- The Dow Jones reached new 21 weeks on Thursday.

- The EE.U. NFP employment earnings far exceeded forecasts, crushing market fears on labor weakness.

- The markets are prepared for an early closure this week before the US USA holiday.

The Dow Jones industrial average (DJIA) registered firm profits on Thursday, testing its highest offers in five months after the US non -agricultural payroll (NFP) showed that more jobs were added in June in terms of seasonally adjusted from what the markets feared. ADP employment numbers Earlier this week they hinted at a contraction in the total employment of the US last month, generating new fears among investors that the US employment segment began to show cracks at its base.

The NFP exceeds expectations while government employment shoots

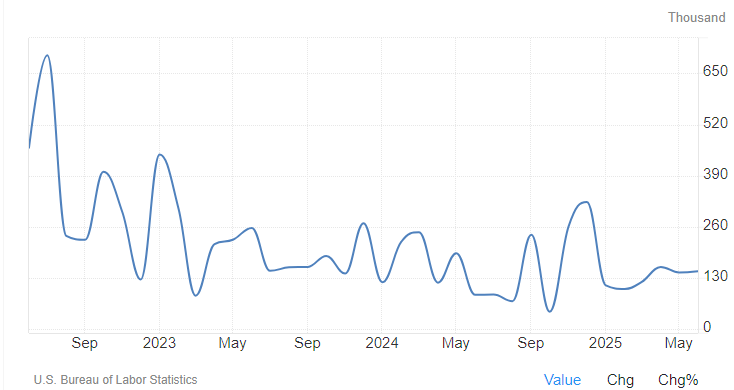

The US NFP figures showed a net gain of 147K new jobs until June, exceeding the average 110K market forecast. The figure of the previous month was also reviewed at 144k, ending functionally to the fears of employment growth in the broad market this week. However, not everything is as optimistic as it seems in the holders: about half of all employment gains registered in June came from hiring in the state and local government (+73K), closely followed by more employment gains in health services (+58.6k), with hiring in leisure and hospitality in third place (+20k). With most government hiring occurring in the education sector, analysts are launching early warning signs that it is incredibly unlikely that state and local governments can maintain this pace of employment creation.

(Source: Trainingeconomics.com)

Business services (-7k), manufacturing (-7k), wholesale trade (-6.6k) and the extraction of resources, including mining and logging (-2k), all lost jobs until June. The majority of the employment profits of the month came from roles of government spending, and with the reduction in jobs of the ‘real economy’, the June NFP, although strong, is, however, expensive.

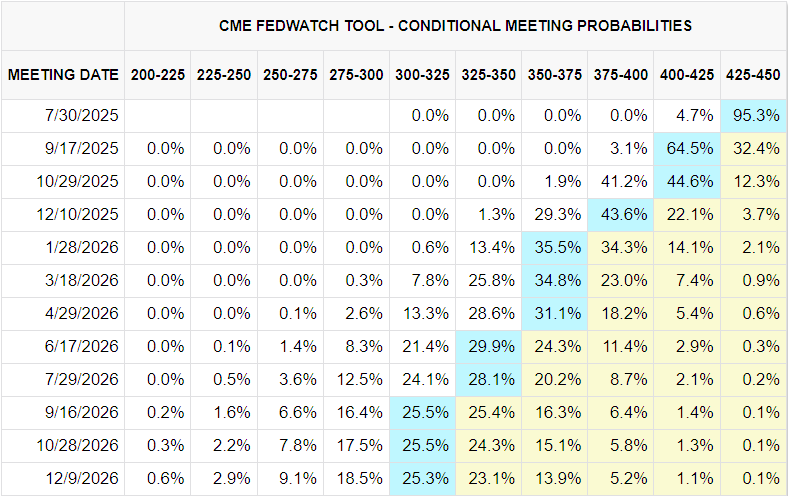

Strong profits in the net NFP of employment profits have also crushed the hopes for feat cuts in the market. The overcoming of the June employment expectations has annihilated any expectation of the market of a rate cut in the next meeting of Federal Reserve (Fed) at the end of the month, and the probabilities of three rate cuts before the end of the year have also been questioned.

The US Variable Rent markets closed early on Thursday, turning off at 5:00 pm GMT/1 pm est. The markets will remain closed until Friday by the US Day of Independence Day., And they will return to activity next week.

(Source: cmegroup.com)

Dow Jones Price forecast

June He has just begun, and the Dow Jones industrial average is already on his way to registering a third consecutive month earnings. The Dow Jones has risen more than 22% since its minimums after the announcement of tariffs about 36,600, testing the 44,800 region and on the way to challenging historical maximums just above 45,000.

The Dow Jones has gained ground in all but two of the last nine consecutive sessions. The price action is firmly anchored at the high end, maintaining the technical oscillators buried in overcompra territory. A low correction will help release the accumulated bullish pressure, and a significant drop in daily offers will be needed to take the 200 -day exponential mobile (EMA) average near the 42,000 zone.

Dow Jones daily graphics

Dow Jones – Frequently Questions

The Dow Jones Industrial Avenge, one of the oldest stock market indexes in the world, consists of the 30 most negotiated values in the United States. The index is weighted by the price instead of capitalization. It is calculated by adding the prices of the values that compose it and dividing them by a factor, currently 0.152. The index was founded by Charles Dow, also founder of the Wall Street Journal. In recent years it has been criticized for not being sufficiently representative, since it only follows 30 companies, unlike broader rates such as S&P 500.

There are many factors that promote the Dow Jones Industrial Average (DJIA) index. The main one is the added performance of the companies that compose it, revealed in the quarterly reports of business benefits. The American and world macroeconomic data also contribute, since they influence investor confidence. The level of interest rates, set by the Federal Reserve (FED), also influences the DJia, since it affects the cost of credit, on which many companies depend largely. Therefore, inflation can be a determining factor, as well as other parameters that influence the decisions of the Federal Reserve.

Dow’s theory is a method to identify the main trend of the stock market developed by Charles Dow. A key step is to compare the direction of the Dow Jones Industrial Avenge (DJIA) and the Dow Jones Transportation Average (DJTA) and just follow the trends in which both move in the same direction. The volume is a confirmation criterion. The theory uses elements of maximum and minimum analysis. Dow’s theory raises three phases of the trend: accumulation, when intelligent money begins to buy or sell; Public participation, when the general public joins the trend; and distribution, when intelligent money abandons the trend.

There are several ways to operate with the DJ. One of them is to use ETF that allow investors to negotiate the DJ as a single value, instead of having to buy shares of the 30 companies that compose it. An outstanding example is the SPDR Dow Jones Industrial Avenge ETF (day). Future contracts on the DJ allow the specular operators about the future value of the index and the options provide the right, but not the obligation, to buy or sell the index at a predetermined price in the future. Investment funds allow investors to buy a part of a diversified portfolio of DJ values, which provides exposure to global index.

Source: Fx Street

I am Joshua Winder, a senior-level journalist and editor at World Stock Market. I specialize in covering news related to the stock market and economic trends. With more than 8 years of experience in this field, I have become an expert in financial reporting.