- The Euro remains on the defensive against the US Dollar.

- Stock markets in Europe maintain the positive streak on Wednesday.

- EUR/USD is approaching the key support at 1.0800.

- The DXY Dollar Index advances towards fresh two-month highs near 104.00.

- Eurozone preliminary PMI indices returned mixed results in August.

- On the other side of the Atlantic, housing data and preliminary PMIs will be published.

Selling pressure around the Euro (EUR) against the US Dollar (USD) continued on Wednesday, forcing EUR/USD to trade at fresh multi-week lows and challenge the key support at 1.0800.

Further dollar gains have led the DXY Dollar Index to trade near the key 104.00 barrier, against a backdrop of further correction in US yields across maturities after recent highs.

As for monetary policy, the debate on the Federal Reserve’s commitment to maintain a more restrictive stance for a long period of time has been renewed. This renewed interest is a result of the resilience of the US economy, even amid a slight easing in the labor market and lower inflation readings in recent months.

In the European Central Bank (ECB) internal disagreements have arisen among the members of its Council on the continuation of the tightening measures beyond the summer period. These disagreements are contributing to a renewed sense of weakness that is weighing heavily on the Euro.

Looking ahead, market participants are expected to be cautious ahead of the upcoming Jackson Hole Symposium and Chairman Jerome Powell’s speech later in the week.

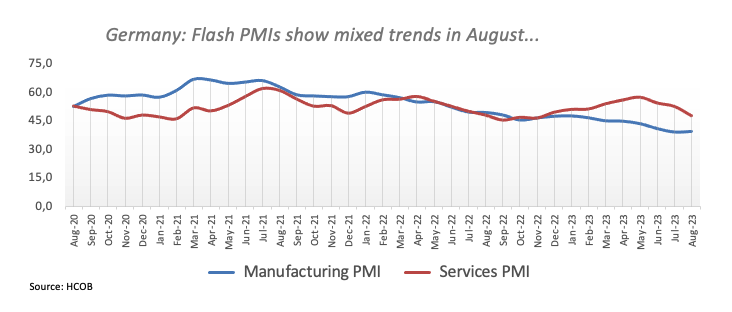

On the European calendar, August flash PMI indices in Germany and the Eurozone in general showed a small improvement in the manufacturing sector, but further weakness among service providers.

In this sense, money market futures indicate a probability of only 40% for a 25 basis point increase in interest rates by the ECB in the next month. This contrasts with the situation prior to the publication of the data, when the probability was approximately 60%.

Preliminary PMIs will also be released in the US, along with the usual weekly data on MBA mortgage applications and new home sales.

Market drivers: The Euro maintains the sales position near 1.0800

- The Euro continues to weaken against the Dollar and is trading near 1.0800.

- Risk aversion trading underpins the bullish bias in the US dollar.

- US yields appear to have stalled after recent highs.

- Investors’ attention remains focused on the Jackson Hole Symposium to be held later in the week.

- The Fed’s talk of tightening rates for longer dominates trader sentiment.

- The Fed is likely to keep rates unchanged through the first quarter of 2024.

Technical Analysis: Euro could accelerate losses below the 200-day SMA

EUR/USD slide gains additional momentum and gradually approaches key support at 1.0800, which also seems to be underpinned by the proximity of the 200-day SMA at 1.0797.

Further pullbacks could force EUR/USD to revisit the important 200-day SMA at 1.0797 ahead of the May 31 low at 1.0635. Further below, additional support levels exist at the March 15 low at 1.0516 and the 2023 low at 1.0481 seen on January 6.

Should the bulls regain the lead, the pair is expected to find an interim barrier at the 55-day SMA at 1.0961 before the psychological level of 1.1000 and the Aug 10 high at 1.1064. Once the latter is broken, the pair could challenge the high of 1.1149. If the pair breaks above this zone, it could relieve some of the bearish pressure and possibly visit the 2023 high of 1.1275 recorded on July 18. Further up is the 2022 high at 1.1495 on Feb 10, closely followed by the round 1.1500 level.

The positive outlook for EUR/USD could be threatened if the pair breaks below the important 200-day SMA.

Source: Fx Street

I am Joshua Winder, a senior-level journalist and editor at World Stock Market. I specialize in covering news related to the stock market and economic trends. With more than 8 years of experience in this field, I have become an expert in financial reporting.