The expensive mortgage loans continue to hinder the housing market In the United States (USA), according to recent data, pointing out the growing difficulties for a key sector in the world’s largest economy. Given the improbable decrease in short -term mortgage rates and the growing economic uncertainty, the real estate market could be seen in difficulties, since more and more buyers consider that investing in it is too expensive.

Sales of pending housing in the US fell by 6.3% in April, according to the National Association of Real Estate Agents (NAR) in its latest statistical report published on Thursday. The fall exceeded the 1% drop forecast by analystsunderlining the problems that are currently observed in the Housing Market in the USA.

The pending sales index of the Nar housing – an advanced indicator that typically anticipates the sales of existing housing from one to two months – fell to 71.3, its lower level in almost a year. According to Nar, an index of 100 would be equal to the level of contract activity in 2001.

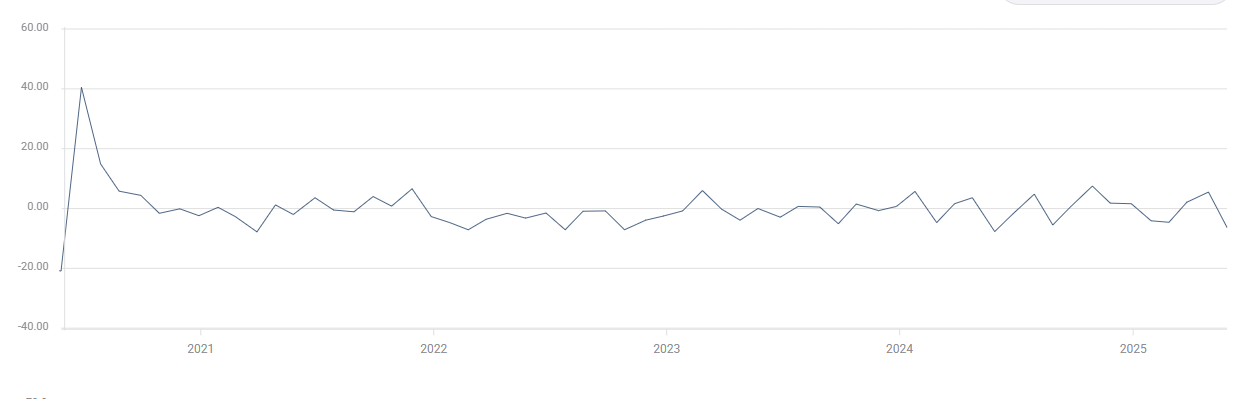

Change in sales of pending housing in the US in % (intermennsual). Source: FXSTERET.

The fall was widespreadwith the four main regions of the US registers monthly falls. In interannual terms, contract signatures decreased in the northeast, south and west, with only the west medium registering a modest increase.

“In this critical stage of the real estate market, Everything revolves around mortgage rates“, Said Lawrence Yun, chief economist of Nar.” Despite the increase in housing inventory, we are not seeing an increase in housing sales. “

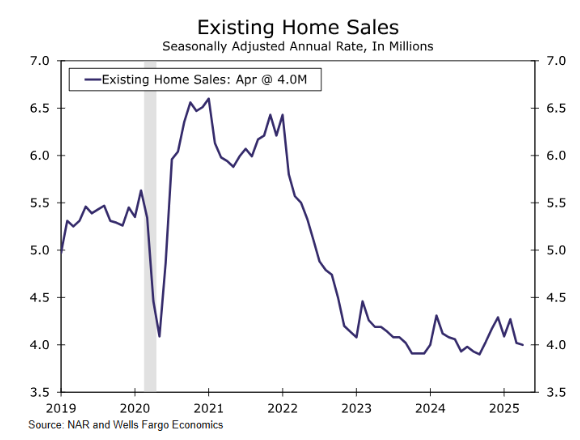

Existing housing sales – The main market volume indicator – They also fell 0.5% in April and remain close to minimums of several years in seasonally adjusted terms. The discrepancy between the increase in the inventory and the stagnation of sales highlight to what extent High rates have paralyzed both buyers and vendors.

Mortgage rates in the US reaches maximum of 2025, housing affordability decreases

In fact, it is no accident that the fall in the agreed housing contracts coincides with The increase in mortgage rates. According to the Primary Mort Mac Mort Mercado Survey, published on Thursday, fixed mortgage rates at 30 years are 6.89%, and the rate at 15 years is 6.03%, both marking new maximums since February.

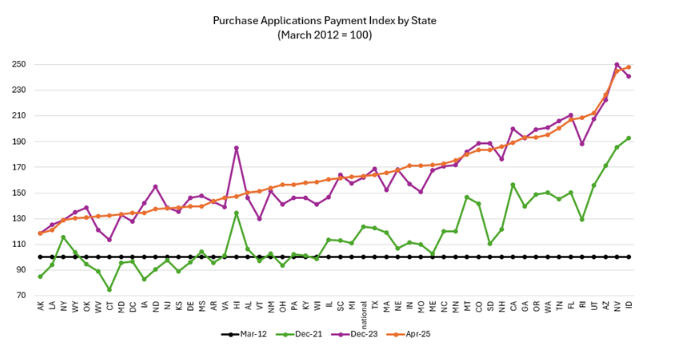

The Mortgage Banqueros Association (MBA) will publish its weekly data on mortgage interest rates on Friday, but reported a similar behavior last week, with 30 -year -old rates around 6.9% for fixed loans at the end of May. Their monthly data applications published on Thursday showed that the affordability of housing buyers decreased in April, “with the average payment applied by purchase applicants by increasing to $ 2,186 from 2,173 $.”

Purchase requests index (Source: Association of Mortgage Banners)

The Fed maintains a restrictive posture, continues to delay feat cuts in 2025

One of the main “guilty” of The expensive mortgage loans is the Fed because Financing costs depend largely on the rates established by the US Central Bank.. Commercial banks borrow and lend their surplus reserves to each other at that level, so any change in the expectations of the Fed fund rate decisively affects commercial interest rates for mortgage loans.

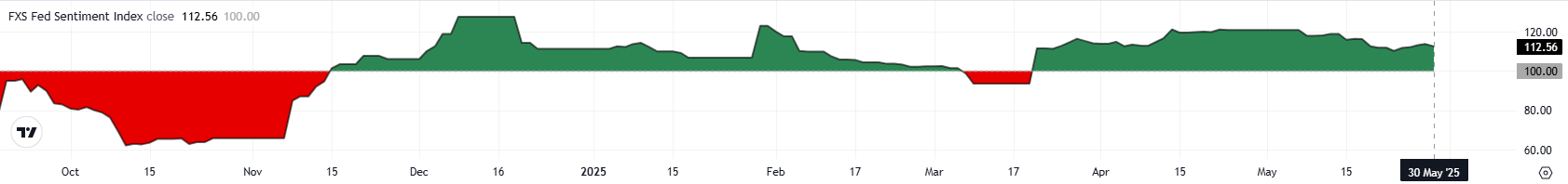

The federal reserve position (FED) continues to generate winds against the housing market. The minutes of the May meeting and a chorus of recent speeches of the FED have reinforced a higher interest rate perspective for a longer time. He FXSTERET FED Fee Index It is currently above 110, remaining comfortably in hard line territory, after the activity of this week’s Fed speeches.

FXSTERET FED Fee Index

Even traditionally neutral voices such as that of the President of the Federal Reserve of New York, John Williams (an average speaker of 5.8, a neutral score according to Fxstreet Fxstret). Tuesday.

The president of the Fed of Dallas, Lorie Logan, repeated the issue, saying that politics is “in a good place” and suggesting that any change could take “quite time” – a language that indicates that there is no urgency to cut interest rates and offers little comfort to possible housing buyers or mortgage lenders.

After these comments, the markets continue to value delayed interest rate cuts, according to the CME Fedwatch tool, which now only projects an average of two cuts this year, in September and December.

What is the correlation between the bond market and the housing market?

The finding that interest rates could remain at higher levels during a longer period is also affecting the bond market American Treasurystill Sample signs of a weak demand.

Long -term yields have retreated slightly from the maximum of 18 months reached last week after the reduction of US sovereign debt by Moody’s, but remain at very high levels. The yields of the Treasury bonds at 20 and 30 years in the US are just below the 5%psychological threshold, currently in 4.94%and 4.93%, respectively.

With the Fed pointing out patience and stagnant mortgage rates near cyclic maximums, The housing market in the US will probably remain content. Until financing costs retramed significantly, The affordability will remain outside the reach of manyand the new mortgage firms will remain weak.

As Yun of the Nar said: “The lowest mortgage rates are essential to attract housing buyers back to the real estate market.” For now, they may have to keep waiting.

Source: Fx Street

I am Joshua Winder, a senior-level journalist and editor at World Stock Market. I specialize in covering news related to the stock market and economic trends. With more than 8 years of experience in this field, I have become an expert in financial reporting.