- The Dow Jones rose about 350 points on Monday, claiming 42,500.

- Investors are betting on some kind of resolution in the Israel-Iran conflict that emerged last week.

- Despite a positive inclination in actions, commercial concerns and conflicts in the Middle East are maintaining the limited upward impulse.

The industrial average Dow Jones (DJIA) found a firmer support on Monday, starting the new week of operations with a high note and reducing most of the losses of the week ends that pushed the indices downward last Friday. Israel launched attacks against Iranian goals under the auspices of denying Iran access to nuclear weapons. Israel is one of only four countries that did not sign the Nuclear Non -Proliferation Treaty, and is not part of the Treaty on the Prohibition of Nuclear Weapons.

Although Israel’s attacks quickly became a series of missile releases between Iran and Israel that continued during the weekend and until Monday, investors are still betting on a possible fire, or at least one cooling of tensions constantly increasing in the Middle East. The actions rose on Monday after the headlines of the Wall Street Journal that indicated that Iran was “open” to the idea of participating in peace conversations with Israel. However, the Iranian government, through the medium controlled by the Catarí Al Jazeera state, denied the reports as false. Without discouraging, merchants are covering their bets that a resolution will be found, instead of continuing to climb towards a generalized conflict.

The aggregate figures of consumer feeling increased for the first time in almost seven months last week, adding more pressure on the long side. The rebound in the feeling of the consumer occurs at a time when those responsible for the Federal Reserve Policy (FED) are still in “waiting and seeing” on the possible economic repercussions of the commercial policies of the Vaivén of the Trump administration, which consist mainly of threatening and then canceling generalized import taxes.

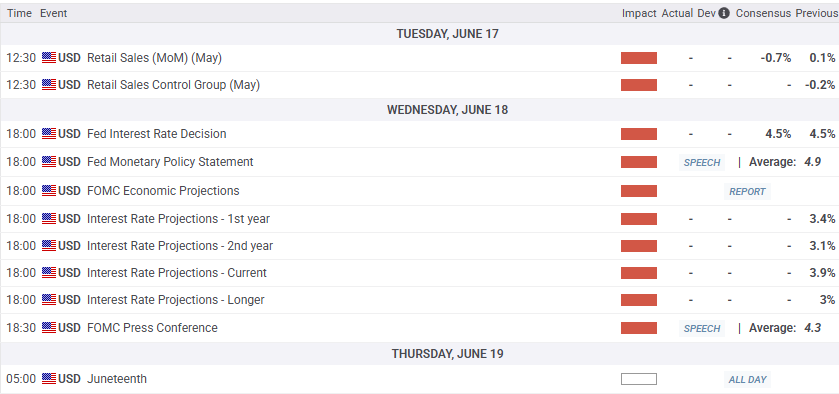

Fed in sight, another pause is expected in the rates

The Fed is ready to make another advertisement on interest rates this week; The Central Bank is expected to maintain interest rates, a movement that will probably attract more anger by President Donald Trump. Trump has expressed frustration on multiple occasions due to the lack of Fed disposal to reduce interest rates while looking for a way to make federal debt more manageable; It is expected that Trump’s “great budget project” Billones add to the federal deficit during the next decade, despite having campaigned with a platform to eliminate the burden of federal debt “in months” after assuming the position.

According to the CME Fedwatch tool, interest rates operators are currently valuing 70% probabilities of at least one rate cut of a quarter cord in September. An additional rates cut in October or December is expected, with probabilities that change between two of one day to another.

Read more news about actions: IBM’s actions lead to Dow Jones upwards

Dow Jones price forecast

Monday’s bullish impulse has reduced some of the losses at the end of last week, pushing Dow Jones industrial average above 42,500. However, the main actions index continues to be trapped in a consolidation zone that has affected Dow since mid -May.

The Dow Jones found new maximums above the 43,000 area the highest price last week before the holders of the Middle East made the feeling of investors fall, carrying the Djia offers with it. The Dow still has an important technical floor set from the 200 -day exponential average (EMA) about 41,800, and the 50 -day EMA is in the process of confirming a long -term mobile average bullish crossing.

Dow Jones daily graphics

Dow Jones Faqs

The Dow Jones Industrial Avenge, one of the oldest stock market indexes in the world, consists of the 30 most negotiated values in the United States. The index is weighted by the price instead of capitalization. It is calculated by adding the prices of the values that compose it and dividing them by a factor, currently 0.152. The index was founded by Charles Dow, also founder of the Wall Street Journal. In recent years it has been criticized for not being sufficiently representative, since it only follows 30 companies, unlike broader rates such as S&P 500.

There are many factors that promote the Dow Jones Industrial Average (DJIA) index. The main one is the added performance of the companies that compose it, revealed in the quarterly reports of business benefits. The American and world macroeconomic data also contribute, since they influence investor confidence. The level of interest rates, set by the Federal Reserve (FED), also influences the DJia, since it affects the cost of credit, on which many companies depend largely. Therefore, inflation can be a determining factor, as well as other parameters that influence the decisions of the Federal Reserve.

Dow’s theory is a method to identify the main trend of the stock market developed by Charles Dow. A key step is to compare the direction of the Dow Jones Industrial Avenge (DJIA) and the Dow Jones Transportation Average (DJTA) and just follow the trends in which both move in the same direction. The volume is a confirmation criterion. The theory uses elements of maximum and minimum analysis. Dow’s theory raises three phases of the trend: accumulation, when intelligent money begins to buy or sell; Public participation, when the general public joins the trend; and distribution, when intelligent money abandons the trend.

There are several ways to operate with the DJ. One of them is to use ETF that allow investors to negotiate the DJ as a single value, instead of having to buy shares of the 30 companies that compose it. An outstanding example is the SPDR Dow Jones Industrial Avenge ETF (day). Future contracts on the DJ allow the specular operators about the future value of the index and the options provide the right, but not the obligation, to buy or sell the index at a predetermined price in the future. Investment funds allow investors to buy a part of a diversified portfolio of DJ values, which provides exposure to global index.

Source: Fx Street

I am Joshua Winder, a senior-level journalist and editor at World Stock Market. I specialize in covering news related to the stock market and economic trends. With more than 8 years of experience in this field, I have become an expert in financial reporting.