- The Dow Jones reached the 45,000 level for the first time in history.

- Despite an early rise to a new record supply, the main index is trading softer.

- US inflation and growth data met expectations, causing little agitation.

The Dow Jones Industrial Average (DJIA) rose to another all-time high on Wednesday, reaching the main 45,000 price level before retreating below the day’s opening bids near 44,800. Stocks are cooling rapidly as the US market prepares for the upcoming Thanksgiving holiday on Thursday. Friday’s shorter hours further reduce the potential for momentum in the second half of the trading week.

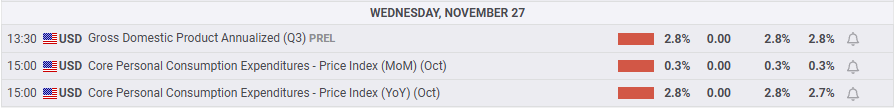

The annualized US Gross Domestic Product (GDP) grew by an expected 2.8% during the third quarter, surprising no one and barely moving the needle on investors’ pulses. The underlying Personal Consumption Expenditure Price Index (PCEPI) accelerated to 2.8% for the year ended October, also meeting expectations. While increases in inflation metrics generally bode poorly for market expectations of future rate cuts, the move higher was widely expected, and a stability in the monthly numbers at 0.3% mom helped frame the rise in the data. like something from the past.

Dow Jones News

After an early surge to test all-time highs, the Dow Jones is softening slightly, down around 75 points at the time of writing. Most stocks listed on the main stock dashboard are finding higher ground on the day, but concentrated losses in familiar tech stocks are dragging averages lower.

Salesforce (CRM) fell more than 3.5% to $330 per share as investors pull back on the data management company that has been at the forefront of the AI integration space. CRM is scheduled to deliver its latest quarterly financial results on December 3. Despite remaining short on details about how a larger AI segment within the company will drive additional revenue, the wave of generative data has propelled Salesforce to a market capitalization of $315 billion, doubling its share price in the past few years. last five years.

Dow Jones Price Forecast

Despite turning lower during the trading session on Wednesday, the Dow Jones still set another all-time high, briefly piercing the 45,000 level for the first time in history. Even though all technical signals suggest that the DJIA is overbought, bearish momentum has proven to be a trap rather than a successful entry point for most of 2024.

The Dow Jones is up around 20% so far this year, and has surpassed its own 200-day exponential moving average (EMA), which is currently up at 40,460, for more than a year in a row. A short-term bottom has been set at the 50-day EMA near 42,900, with the latest swing low up to the 42,000 level.

Dow Jones Daily Chart

The Dow Jones FAQs

The Dow Jones Industrial Average, one of the world’s oldest stock indices, is made up of the 30 most traded securities in the United States. The index is weighted by price rather than capitalization. It is calculated by adding the prices of the securities that comprise it and dividing them by a factor, currently 0.152. The index was founded by Charles Dow, also founder of the Wall Street Journal. In recent years it has been criticized for not being sufficiently representative, since it only follows 30 companies, unlike broader indices such as the S& P 500.

There are many factors that drive the Dow Jones Industrial Average (DJIA). The main one is the aggregate performance of its component companies, revealed in quarterly corporate earnings reports. US and global macroeconomic data also contribute, influencing investor sentiment. The level of interest rates, set by the Federal Reserve (Fed), also influences the DJIA, as it affects the cost of credit, on which many companies largely depend. Therefore, inflation can be a determining factor, as well as other parameters that influence the decisions of the Federal Reserve.

The Dow Theory is a method for identifying the main trend of the stock market developed by Charles Dow. A key step is to compare the direction of the Dow Jones Industrial Average (DJIA) and the Dow Jones Transportation Average (DJTA) and only follow trends where they are both moving in the same direction. Volume is a confirmation criterion. The theory uses elements of maximum and minimum analysis. The Dow theory proposes three phases of the trend: accumulation, when the smart money begins to buy or sell; public participation, when the general public joins the trend; and distribution, when the smart money abandons the trend.

There are several ways to trade the DJIA. One of them is to use ETFs that allow investors to trade the DJIA as a single security, instead of having to buy shares of the 30 companies that comprise it. A prominent example is the SPDR Dow Jones Industrial Average ETF (DIA). Futures contracts on the DJIA allow traders to speculate on the future value of the index, and options provide the right, but not the obligation, to buy or sell the index at a predetermined price in the future. Mutual funds allow investors to purchase a portion of a diversified portfolio of DJIA securities, providing exposure to the global index.

Source: Fx Street

I am Joshua Winder, a senior-level journalist and editor at World Stock Market. I specialize in covering news related to the stock market and economic trends. With more than 8 years of experience in this field, I have become an expert in financial reporting.