The International Monetary Fund revised downwards its forecast for global growth again today, warning that downside risks from high inflation and the war in Ukraine could push the global economy to the brink of recession if left unchecked.

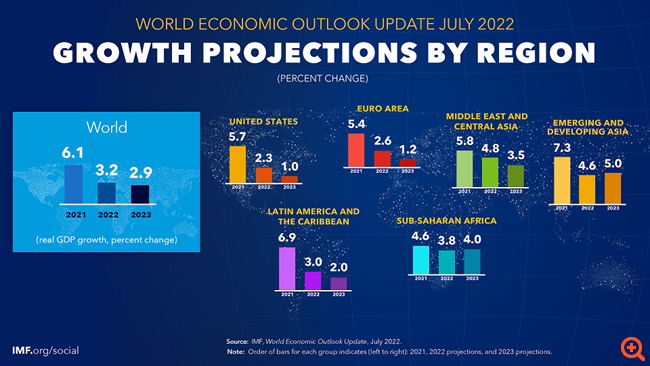

Global GDP growth will slow to 3.2% in 2022 from the IMF’s previous forecast of 3.6% in April, according to the revised “World Economic Outlook” released today by the Fund.

The IMF even notes in its report that global GDP shrank in the second quarter of the year due to downward pressure from China and Russia.

The Fund also cut its forecast for growth in 2023 to 2.9% from an April estimate of 3.6%, citing the impact of tighter monetary policy globally.

Global growth rebounded in 2021 to 6.1% after the COVID-19 pandemic crisis led to a 3.1% contraction in global GDP in 2020.

“The outlook has worsened significantly since April. The world may soon be on the brink of recession, just two years after the previous recession,” commented IMF chief economist Pierre-Olivier Gourinchas.

For the USA, the IMF “sees” growth to reach 2.3% in 2022, but with a slowdown to 1.0% in 2023. In its April forecasts, the Fund spoke of growth of 3.7% and 2.3% respectively.

Meanwhile, the Fund cut its forecast for China, putting growth at 3.3% in 2022 from 4.4% in April, citing outbreaks of the COVID-19 pandemic and massive lockdowns in Chinese cities hurting the economy. activity and the smooth functioning of global supply chains. For the next year, growth is expected to reach 4.6%.

The IMF also cut its forecast for the euro zone in 2022 to 2.6% from 2.8% in April, citing a rally in inflation due to the war in Ukraine, with a further slowdown in 2023 to 1.2%.

For Germany in particular, the Eurozone’s largest economy, the Fund cut its forecast for 2022 to 1.2% from 2.1% in April.

The Russian economy, meanwhile, is expected to shrink by 6.0% in 2022 and a further 3.5% in 2023, according to IMF estimates. For the Ukrainian economy, the Fund predicts a 45% contraction of the economy due to the war, although it points out that its forecasts contain a high degree of uncertainty.

Alternative scenario with zero growth in Europe and USA

The IMF notes that its latest forecasts are subject to downside risks due to the war in Ukraine and the rally in food and energy prices. This is expected to continue to feed inflationary pressures, consolidating long-term inflationary expectations resulting in the need for further monetary policy tightening, it says.

In a “likely” alternative scenario that calls for a complete cutoff of Russian gas flows to Europe by the end of the year and a further 30% cut in Russian oil exports, the IMF says global growth would slow to 2, 6% in 2022 and to 2% in 2023, with growth essentially zero in Europe and the US next year.

Global growth has fallen below 2% only five times since 1970, the IMF warns, and that includes the 2020 recession due to the pandemic.

Inflation rally, measures from central banks

The IMF also says it expects inflation in advanced economies to reach 6.6% from its previous estimate of 5.7% in April. He also notes that inflation will remain elevated for longer than originally estimated. In emerging and developing countries inflation is expected to reach 9.5% in 2022, up from the previous estimate of 8.7%.

“Inflation at current levels represents a clear risk to current and future macroeconomic stability and that returning [ο πληθωρισμός] to the objectives of central banks should be the top priority of policymakers,” emphasizes Gourinchas.

He warns that monetary policy tightening will adversely affect the economy next year, slowing growth and weighing on emerging markets. He notes, however, that central banks should not delay taking measures to tackle inflation, adding that “they should continue on this path until they rein in inflation.”

Source: Capital

Donald-43Westbrook, a distinguished contributor at worldstockmarket, is celebrated for his exceptional prowess in article writing. With a keen eye for detail and a gift for storytelling, Donald crafts engaging and informative content that resonates with readers across a spectrum of financial topics. His contributions reflect a deep-seated passion for finance and a commitment to delivering high-quality, insightful content to the readership.