the stock market and economic trends. With more than 8 years of experience in this field, I have become an expert in financial reporting.