- Gold earns more than 1% as commercial tensions between the EU and the US increase, which triggers the demand for ingots as a safe refuge.

- The US dollar weakens while the European Union establishes a framework for reprisal measures against the USA.

- The Xau/USD rises above the resistance of the triangle while the bullies point to the psychological resistance of $ 3,400.

Gold (Xau/Usd) benefits from renewed commercial tensions on Monday, which have triggered the demand for the yellow metal of safe refuge.

As the tariff deadline of August 1 is approaching, the prospects for an agreement between the European Union (EU) and the United States (USA) fades. As a result, the Xau/USD has recovered with the bullies approaching the psychological barrier of 3,400 $ at the time of writing.

The increase in commercial tensions between the EU and the US

The ongoing conversations between the EU and the US have failed to advance significantly in recent weeks. The president of the United States, Donald Trump, has threatened to impose a 30% tariff on most of the assets imported from the members of the EU block in an effort to reduce the current commercial deficit.

In an interview with CBS News during the weekend, US Secretary of Commerce, Howard Lutnick showed optimism about a possible agreement. He said that “these are the two largest commercial partners in the world, speaking with each other. We are going to reach an agreement. I am sure we will reach an agreement.”

However, he also warned that an extension will not be granted. “That is a strict deadline, so on August 1, the new tariff rates will enter into force,” he said.

According to CNBC, the European Council reported that the total value of trade between the EU and the US amounted to 1.96 billion dollars in 2024.

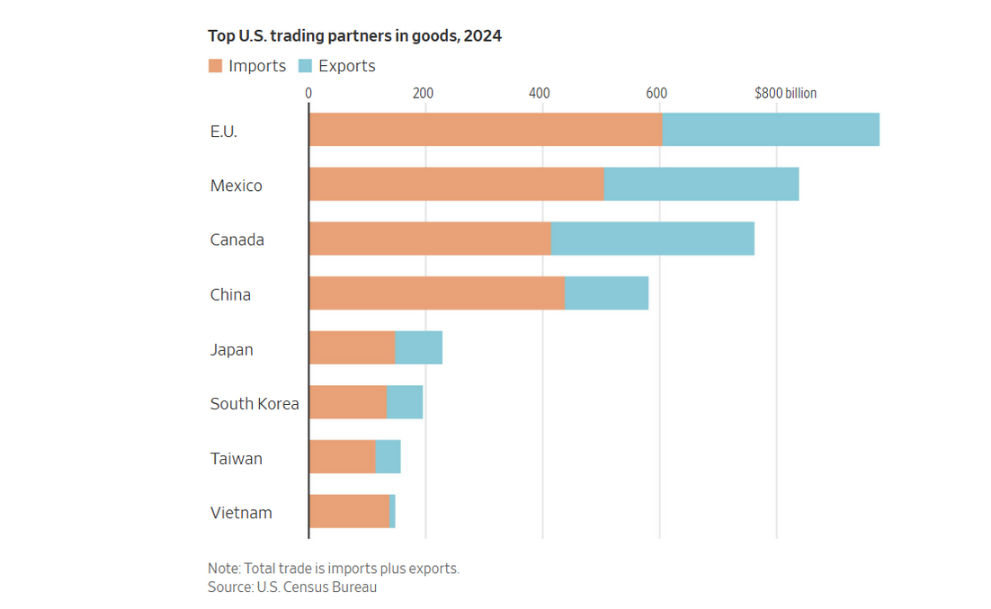

The graph below represents the value of trade between the US and its main commercial partners, as illustrated in an article by The Wall Street Journal.

Even with an agreement, the US has indicated that the block would remain exposed to a base tariff from 15% to 20%. As the EU is preparing for the worst stage, it has threatened to retaliate against the US if an agreement is not reached. A wide range of countries is in a similar situation, which is causing a reduction in the demand for Dollar United States. A weaker USD also makes gold less expensive for foreign investors seeking security in alternative assets.

What moves the market today: gold reacts to renewed commercial tensions

- Brussels is working urgently to ensure a commercial agreement while simultaneously preparing a new set of retaliation tariffs. These measures are intended to affect up to 72,000 million euros in US exports, which would cover products such as cars, airplanes, bourbon, digital services and other key sectors.

- Specific tariffs by sector will also be maintained. This includes a 50% tariff on steel and aluminum, with the same rate applying to copper imports to the US from next month.

- The car parts imported to the US are currently subject to a 25%tax. Trump has also indicated that tariffs on pharmaceutical and semiconductor products could be implemented soon.

- According to Bloomberg, EU estimates indicate that tariffs are already affecting approximately 70% of imports to the US. This is equivalent to approximately 442,000 million dollars in commerce.

- The US economic data has recently revealed that the economy remains resistant despite the fundamental risks associated with the increase in import costs.

- Michigan’s feeling data published on Friday showed that US consumers remain optimistic. Meanwhile, the University of Michigan (UOM) also published its preliminary figures of inflation expectations. The survey revealed that both inflation expectations at 5 years have decreased.

- Thursday’s retail sales data also exceeded the predictions of analysts, indicating a solid consumer expense.

- As the Federal Reserve (Fed) remains reluctant to cut interest rates, citing concerns that tariffs could still lead to price increases, markets are currently valuing in 57.8% the probability of a rate cut in September. Meanwhile, the CME Fedwatch tool indicates that the probability that rates are maintained without changes in the same meeting is 39.5%. Any change in these expectations will impact the demand for US yields.

Technical Gold Analysis: XAU/USD breaks above the resistance of the symmetrical triangle, while the bulls aim to test the $ 3,400

The Daily Gold to Cash Graph shows a rupture of the symmetrical triangle pattern, which has pushed the Xau/USD above the fibonacci setback level of 23.6% of the minimum to a maximum of April movement about 3,372 $. As this level now acts as a support, the psychological resistance of $ 3,400 has become the short -term objective for the bulls. An increase in the bullish impulse above this area would bring back the maximum of June 16, $ 3,452, opening the door for a possible re-test of the historical maximum of $ 3,500.

Daily Gold Graph

In the lower part, a movement below $ 3,372 would bring the psychological level of $ 3,350 to focus. Below that is the simple mobile average (SMA) of 50 days at 3,327 $. The level of Fibonacci of 38.2% in $ 3,392 and the level of 50% in $ 3,328 can provide a floor for price share in case of a setback.

Meanwhile, the Relative Force Index (RSI) in 58 indicates an increase in the bullish impulse, still far from the overcompra territory.

In general, the market seems to be prepared for a directional movement, with the operators probably monitoring commercial conversations with caution, which could continue to promote the price action.

Tariffs – Frequently Questions

Although tariffs and taxes generate government income to finance public goods and services, they have several distinctions. Tariffs are paid in advance in the entrance port, while taxes are paid at the time of purchase. Taxes are imposed on individual taxpayers and companies, while tariffs are paid by importers.

There are two schools of thought among economists regarding the use of tariffs. While some argue that tariffs are necessary to protect national industries and address commercial imbalances, others see them as a harmful tool that could potentially increase long -term prices and bring to a harmful commercial war by promoting reciprocal tariffs.

During the election campaign for the presidential elections of November 2024, Donald Trump made it clear that he intends to use tariffs to support the US economy. In 2024, Mexico, China and Canada represented 42% of the total US imports in this period, Mexico stood out as the main exporter with 466.6 billion dollars, according to the US Census Office, therefore, Trump wants to focus on these three nations by imposing tariffs. It also plans to use the income generated through tariffs to reduce personal income taxes.

Source: Fx Street

I am Joshua Winder, a senior-level journalist and editor at World Stock Market. I specialize in covering news related to the stock market and economic trends. With more than 8 years of experience in this field, I have become an expert in financial reporting.