- The GBP/USD is quoted in a narrow range after the Fed maintains the rates at 5.25%–5.50%.

- The Fed points chart shows a slower GDP by 2025, with a higher underlying inflation of 3.1%.

- The operators await Powell’s press conference to obtain clarity on the Rate.

The GBP/USD quotes within a range of 40 pips, exhibiting slight volatility on Wednesday, after the Federal Reserve (Fed) Keep the rates and suggest that you still wait for two rates cuts this year. At the time of writing, the PAR quotes about 1,3450, registering modest profits of 0.20%, while the operators expect the press conference of the president of the Fed, Powell.

La Libra quotes about 1,3450 after the Fed adheres to its script, projecting two rates cuts this year

As expected, the Federal Reserve maintained the objective range for the federal funds unchanged in 4.25%–4.50%, reaffirming that the US economy continues to expand at a solid rhythm, with strong labor market conditions. The Federal Open Market Committee (FOMC) reiterated its commitment to monitor the risks associated with both sides of its dual mandate and confirmed plans to further reduce their treasure bond holdings.

The June projections of the Summary of Economic Projections (SEP) indicated a slight degradation in the growth prospects of GDP by 2025 to 1.4% from 1.7% in March. The forecast for the unemployment rate was checked from 4.4% to 4.5%, while the inflation projection of the underlying PCE is projected to increase 3.1% from 2.8%.

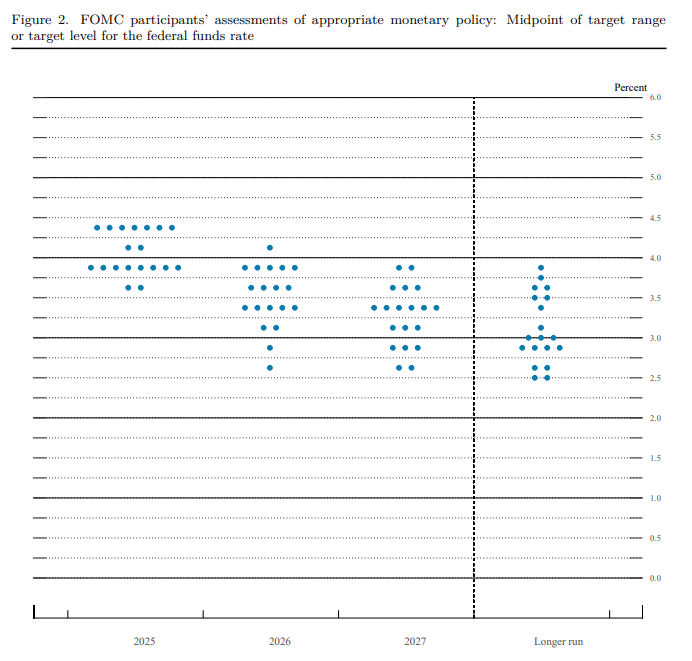

The medium projection of the federal funds rate by 2025 remained at 3.9%, suggesting that Fed officials are still waiting for two 25 -point rate cuts this year.

Source: Federal Reserve Points Graph

GBP/USD reaction

The GBP/USD is currently quoting within the range of 1,3450 – 1,3500 at the time of writing, with key resistance levels located in the maximums of the 20 -day SMA in 1,3535. If Powell adopts a dovish posture, a greater increase is expected, 1,3600 being the following objective, followed by a test of the annual peak in 1,3631. On the contrary, a Hawkish inclination of Powell, with a fall below 1,3400, is in the cards, clearing the way to try the 50 -day SMA in 1,3376, before 1,3350.

LIBRA ESTERLINA PRICE THIS WEEK

The lower table shows the percentage of sterling pound (GBP) compared to the main currencies this week. Libra sterling was the strongest currency against pound sterling.

| USD | EUR | GBP | JPY | CAD | Aud | NZD | CHF | |

|---|---|---|---|---|---|---|---|---|

| USD | 0.25% | 0.86% | 0.03% | 0.59% | -0.62% | -0.45% | 0.67% | |

| EUR | -0.25% | 0.50% | -0.22% | 0.35% | -0.74% | -0.70% | 0.43% | |

| GBP | -0.86% | -0.50% | -0.68% | -0.15% | -1.22% | -1.18% | -0.07% | |

| JPY | -0.03% | 0.22% | 0.68% | 0.54% | -0.97% | -0.83% | 0.21% | |

| CAD | -0.59% | -0.35% | 0.15% | -0.54% | -1.14% | -1.04% | 0.07% | |

| Aud | 0.62% | 0.74% | 1.22% | 0.97% | 1.14% | 0.04% | 1.17% | |

| NZD | 0.45% | 0.70% | 1.18% | 0.83% | 1.04% | -0.04% | 1.13% | |

| CHF | -0.67% | -0.43% | 0.07% | -0.21% | -0.07% | -1.17% | -1.13% |

The heat map shows the percentage changes of the main currencies. The base currency is selected from the left column, while the contribution currency is selected in the upper row. For example, if you choose the sterling pound from the left column and move along the horizontal line to the US dollar, the percentage change shown in the box will represent the GBP (base)/USD (quotation).

Source: Fx Street

I am Joshua Winder, a senior-level journalist and editor at World Stock Market. I specialize in covering news related to the stock market and economic trends. With more than 8 years of experience in this field, I have become an expert in financial reporting.