- The Dow Jones went up 300 points on Monday while the index extends its rebound.

- The actions are recovering their position after a recent collapse due to geopolitical concerns.

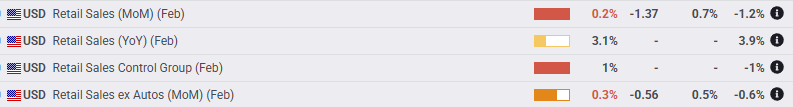

- The February retail sales figures were recovered, but not much.

The Dow Jones industrial average (DJIA) rose about 300 points on Monday while the shares continue to recover land after a recent decrease that saw the main indexes approaching the correction territory. The US economic data continues to hint a possible deceleration on the horizon, but the overene variable rental markets are ignoring the warning signals after falling too quickly, too fast in recent weeks.

The US retailers of the United States rebounded a lukewarm 0.2% intermensual in February after the fall of January. The markets expected a better performance of the results of the key retail activity, with a median forecast of 0.7%. Data observers will notice that the January figure was also reviewed at a minimum of two years of -1.2%, and the downward reviews will continue to affect the economic calendar as US data continues to get worse on the front end of the curve.

Despite a short -term rebound in variable income markets, key rates remain significantly lower in March, driven by general tariff threats of the Trump administration. The US president, Donald Trump, has played quickly and loose with his constantly changing tariff threats, introducing a new level of political friction to which markets have not yet become accustomed. Although President Trump flatly refuses to recognize a growing risk of recession because of his commercial policies, key comments of people within his administration have suggested that Trump’s team expects some “economic pain.” However, the Trump administration attempt to reburate economic contraction as “restarting US markets.” It seems to have been received quite badly by investors.

Dow Jones News

The Dow Jones has extended its recovery earnings for the second day, with most of the main shares indices up Monday. UnitedHealth (UNH), Walmart (WM) and IBM (IBM) have risen more than 2% in the day. UNH returned to $ 500 per share, Walmart rose above $ 85 per share, and IBM has recovered $ 250 per share. At the low extreme, Nvidia fell 2.5%, going down again below $ 120 per share while the technological rally continues to face difficulties.

Dow Jones price forecast

The Dow Jones industrial average is looking for a technical recovery after a rapid readjustment of investors’ expectations: Dow Jones has climbed 300 points on Monday, adding more impulse to the gain of 550 points last Friday. However, the key index is still significantly below the recent maximums, falling more than 3,300 points from top to bottom in the last two weeks.

The purchase pressure is pushing Dow Jones back to the 200 -day exponential mobile average (EMA) at the 42,000 level. The Djia found a technical floor at the key price level of 41,000, but buyers remain at the low end of a particularly steep hole while the Dow is traded 3,300 points below the historical maximums established last November just north of 45,000.

Dow Jones daily graphics

Dow Jones Faqs

The Dow Jones Industrial Avenge, one of the oldest stock market indexes in the world, consists of the 30 most negotiated values in the United States. The index is weighted by the price instead of capitalization. It is calculated by adding the prices of the values that compose it and dividing them by a factor, currently 0.152. The index was founded by Charles Dow, also founder of the Wall Street Journal. In recent years it has been criticized for not being sufficiently representative, since it only follows 30 companies, unlike broader rates such as S&P 500.

There are many factors that promote the Dow Jones Industrial Average (DJIA) index. The main one is the added performance of the companies that compose it, revealed in the quarterly reports of business benefits. The American and world macroeconomic data also contribute, since they influence investor confidence. The level of interest rates, set by the Federal Reserve (FED), also influences the DJia, since it affects the cost of credit, on which many companies depend largely. Therefore, inflation can be a determining factor, as well as other parameters that influence the decisions of the Federal Reserve.

Dow’s theory is a method to identify the main trend of the stock market developed by Charles Dow. A key step is to compare the direction of the Dow Jones Industrial Avenge (DJIA) and the Dow Jones Transportation Average (DJTA) and just follow the trends in which both move in the same direction. The volume is a confirmation criterion. The theory uses elements of maximum and minimum analysis. Dow’s theory raises three phases of the trend: accumulation, when intelligent money begins to buy or sell; Public participation, when the general public joins the trend; and distribution, when intelligent money abandons the trend.

There are several ways to operate with the DJ. One of them is to use ETF that allow investors to negotiate the DJ as a single value, instead of having to buy shares of the 30 companies that compose it. An outstanding example is the SPDR Dow Jones Industrial Avenge ETF (day). Future contracts on the DJ allow the specular operators about the future value of the index and the options provide the right, but not the obligation, to buy or sell the index at a predetermined price in the future. Investment funds allow investors to buy a part of a diversified portfolio of DJ values, which provides exposure to global index.

Source: Fx Street

I am Joshua Winder, a senior-level journalist and editor at World Stock Market. I specialize in covering news related to the stock market and economic trends. With more than 8 years of experience in this field, I have become an expert in financial reporting.