If the US Congress does not accept at least one of the laws regarding the crypto, the industry can wait for the “difficult summer.” This was written by the chief investment director of Bitwise Matt Housogan in a note for investors. At the same time, it predicts price maximums in most crypto acts, including bitcoin of $ 200 thousand in 2025, but subject to legislative progress, reports RBC Crypto.

“Cryptocurrency grew after the November elections partly due to the assumption that Washington will relate to cryptocurrency positively. And while it is. But in order to move forward, it is necessary that Congress consolidate cryptocurrencies at the legislative level, ”Housogan writes, adding that the adoption of at least one cryptocurrency bill will show that democrats and republicans can unite with cryptocurrencies.

Hawgan notes the importance of changes in the United States that has already occurred, but believes that it is the legislation that will be able to strengthen the position of the cryptorrhist, while all other initiatives can be easily canceled by the future administration.

According to Hawgan, delaying the adoption of laws can jeopardize the entire crypto pour. He also criticized the attempts of lobbyists to combine the stabiblcoin market and a wider crypto reform in one law. “This is the case when the best becomes the enemy of the good,” he wrote.

BitWise controls the Bitcoin-ETF spotov with assets for the amount of about $ 3.64 billion. At the end of 2024, the company introduced a list of forecasts for crypto for 2025, predicting that Bitcoin will be traded above $ 200 thousand, and Ethereum and Solana have reached new maximums. Bitcoin is $ 200 thousand and not only. Bitwise’s main forecasts for 2025

What the law

First of all, we are talking about the Steabelcoin bill (Genius Act, Guiling and Establing National Innovation for US Stablecoins Act), which obliges the emitted tokens to fully provide tokens with reserves in dollars and short -term treasury bonds, publish data about reserves and passing the audit.

In March, the project approved the Senate banking committee, but in early May nine democrats, including four previously voting for it, recalled support. They demanded to strengthen the requirements for national security and counteracting money laundering.

“Stebblecoins are too beneficial for America, dollar, traders, entrepreneurs and others, so that petty political intrigues can interfere with progress. If the legislation fails, this may become difficult for cryptocurrencies, ”Housogan said, noting that if it is possible to accept the regulatory framework, the bull market will not be stopped.

Stebblecoins are cryptocurrency tokens, the course of which is tied to any asset, for example, to the dollar, euro or ounce of gold. The company uses securities, national currencies or other crypto assets as ensuring the course of the course to the basic asset of the company. The most famous stable tokens are produced by Tether (USDT) and Circle (USDC).

The business model of most stablecoins is to buy US government bonds as security for the release of tokens. Minutes receive interest income to retain these securities, having the opportunity to gain access to liquidity at any time if the owners of stabilcoins will demand to repay the released crypto assets.

The bill will require stablecoins to have 100 percent reserve support in US dollars and short-term treasury obligations (or other similar liquid assets), a monthly public disclosure of reserves and annual audits with market capitalization of more than $ 50 billion (at the beginning of May there are only two-USDT and USDC). The bill also establishes strict marketing standards and other provisions.

Protection from the dollar

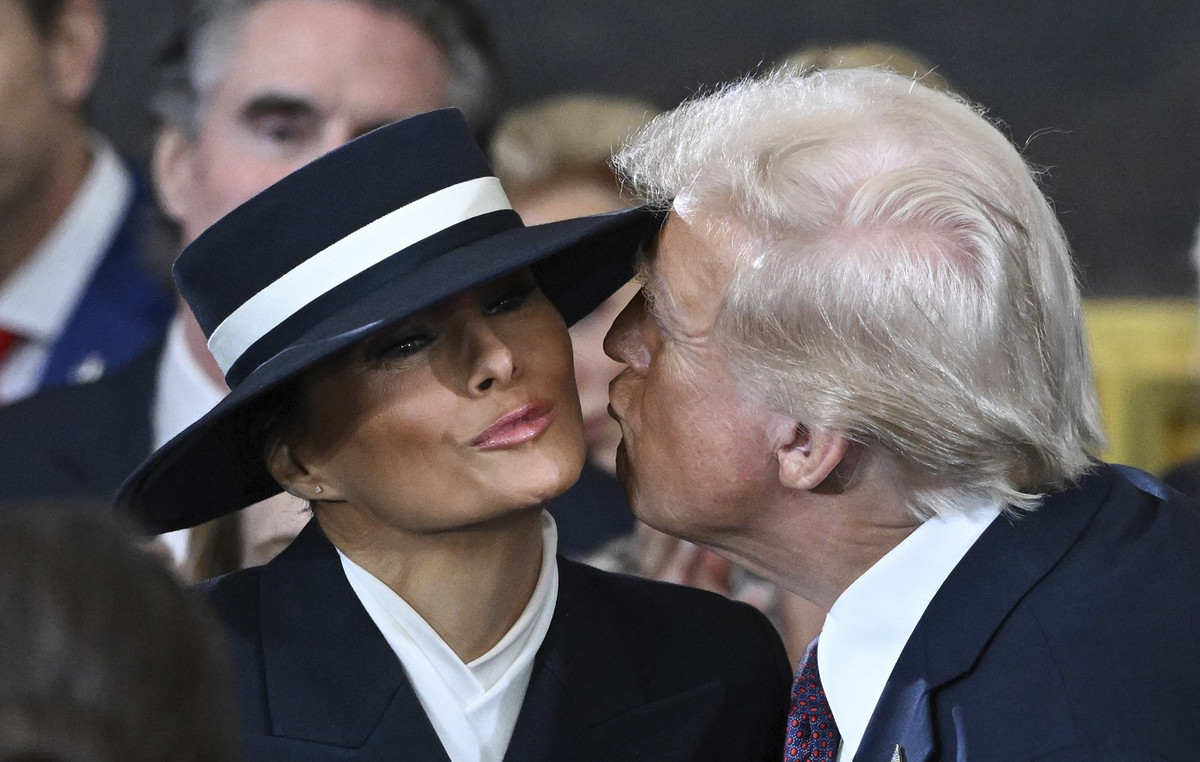

The topic of development of the market for stabilcoins based on the dollar has been promoted by US President Donald Trump since late January, when his first decree was signed after the inauguration “Strengthening the US leadership in digital finances”, where stablecoins were highlighted.

However, the promotion initiative met resistance not only within the United States, but also outside. The European Union has already taken steps to protect its market. The new European rules for regulating the Mica cryptocurrencies this year require that all the stablcoins presented on local crypto -rhms are produced by issuers who have received a special license and located in the EU. In this regard, the largest USDT stabilcoin from Tether, which did not receive the desired license in Europe, as well as several other tokens were removed from crypto -streaks on the territory of the block.

European regulators openly talk about the dangers of the spread of dollar stablecoins and their introduction into the legal field of the United States as a global threat. So, for example, the Minister of Economy of Italy Dzhancarlo Georghetti said that the new US policy against stablecoins has a great threat to Europe than trade duties, and in the ECB they called them a risk to weaken European control over financial flows.

Nevertheless, stabiblcoins remain the central element of the crypto market discussed throughout the world both at the level of regulators and fintech companies. And the growth in the capitalization of stablecoins is ahead of all other classes of assets in 2025. According to Defillama on May 6, the total indicator grew by more than 20% from the beginning of the year – above $ 242 billion.

Be in the know! Subscribe to Telegram.

Source: Cryptocurrency

I am an experienced journalist and writer with a career in the news industry. My focus is on covering Top News stories for World Stock Market, where I provide comprehensive analysis and commentary on markets around the world. I have expertise in writing both long-form articles and shorter pieces that deliver timely, relevant updates to readers.