- The Euro maintains its firm position against the US dollar.

- European stocks sail in a “sea of green” on Thursday.

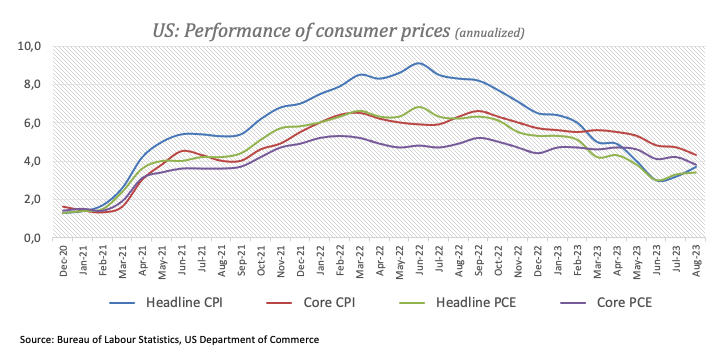

- US PCE and core PCE matched initial estimates in October.

On Thursday, the Euro (EUR) experienced further bearish pressure against the US Dollar (USD), causing the EUR/USD pair to retreat towards the important 1.0900 support level, hitting weekly lows.

On the contrary, the Dollar gained additional momentum and pushed the USD Index (DXY) back above the 103.00 level. This came alongside a modest recovery in US yields across different time frames.

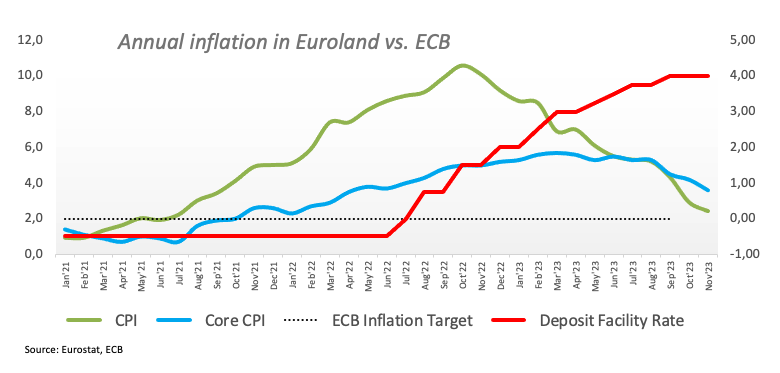

From a broader perspective, the current monetary policy scenario has not changed, with investors considering the possibility of the Federal Reserve (Fed) and the European Central Bank (ECB) reducing interest rates in the spring of 2024.

The weakness of European currencies was aggravated by disappointing figures from the German labor market, where the unemployment rate rose to 5.9% in November and the unemployment rate increased by 22,000 people. Furthermore, the Eurozone’s preliminary inflation rate showed that the CPI rose 2.4% through November, while the core CPI rose 3.6% from a year ago and the unemployment rate remained stable at 6.5%.

In the United States, inflation measured by headline PCE rose by 3.0% annualized (from 3.4%) in October and core PCE by 3.5% (from 3.7%). Other data included initial jobless claims, which increased by 218,000 in the week to November 25, and personal income and spending, which grew 0.2% month-on-month. Later in the session, pending home sales will close out the daily schedule.

Daily market summary: The Euro succumbs to the recovery of the Dollar

- The Euro loses ground against the Dollar.

- US and German yields reverse initial pessimism.

- Markets see the Fed cutting its interest rates in the second quarter of 2024.

- Investors also expect the ECB to begin cutting rates in the first half of 2024.

- The ECB’s Fabio Panetta reiterated that the euro bloc still faces downside risks.

Technical Analysis: Euro outlook remains positive above 1.0816

The acceleration of the downtrend causes EUR/USD to retreat towards the vicinity of the 1.0900 area on Thursday, adding to Wednesday’s pullback.

Further weakness could lead EUR/USD to face small initial support at 1.0852 (Nov 22). If broken, the pair could face the 200-day SMA at 1.0816, ahead of the interim 55-day SMA at 1.0676. From here, the weekly low of 1.0495 (Oct 13), before the 2023 low of 1.0448 (Oct 3) and the round level of 1.0400.

Should the bulls regain control, the pair is expected to find the next bullish barrier at the November high of 1.1017 (Nov 29) before the August high of 1.1064 (Aug 10) and another weekly high of 1.1149 (July 27), all of which precede the 2023 high of 1.1275 (July 18).

Meanwhile, the pair maintains a constructive outlook above the 200-day SMA.

Frequently asked questions about the Euro

What is the Euro?

The Euro is the currency of the 20 countries of the European Union that belong to the euro zone. It is the second most traded currency in the world, behind the US dollar. In 2022, it accounted for 31% of all foreign exchange transactions, with an average daily volume of more than $2.2 trillion per day.

EUR/USD is the most traded currency pair in the world, accounting for an estimated 30% of all transactions, followed by EUR/JPY (4%), EUR/GBP (3%) and EUR/AUD (2% ).

What is the ECB and how does it influence the Euro?

The European Central Bank (ECB), headquartered in Frankfurt, Germany, is the reserve bank of the euro zone. The ECB sets interest rates and manages monetary policy

The ECB’s main mandate is to maintain price stability, which means controlling inflation or stimulating growth. Its main instrument is to raise or lower interest rates. Relatively high interest rates – or the expectation of higher rates – tend to benefit the Euro and vice versa.

The Governing Council of the ECB takes monetary policy decisions at meetings held eight times a year. Decisions are made by the heads of the eurozone’s national banks and six permanent members, including ECB President Christine Lagarde.

How do inflation data influence the value of the Euro?

Eurozone inflation data, measured by the Harmonized Index of Consumer Prices (HICP), are important econometric data for the euro. If inflation rises more than expected, especially if it exceeds the 2% target set by the ECB, it is forced to raise interest rates to bring it back under control.

Relatively high interest rates compared to their peers tend to benefit the Euro, as it makes the region more attractive as a place for global investors to park their money.

How do economic data influence the value of the Euro?

Data releases measure the health of the economy and can influence the Euro. Indicators such as GDP, manufacturing and services PMIs, employment and consumer sentiment surveys can influence the direction of the single currency.

A strong economy is good for the Euro. Not only does it attract more foreign investment, but it may encourage the ECB to raise interest rates, which will directly strengthen the Euro. Conversely, if economic data is weak, the Euro is likely to fall.

The economic data for the four largest economies in the eurozone (Germany, France, Italy and Spain) are especially significant, as they represent 75% of the eurozone economy.

How does the trade balance affect the Euro?

Another important release for the euro is the trade balance. This indicator measures the difference between what a country earns from its exports and what it spends on imports during a given period.

If a country produces highly sought-after export products, its currency will appreciate due to the additional demand created by foreign buyers wishing to purchase these goods. Therefore, a positive net trade balance strengthens a currency and vice versa for a negative balance.

Source: Fx Street

I am Joshua Winder, a senior-level journalist and editor at World Stock Market. I specialize in covering news related to the stock market and economic trends. With more than 8 years of experience in this field, I have become an expert in financial reporting.

.jpg)