- The Dow Jones industrial average lost ground on Tuesday, going back below 42,500.

- Geopolitical tensions occupied the center of the stage as the conflict between Israel and Iran is accelerated.

- Retail sales in the US collapsed in May, falling almost a full point compared to the previous month.

The Dow Jones industrial average (DJIA) lost some land on Tuesday, declining below 42,500 while the variable rental markets are agitated under the weight of the growing conflict between Israel and Iran. President Donald Trump hastened towards direct participation in the dispute, a movement that could further destabilize the region. Retail sales data were also drastically contracted in May, with the publication of Data on Tuesday that showed a drop in almost a percentage point in US retail purchase volumes.

Donald Trump, publishing on social networks on Tuesday, said who wants an “> unconditional surrender” of the Iranian supreme leader Ali Khamenei, and announced that US military assets were moving towards the region of the conflict in the Middle East. The climb between Israel and Iran, in addition to Trump’s decision to even more involve US assets and military personnel, has tension investors, since their previous hopes of a rapid resolution wither. The Trump administration has a poor history in the successful resolution of geopolitical problems, both internal and external, despite the insistence of Trump’s team to become structurally involved in complex problems both at home and abroad.

The US data, tensions in the Middle East press the actions

Adding more downward pressure on the shares, retail sales figures for the month of May were drastically, falling 0.9% intermensual as consumer expense continues to slow down. It is the second time this year that the aggregate figures of retail sales have contracted almost a complete point, and the previous data also saw downward reviews. Although retail sales do not have the weight that moves the market of other key indicators, such as inflation or net monthly employment gains, it remains a key factor that the Federal Reserve (Fed) considers when evaluating adjustments in interest rates.

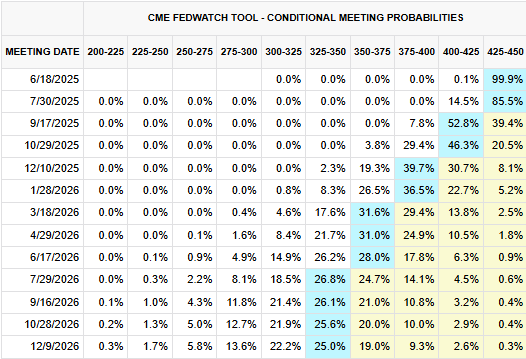

The failure of May retail sales arrives at a bad time: the Fed is ready to issue its last decision on interest rates on Wednesday, and the markets have already incorporated another flat rate decision. Market bets for the next FED fees cut still expect a cut in September; However, the chances of at least one quarter of a quarter have decreased to almost 50% this week.

Read more news about actions: The US stock market yield

Dow Jones price forecast

The industrial average Dow Jones failed. The Dow Jones is still caught in a consolidation zone that has plagued the Dow tables since mid -May.

The Dow Jones found new peaks above the important 43,000 figure last week before the Middle East holders affect the feeling of investors, carrying Djia’s offers with them. The Dow still has an important technical support set from the 200 -day exponential mobile average (EMA), and the 50 -day EMA is in the process of confirming a long -term mobile average bullish crossing.

Dow Jones daily graphics

Dow Jones Faqs

The Dow Jones Industrial Avenge, one of the oldest stock market indexes in the world, consists of the 30 most negotiated values in the United States. The index is weighted by the price instead of capitalization. It is calculated by adding the prices of the values that compose it and dividing them by a factor, currently 0.152. The index was founded by Charles Dow, also founder of the Wall Street Journal. In recent years it has been criticized for not being sufficiently representative, since it only follows 30 companies, unlike broader rates such as S&P 500.

There are many factors that promote the Dow Jones Industrial Average (DJIA) index. The main one is the added performance of the companies that compose it, revealed in the quarterly reports of business benefits. The American and world macroeconomic data also contribute, since they influence investor confidence. The level of interest rates, set by the Federal Reserve (FED), also influences the DJia, since it affects the cost of credit, on which many companies depend largely. Therefore, inflation can be a determining factor, as well as other parameters that influence the decisions of the Federal Reserve.

Dow’s theory is a method to identify the main trend of the stock market developed by Charles Dow. A key step is to compare the direction of the Dow Jones Industrial Avenge (DJIA) and the Dow Jones Transportation Average (DJTA) and just follow the trends in which both move in the same direction. The volume is a confirmation criterion. The theory uses elements of maximum and minimum analysis. Dow’s theory raises three phases of the trend: accumulation, when intelligent money begins to buy or sell; Public participation, when the general public joins the trend; and distribution, when intelligent money abandons the trend.

There are several ways to operate with the DJ. One of them is to use ETF that allow investors to negotiate the DJ as a single value, instead of having to buy shares of the 30 companies that compose it. An outstanding example is the SPDR Dow Jones Industrial Avenge ETF (day). Future contracts on the DJ allow the specular operators about the future value of the index and the options provide the right, but not the obligation, to buy or sell the index at a predetermined price in the future. Investment funds allow investors to buy a part of a diversified portfolio of DJ values, which provides exposure to global index.

Source: Fx Street

I am Joshua Winder, a senior-level journalist and editor at World Stock Market. I specialize in covering news related to the stock market and economic trends. With more than 8 years of experience in this field, I have become an expert in financial reporting.