- The Dow Jones moves in the graphics on Tuesday while investors continue to expect clarity.

- Second verse, just like the first: Trump says that the new deadline for tariffs will not be canceled or extended.

- Additional levels of two -digit tariffs have been announced by Trump, affecting the feeling of the market.

The Dow Jones industrial average (DJIA) struggled to maintain its balance on Tuesday, moving in the graph about 44,350 while the Trump administration seeks to maintain pressure in commercial negotiations. President Trump announced additional tariffs of 25% over all imports from South Korea and Japan, which will enter into force on August 1 along with the retarded reciprocal tariffs twice announced in early April.

Echo of the past: without delays in tariffs, and this time we say it seriously

Donald Trump has listed 14 countries that will face additional tariffs on August 1 if there are no commercial agreements for that date. In an echo of previous warnings delivered by Trump himself, the deadline of August 1 for reciprocal tariffs is recorded in stone and will not be delayed or suspended. The same precautionary statement was made by Trump as recently as last week, with respect to the deadline of reciprocal tariffs on July 9, which has since been delayed or suspended.

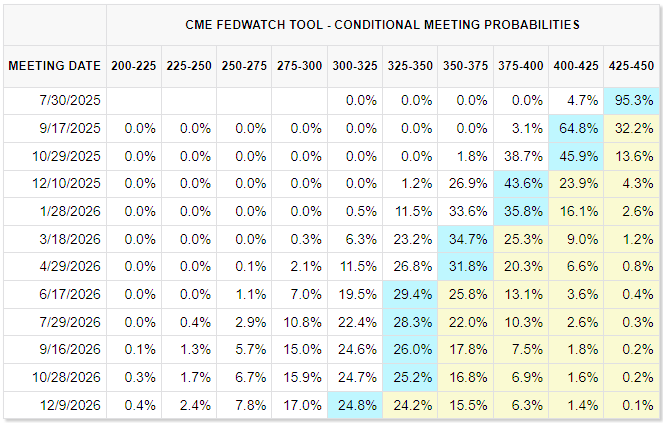

The economic data is still limited throughout the week, giving investors some space to breathe in the data front after the tumultuous launch of labor data last week. The minutes of the last discussion about Federal Reserve rates (FED) will be published on Wednesday, giving market participants a closer look how close or far the Fed could be delivering its next rate cut. As commercial conversations continue to intensify and also postpone, the probabilities of a quarter -spot cutting seem less safe. According to the CME Fedwatch tool, the possibilities of a thrust towards October are increasing in rates markets.

Dow Jones price forecast

A new round of technical weakness has dragged Dow Jones industrial average below 44,400 after strong upward performance during the last third of June. The main stock market index reached about 44,800, without exceeding historical maximums above the 45,000 area.

Despite a short -term turn to the bearish side, the Dow remains firmly planted in the upward territ 42,460. A continuous movement to the low side could be on the horizon with technical oscillators even in overcompra territory, but short -term falls will probably crystallize in new purchase opportunities.

Dow Jones daily graphics

Dow Jones – Frequently Questions

The Dow Jones Industrial Avenge, one of the oldest stock market indexes in the world, consists of the 30 most negotiated values in the United States. The index is weighted by the price instead of capitalization. It is calculated by adding the prices of the values that compose it and dividing them by a factor, currently 0.152. The index was founded by Charles Dow, also founder of the Wall Street Journal. In recent years it has been criticized for not being sufficiently representative, since it only follows 30 companies, unlike broader rates such as S&P 500.

There are many factors that promote the Dow Jones Industrial Average (DJIA) index. The main one is the added performance of the companies that compose it, revealed in the quarterly reports of business benefits. The American and world macroeconomic data also contribute, since they influence investor confidence. The level of interest rates, set by the Federal Reserve (FED), also influences the DJia, since it affects the cost of credit, on which many companies depend largely. Therefore, inflation can be a determining factor, as well as other parameters that influence the decisions of the Federal Reserve.

Dow’s theory is a method to identify the main trend of the stock market developed by Charles Dow. A key step is to compare the direction of the Dow Jones Industrial Avenge (DJIA) and the Dow Jones Transportation Average (DJTA) and just follow the trends in which both move in the same direction. The volume is a confirmation criterion. The theory uses elements of maximum and minimum analysis. Dow’s theory raises three phases of the trend: accumulation, when intelligent money begins to buy or sell; Public participation, when the general public joins the trend; and distribution, when intelligent money abandons the trend.

There are several ways to operate with the DJ. One of them is to use ETF that allow investors to negotiate the DJ as a single value, instead of having to buy shares of the 30 companies that compose it. An outstanding example is the SPDR Dow Jones Industrial Avenge ETF (day). Future contracts on the DJ allow the specular operators about the future value of the index and the options provide the right, but not the obligation, to buy or sell the index at a predetermined price in the future. Investment funds allow investors to buy a part of a diversified portfolio of DJ values, which provides exposure to global index.

Source: Fx Street

I am Joshua Winder, a senior-level journalist and editor at World Stock Market. I specialize in covering news related to the stock market and economic trends. With more than 8 years of experience in this field, I have become an expert in financial reporting.