- The Dow Jones lost 550 points on Tuesday, falling to 42,600.

- Trump’s new and improved commercial war began with new tariffs about Canada and Mexico.

- The US data is still limited to the middle of the week while political holders and policies dominate.

The industrial average Dow Jones (DJIA) collapsed 700 points at its most under point on Tuesday, since the feeling of investors played background. After the initial shock for the new import taxes, the markets recovered some land, but the Dow Jones continues around 550 points.

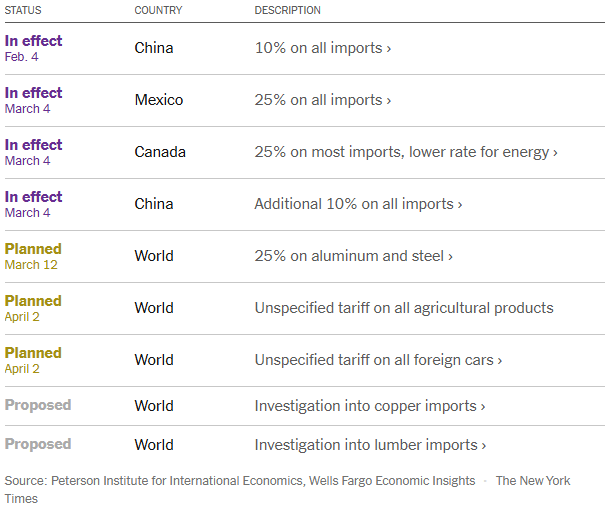

The president of the United States (USA), Donald Trump, has initiated his second global commercial war, by imposing a rigid 25% tariff on all the imported goods from Canada and Mexico, as well as adding an additional tax of 10% to imports from China, carrying the total tariffs of China to 20%. More tariff packages are being prepared, with the Trump administration planning to point to aluminum, steel, agricultural goods, foreign cars, copper and wood.

The rates markets are now valuing around 100 bp of cuts in interest rates until the end of the year, with the first cut of an expected point in June. ADP employment change figures will be published on Wednesday and will serve as an advance of the Non -Agricultural Payroll (NFP) report that will be published this Friday. The markets will be observing the economic figures with renewed anxiety while investors prepare for the negative impacts of the wide tariff packages of President Trump.

Dow Jones News

The overwhelming majority of the values listed in Dow Jones are in red on Tuesday, with slight recovery profits in Unitedhealth (UNH) and NVIDIA (NVDA), which won around 1.8% and 1.1%, respectively. UNH is quoted again above $ 475 per share, while Nvidia deal with $ 115.

Boeing (BA) collapsed 5.5% to $ 160 per share, with American Express (AXP) and 3M (mmm) falling around 4.5% each, at $ 281 and $ 146 per share, respectively. The entire industrial sector is going back in its own reactions to tariffs, with key losses concentrated in the financial sector.

Dow Jones Price forecast

Tuesday’s fall puts the Dow Jones industrial average on the way to make contact with the 200 -day exponential mobile average (EMA) about 42,060 for the first time since November 2023. The Dow Jones has fallen almost 1,700 points in two days from top to bottom, losing 3.8% in the process.

The impulse is completely under the control of the short -term bassists, but the level of 42,000 could be to be a great challenge for a greater fall unless market foundations continue to stir. The technical oscillators remain in overall territory and could point out a prime opportunity for a bull recovery if the bidders are organized in time.

Dow Jones daily graphics

Dow Jones Faqs

The Dow Jones Industrial Avenge, one of the oldest stock market indexes in the world, consists of the 30 most negotiated values in the United States. The index is weighted by the price instead of capitalization. It is calculated by adding the prices of the values that compose it and dividing them by a factor, currently 0.152. The index was founded by Charles Dow, also founder of the Wall Street Journal. In recent years it has been criticized for not being sufficiently representative, since it only follows 30 companies, unlike broader rates such as S&P 500.

There are many factors that promote the Dow Jones Industrial Average (DJIA) index. The main one is the added performance of the companies that compose it, revealed in the quarterly reports of business benefits. The American and world macroeconomic data also contribute, since they influence investor confidence. The level of interest rates, set by the Federal Reserve (FED), also influences the DJia, since it affects the cost of credit, on which many companies depend largely. Therefore, inflation can be a determining factor, as well as other parameters that influence the decisions of the Federal Reserve.

Dow’s theory is a method to identify the main trend of the stock market developed by Charles Dow. A key step is to compare the direction of the Dow Jones Industrial Avenge (DJIA) and the Dow Jones Transportation Average (DJTA) and just follow the trends in which both move in the same direction. The volume is a confirmation criterion. The theory uses elements of maximum and minimum analysis. Dow’s theory raises three phases of the trend: accumulation, when intelligent money begins to buy or sell; Public participation, when the general public joins the trend; and distribution, when intelligent money abandons the trend.

There are several ways to operate with the DJ. One of them is to use ETF that allow investors to negotiate the DJ as a single value, instead of having to buy shares of the 30 companies that compose it. An outstanding example is the SPDR Dow Jones Industrial Avenge ETF (day). Future contracts on the DJ allow the specular operators about the future value of the index and the options provide the right, but not the obligation, to buy or sell the index at a predetermined price in the future. Investment funds allow investors to buy a part of a diversified portfolio of DJ values, which provides exposure to global index.

Source: Fx Street

I am Joshua Winder, a senior-level journalist and editor at World Stock Market. I specialize in covering news related to the stock market and economic trends. With more than 8 years of experience in this field, I have become an expert in financial reporting.