- The Dow Jones was eclipsed by other indexes on Thursday, stagnated by weak profits reports.

- Political agitation continues to cloud investor screens while the dispute between Trump and the Fed continues to develop.

- Despite short -term weakness, Dow Jones continues to call historical maximums.

The Dow Jones industrial average (DJIA) stumbled on Thursday, consolidating just below the 45,000 area, since the errors in the profits drag the key actions raised listed in the Dow Jones. The actions remain firmly inclined to the high side, with all the main rates testing new historical maximums, but the clouds of political storm continue to accumulate while the president of the United States (USA), Donald Trump, continues his campaign to replace his own chosen for the head of the Federal Reserve (Fed) earlier than expected.

IBM, Honeywell and UnitedHealth in the sights

The key actions in the Dow fell on Thursday, dragging the general index down the day. IBM (IBM) collapsed 8% in night operations despite publishing better profits than expected after the closure of the markets on Wednesday. IBM’s income, sales and gains metrics continue to increase as the technological rally tide of the large market raises all ships; However, the growth of the IBM software segment did not reach its peers, growing to a comparatively quiet 10% per year.

Honeywell (Hon) also stumbled after the profit report after Wednesday, falling 5% on Thursday despite exceeding profit expectations. Investors have noticed some warning signs of weakening profitability, pushing Hon down and punishing the technological conglomerate for only delivering a growth of 8% year -on -year and not raising the future guide as much as analysts expected.

UnitedHealth (UNH) weakened around 4% on Thursday after the insurance supplier, with a strong history of coverage denials as a means to generate profits, admitted that it was under investigation by federal authorities. Investigations are being carried out for both criminal and civil litigation around the Medicare arm of UNH, citing problems with the use of questionable practices in the collection of diagnoses of doctors and nurses to deny claims and increase payments.

Labor data, business feeling indicators indicate a still strong economy

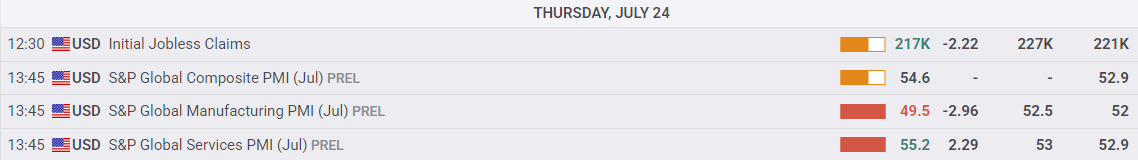

A strong report in the key economic data of the US also hindered an absolute bullish rally on Thursday. Initial weekly unemployment applications were reduced to 217K, and the US purchasing managing index segment (PMI). A firm labor market and the expectations of business activity continue to progress strongly, which makes it difficult for the Fed to make rates cuts sooner rather than later.

Solid economic data exceed Trump’s desire for lower interest rates

According to the CME Fedwatch tool, rates operators still value the possibility of at least one rate cut of a quarter of September on September 17, but hope is fading as the US economy continues to challenge the expectations of a pronounced decline. However, President Trump remains on the path of the war while attacking against the president of the Fed, Jerome Powell. The Trump administration is actively looking for ways to replace the president of the FED, Powell, before the end of his mandate and force the Fed to arbitrarily reduce interest rates.

Dow Jones price forecast

The price action on Thursday has left Dow Jones trapped in short -term congestion levels despite a bullish general inclination of the main stock market index. The Dow is still trapped just south of the historical maximums above the area of 45,000, but the impulse at the top continues to fight to make significant progress.

Dow Jones daily graphics

Dow Jones – Frequently Questions

The Dow Jones Industrial Avenge, one of the oldest stock market indexes in the world, consists of the 30 most negotiated values in the United States. The index is weighted by the price instead of capitalization. It is calculated by adding the prices of the values that compose it and dividing them by a factor, currently 0.152. The index was founded by Charles Dow, also founder of the Wall Street Journal. In recent years it has been criticized for not being sufficiently representative, since it only follows 30 companies, unlike broader rates such as S&P 500.

There are many factors that promote the Dow Jones Industrial Average (DJIA) index. The main one is the added performance of the companies that compose it, revealed in the quarterly reports of business benefits. The American and world macroeconomic data also contribute, since they influence investor confidence. The level of interest rates, set by the Federal Reserve (FED), also influences the DJia, since it affects the cost of credit, on which many companies depend largely. Therefore, inflation can be a determining factor, as well as other parameters that influence the decisions of the Federal Reserve.

Dow’s theory is a method to identify the main trend of the stock market developed by Charles Dow. A key step is to compare the direction of the Dow Jones Industrial Avenge (DJIA) and the Dow Jones Transportation Average (DJTA) and just follow the trends in which both move in the same direction. The volume is a confirmation criterion. The theory uses elements of maximum and minimum analysis. Dow’s theory raises three phases of the trend: accumulation, when intelligent money begins to buy or sell; Public participation, when the general public joins the trend; and distribution, when intelligent money abandons the trend.

There are several ways to operate with the DJ. One of them is to use ETF that allow investors to negotiate the DJ as a single value, instead of having to buy shares of the 30 companies that compose it. An outstanding example is the SPDR Dow Jones Industrial Avenge ETF (day). Future contracts on the DJ allow the specular operators about the future value of the index and the options provide the right, but not the obligation, to buy or sell the index at a predetermined price in the future. Investment funds allow investors to buy a part of a diversified portfolio of DJ values, which provides exposure to global index.

Source: Fx Street

I am Joshua Winder, a senior-level journalist and editor at World Stock Market. I specialize in covering news related to the stock market and economic trends. With more than 8 years of experience in this field, I have become an expert in financial reporting.