- GBP/USD stable about 1,3638 in the middle of the divergence of Fed and BOE policies.

- The US NFPs exceed expectations and fall in unemployment applications support the dollar.

- Trump’s tariff threats revive the feeling of risk aversion, reducing the attractiveness of the pound.

- The United Kingdom Chancellor warns about tax increases after the change of course in well -being; GDP and production data are expected.

The sterling pound remains practically unchanged during the North American session, but remains above a key technical level, after a solid employment report in the United States (USA). This, together with the probability of new tax increases by the British government, is exerting pressure on the cable. At the time of writing, the GBP/USD exchange rate is 1,3638.

The pound is stabilized by about 1,3640 while the solid US data and the imminent tax increases in the United Kingdom weigh on the feeling; The probabilities of rate cuts favor the upstream of the USD

Last week, the US revealed that non -agricultural payroll figures exceeded 110K estimates, reaching 147K, while the unemployment rate decreased. In addition, salaries remain stable and the number of Americans who request unemployment benefits has decreased.

The appetite for the risk became slightly negative, since the attention of the traders focused again on US commercial policy, particularly on tariffs. US President Donald Trump announced that more than ten to twelve letters would be sent later during the day to some commercial partners, establishing tariffs on those countries, which increases the anguish and fears of investors that the commercial war continues.

In the United Kingdom, Finance Minister Rachel Reeves warned the ministers that taxes would have to increase after the change of the government’s direction in the welfare reform. Meanwhile, the traders focus on the BRC retail sales report, Breeden’s speech of the Bank of England and the publication of the figures of the Gross Domestic Product (GDP), as well as the industrial and manufacturing production data.

On the other side of the Atlantic, the traders will be attentive to the publication of the minutes of the meeting of the Federal Open Market Committee (FOMC), the data of initial unemployment applications and the speeches of the Federal Reserve.

Expectations of interest rates of the Fed vs. BOE

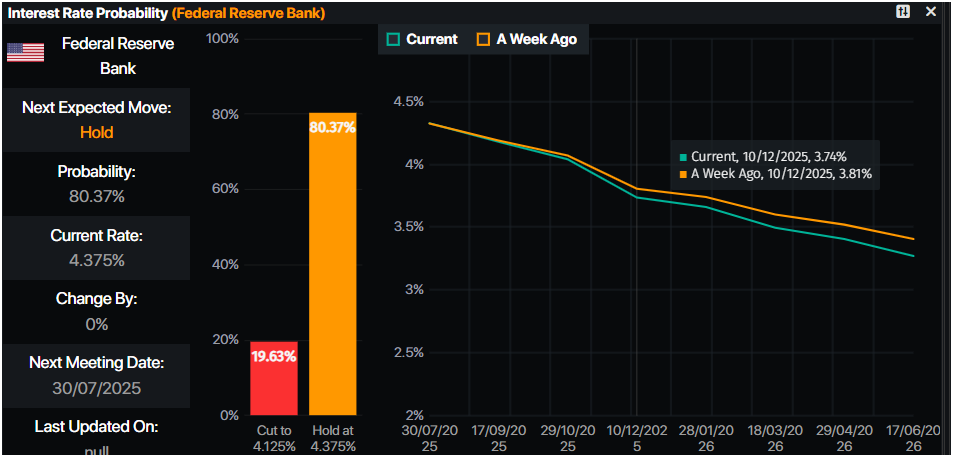

The Federal Reserve is expected to maintain the rates without changes in the July 30 meeting, with probabilities of 80.37%. Futures of the monetary market had projected 50 basic relief points by December 2025.

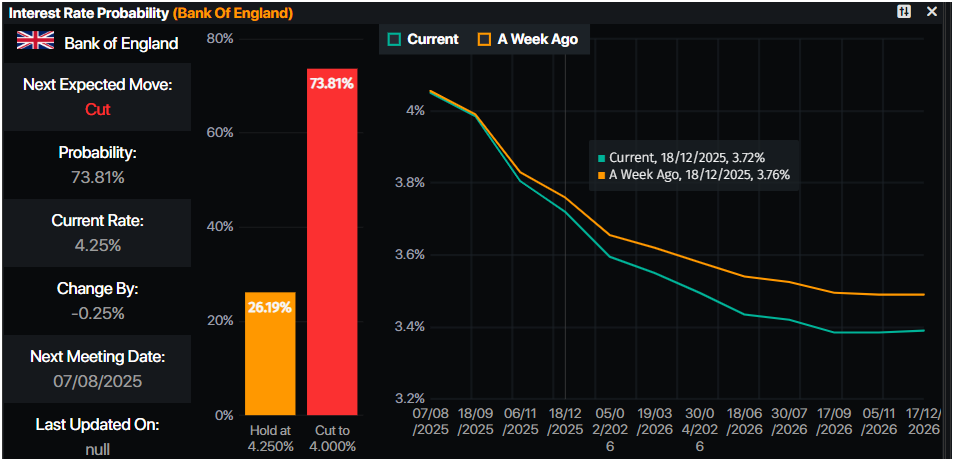

The possibilities of the Bank of England of a 25 basic points cut at the August 7 meeting are 73.81%, which would take the bank rate to 4.25%. The traders had incorporated more than 53 basic points of relief towards the end of the year.

Fed interest rate probabilities – Prime Market Terminal

BOE interest rate probabilities – Prime Market Terminal

Therefore, greater divergence between central banks could exert pressure on the GBP/USD and improve the prospects of the US dollar, since the difference in interest rates could benefit the US.

GBP/USD price forecast: Technical Perspectives

The gBP/USD bullish trend remains intact, but the impulse seems to be weakening. The relative force index (RSI) is going down to its neutral line. Therefore, a setback towards the level of 1,3600, and below, is on the horizon.

In that case, the key support levels would be the minimum daily of July 2 in 1,3561, followed by 1,3500 and the 50 -day SMA in 1,3473. On the positive side, if the GBP/USD exceeds the maximum daily of July 4, the following objective would be 1,3681, which would put 1,3700 at stake. A rupture of this last would expose the annual maximum of 1,3788.

LIBRA ESTERLINA PRICE THIS MONTH

The lower table shows the percentage of sterling pound (GBP) compared to the main currencies this month. Libra sterling was the strongest currency against the New Zealand dollar.

| USD | EUR | GBP | JPY | CAD | Aud | NZD | CHF | |

|---|---|---|---|---|---|---|---|---|

| USD | 0.49% | 0.71% | 1.34% | 0.32% | 1.02% | 1.35% | 0.49% | |

| EUR | -0.49% | 0.23% | 0.68% | -0.14% | 0.60% | 0.83% | 0.00% | |

| GBP | -0.71% | -0.23% | 0.60% | -0.37% | 0.38% | 0.61% | -0.22% | |

| JPY | -1.34% | -0.68% | -0.60% | -0.89% | -0.26% | 0.06% | -0.76% | |

| CAD | -0.32% | 0.14% | 0.37% | 0.89% | 0.67% | 0.98% | 0.15% | |

| Aud | -1.02% | -0.60% | -0.38% | 0.26% | -0.67% | 0.23% | -0.61% | |

| NZD | -1.35% | -0.83% | -0.61% | -0.06% | -0.98% | -0.23% | -0.83% | |

| CHF | -0.49% | -0.00% | 0.22% | 0.76% | -0.15% | 0.61% | 0.83% |

The heat map shows the percentage changes of the main currencies. The base currency is selected from the left column, while the contribution currency is selected in the upper row. For example, if you choose the sterling pound from the left column and move along the horizontal line to the US dollar, the percentage change shown in the box will represent the GBP (base)/USD (quotation).

Source: Fx Street

I am Joshua Winder, a senior-level journalist and editor at World Stock Market. I specialize in covering news related to the stock market and economic trends. With more than 8 years of experience in this field, I have become an expert in financial reporting.