- The Euro turns its attention at the 200-day SMA against the US Dollar.

- European stocks remain optimistic unchanged on Monday.

- The bullish view on the USD Index (DXY) seems limited near 104.50.

- German yields add to Friday’s advance at the start of the week.

- US markets will be closed on Monday due to the Labor Day holiday.

- Germany’s trade surplus narrowed to 15.9 billion euros in July.

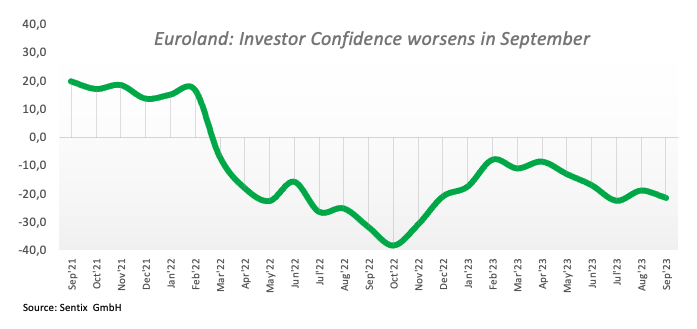

- The EMU Sentix index surprised to the downside in September.

- ECB President Christine Lagarde will speak later in the session.

The Euro (EUR) has regained some bullish momentum against the US Dollar (USD), which has allowed the pair EUR/USD back above the significant 1.0800 level with which it started the week.

Conversely, the Dollar is facing some downward pressure, falling back to the 104.00 area, as indicated by the ÍUSD Index (DXY). This pullback comes as investors continue to scrutinize the mixed results from the US jobs report released on Friday, which showed an increase of +187,000 jobs.

Meanwhile, confidence remains in the Federal Reserve’s decision to pause its interest rate hikes for the remainder of the year. There is also speculation that no interest rate cuts will take place until March 2024. On the other hand, the European Central Bank (ECB) faces considerable uncertainty regarding potential rate decisions beyond the summer. , with market debates centered on the possibility of stagflation.

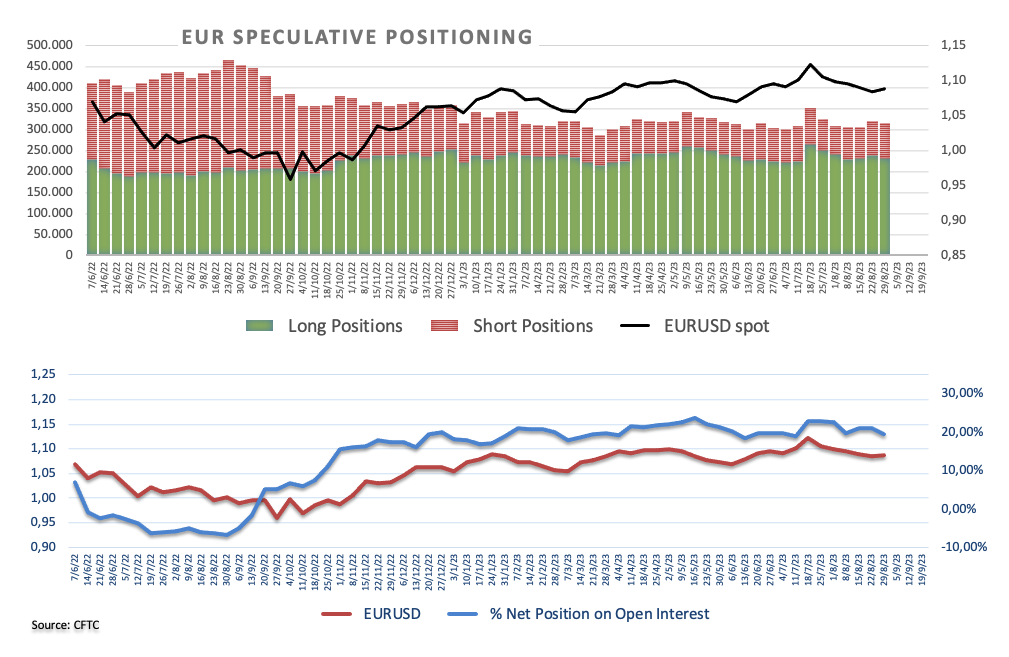

From the speculative community, net long positions in the single currency were reduced to levels last seen in early July during the week ending August 29, according to the CFTC positioning report.

US markets will be closed on Monday due to the Labor Day holiday. On the European calendar, the German trade surplus fell to 15.9 billion euros in July, while investor confidence, as measured by the Sentix index, worsened to -21.5 in the current month.

In addition, on Monday the president of the ECB, Christine Lagarde, and the members of the Council Fabio Panetta, Philip Lane and Frank Elderson will also intervene.

Daily summary of the movements in the markets: The Euro recovers part of its bullish momentum

- The Euro manages to recover part of the lost ground against the dollar.

- Trading conditions are expected to remain tight due to the US holiday.

- Investors’ attention should focus on the ECB’s statement on Monday.

- The decline in inflation and the cooling of the labor market support the Fed’s pause on interest rates.

- Markets expect the Fed to keep rates on hold in the coming months.

- The ECB appears divided on an interest rate hike later in the month.

Technical Analysis: Euro faces next hurdle near 1.0950

EUR/USD rallied a bit and manages to retest the 1.0800 zone, just before the key 200-day SMA (1.0817).

Further EUR/USD recovery is expected to target the critical 200-day SMA at 1.0817. To the north, bulls should find last Wednesday’s high at 1.0945, ahead of the interim 55-day SMA at 1.0961, ahead of the 1.1000 psychological barrier and Aug. 10 monthly high at 1.1064.

Once the latter is broken, cash could challenge the July 27 high at 1.1149. If the pair breaks above this zone, it could relieve some of the bearish pressure and potentially visit the 2023 high of 1.1275 on July 18. Further up is the 2022 high at 1.1495, closely followed by the round 1.1500 level.

A resumption of the downside bias could encourage the pair to initially revisit the August 25 low at 1.0765. A break of this level would expose the May 31 low of 1.0635, ahead of the March 15 low of 1.0516 and the 2023 low of 1.0481 seen on January 6.

Furthermore, sustained losses in EUR/USD are likely once the 200-day SMA is broken convincingly.

Source: Fx Street

I am Joshua Winder, a senior-level journalist and editor at World Stock Market. I specialize in covering news related to the stock market and economic trends. With more than 8 years of experience in this field, I have become an expert in financial reporting.