Fear and Greed Index (Fear and Greed) is a tool that helps to evaluate market moods

According to alternative.me, the fear index and greed for cryptoine today, June 11, shows 72 points. This corresponds to the zone of “greed”.

What is an index of fear and greed

The index of fear and greed helps to better understand what mood prevail among crypto -investors. The scale of this tool ranges from 0 to 100, where:

- 0–25 – extreme fear (underestimation of assets is possible);

- 26–50 – caution or neutrality;

- 51–75 – greed (growth of hype);

- 76–100 – extreme greed (risk of correction).

Initially, the index was created for the stock market. However, Alternative.me adapted it to cryptocurrencies, given the specifics of digital assets. The calculation technique includes factors such as volatility, trading volumes and market impulses, the dominance of bitcoin (BTC) and more.

The current indicator 72 of the paragraph suggests that optimistic moods prevail on the market. Investors are more willing to invest in cryptocurrencies, expecting further growth.

The current indicator 72 of the paragraph suggests that optimistic moods prevail on the market. Investors are more willing to invest in cryptocurrencies, expecting further growth.

What to do to traders in the conditions of “greed”

The current value of the index indicates a growing risk appetite, but experienced market participants know that the correction often follows greed. Here are a few strategies for different types of traders in the current conditions:

For short -term traders and scalper

- Fix profit more often. In the greed zone, sharp prices are possible both up and down. Install teak profites closer to the key resistance levels.

- Tighten the stop losses. Increased volatility increases the risk of false breaks. Place protective orders just below important supports.

- Follow the volume. A sharp increase in trading on peaks can signal the imminent turn.

For medium -term investors

- Build on kickbacks. If the index remains in the zone of greed, but BTC/altcoins will temporarily pass by 5-10%, this can be a point for averaging positions.

- Diversify the portfolio. Part of the funds can be transferred to stabblecoins or protective assets (for example, gold or shares of low -layer sectors).

- Pay attention to altcoins. In phases of greed, capital often flows into more risky assets with high growth potential.

For long -term holders

- Do not succumb to FOMO. If you believe in the prospects of the crypto, the current level is not the best moment for large one -time purchases. Wait for correction or period of fear.

- Use DCA strategy. Buying in equal parts through fixed time intervals will reduce the risks of entering the peaks.

- Analyze fundamental indicators. In conditions of greed, it is important to separate the “noise” from real growth factors.

What is happening on the cryptoine

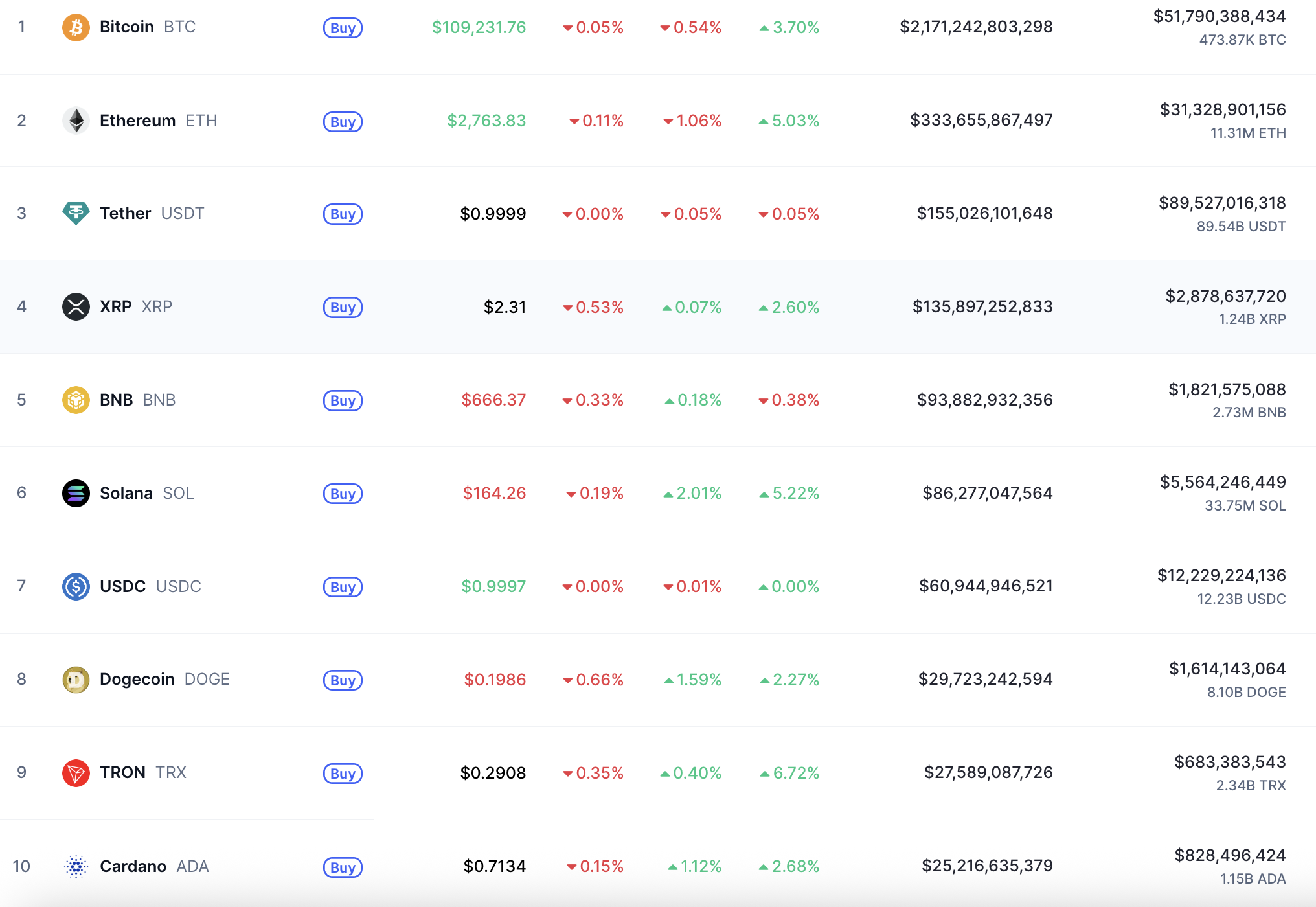

According to CoinmarketCap, at the time of writing this material, bitcoin is traded at $ 109,227. Over the past day, its price has sank by a minor 0.5%.

Meanwhile, the price of Ethereum (ETH) is $ 2,763 – over the past 24 hours, the indicator dropped by 1%. From the top 10 cryptocurrencies on capitalization, SOLANA (SOL) showed the best dynamics, which rose more than 2% to $ 164.

Be in the know! Subscribe to Telegram.

Source: Cryptocurrency

I am an experienced journalist and writer with a career in the news industry. My focus is on covering Top News stories for World Stock Market, where I provide comprehensive analysis and commentary on markets around the world. I have expertise in writing both long-form articles and shorter pieces that deliver timely, relevant updates to readers.