Despite the fact that the hacker who hacked Curve Finance began to return the funds, the total amount is quite large – over $73 million. Therefore, transactions with these tokens occupy a significant share. The attacker has already returned assets worth $52.3 million.

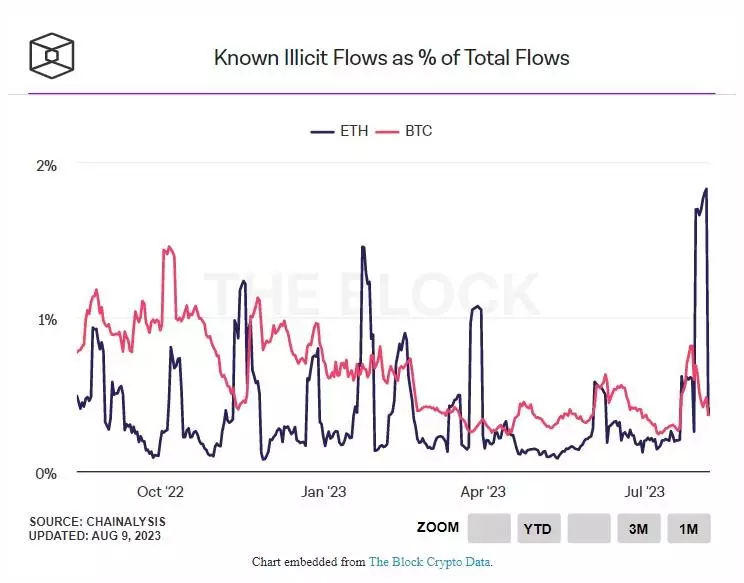

According to Chainalysis, from July 30 to August 5, the share of transactions with criminally acquired assets ranged from 1.7% to 1.82%. At the same time, earlier the maximum share of such transactions reached only 1.46%. However, on August 6, the indicator returned to normal.

The Curve Finance hack is far from the largest in terms of the amount of stolen funds. However, it was precisely when this protocol was hacked that a sharp increase in the share of transactions with criminal assets was recorded.

Earlier it was reported about the hacking of the Cypher cryptocurrency exchange. The attackers managed to withdraw assets worth about $1 million.

Source: Bits

I am an experienced journalist, writer, and editor with a passion for finance and business news. I have been working in the journalism field for over 6 years, covering a variety of topics from finance to technology. As an author at World Stock Market, I specialize in finance business-related topics.