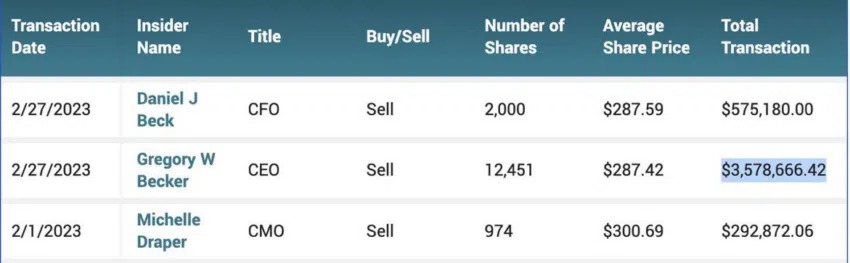

According to statement The US Securities and Exchange Commission (SEC), Silicon Valley Bank CEO Greg Becker sold $2.27 million worth of bank shares on February 27. The sales were part of the 10b5-1 program he filed on January 26. Other SEC Declaration showsthat Becker sold $1.1 million worth of shares in January to cover tax liabilities.

Meanwhile, in a CNBC report saysthat the bank’s senior management, including the CEO, sold $4.5 million worth of shares right before its collapse.

SVB Pays Bonuses Hours Before FDIC Takes Over Bank

In Axios reportedthat SVB paid annual bonuses to US employees on March 10, just hours before the Federal Deposit Insurance Corporation (FDIC) took control of the bank. However, this may have been a coincidence, as the payment date was planned well in advance.

Since the bank now controls the FDIC, payments to employees from other countries have come into question. True, the government agency has offered to retain some of the staff for 45 days to assist in the transition period.

Does Silicon Valley Bank have a chance of being saved?

The data published by the media drew even more attention to the SVB bank. It is the largest US bank that collapsed in the aftermath of the 2008 financial crisis, and several stakeholders are already calling for the government to bail it out.

Billionaire investor Bill Ackman, for example, is urging the government to bail out a bank because it is used by several large venture capital firms. According to him, the collapse of the SVB could be disastrous for the economy. Ackman also noted that another private bank is unlikely to be able to bail out SVB, given how the regulator dealt with JPMorgan when it bailed out Bear Stearns.

The crypto community makes fun of regulators

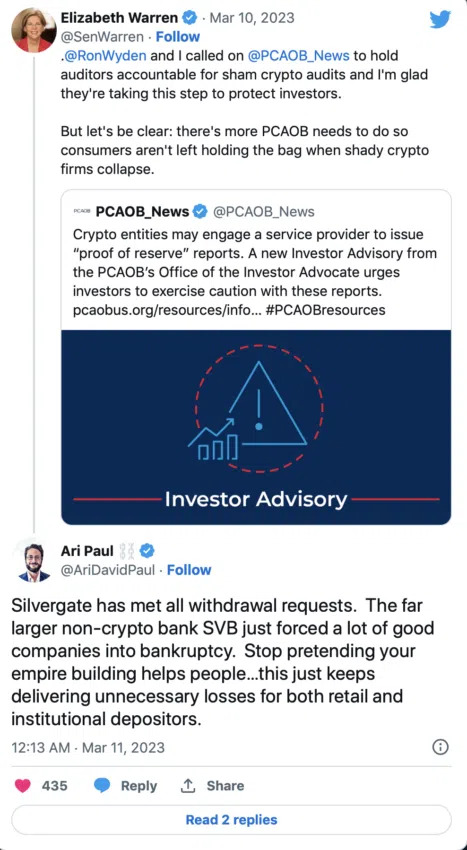

Several members of the community pointed to the failure of the SVB as proof of the hypocrisy of American regulators and politicians. Senator Elizabeth Warren, for example, has been criticized for a tweet about a fictitious audit of cryptocurrencies.

BlockTower Capital founder Ari Paul noted that Silvergate granted all withdrawal requests, while the much larger bank SVB caused many good companies to fail.

Source: Cryptocurrency

I am an experienced journalist and writer with a career in the news industry. My focus is on covering Top News stories for World Stock Market, where I provide comprehensive analysis and commentary on markets around the world. I have expertise in writing both long-form articles and shorter pieces that deliver timely, relevant updates to readers.