The price of Bitcoin could reach $112 thousand by the end of 2024 if the current trend of funds flowing into Bitcoin exchange-traded funds (ETFs) continues, writes RBC Crypto, referring to the head of CryptoQuant.

Spot Bitcoin ETFs accumulated 200 thousand coins worth $9.5 billion in a month. Bitcoin ETFs own almost 1% of the total number of Bitcoins, 21 million coins. In less than a month, BlackRock (IBIT) and Fidelity (FBTC) raised the largest amounts of funds. IBIT accumulated 82,515 BTC worth $3.7 billion, and FBTC accumulated 59,380 BTC worth $2.6 billion. The total inflows into the new ETFs were greater than the net outflows from the Graysacle ETF.

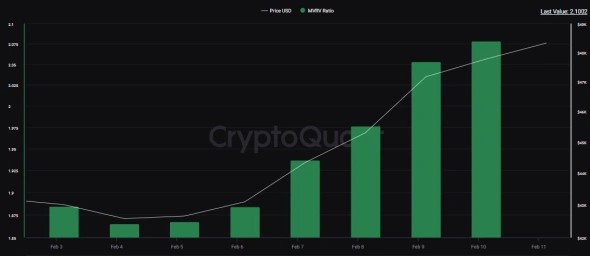

Ki Young Joo, CEO of CryptoQuant, believesthat the “worst-case scenario” for Bitcoin is $55 thousand. His forecast is based on an analysis of the impact of the influx of funds on Bitcoin’s capitalization and the MVRV metric, which historically indicated that the asset was “overvalued” or “undervalued.”

Ratio of market capitalization to realized capitalization of the asset (MVRV) Source: СryptoQuant

Ratio of market capitalization to realized capitalization of the asset (MVRV) Source: СryptoQuant

According to Ki Young Joo, Bitcoin is injecting $9.5 billion into Bitcoin each month as a result of inflows into spot ETFs, potentially adding $114 billion in realized capitalization per year. Even with the outflow of funds from GBTC, an increase of $76 billion could raise realized capitalization from $451 billion to $527–565 billion.

Source: Cryptocurrency

I am an experienced journalist and writer with a career in the news industry. My focus is on covering Top News stories for World Stock Market, where I provide comprehensive analysis and commentary on markets around the world. I have expertise in writing both long-form articles and shorter pieces that deliver timely, relevant updates to readers.