- The Mexican weight rises slightly, recovering part of the losses of the previous day.

- Banxico cuts rates while the Fed remains cautious, highlighting a contrasting economic panorama that does not predict well for weight.

- The USD/MXN as the operators anticipate Michigan’s feeling data of the US, with expectations of inflation and consumer confidence in the focus.

The Mexican peso (MXN) is consolidating against the US dollar (USD) on Friday after recovering part of the land lost on Thursday after the decision of the Bank of Mexico (Banxico) to cut interest rates, as expected.

At the time of writing, the USD/MXN is quoted about 19,485, with a 0.04% drop in the day, since the pair retreces slightly after the rebound on Thursday. The persistent uncertainty related to trade and divergent policies of central banks remain key issues that guide the price action.

Market participants expect the preliminary publication of consumer feeling data at Michigan University at 14:00 GMT, a key event risk that could influence the direction of the USD/MXN in the short term.

The United States will publish three very observed indicators: the consumer’s feeling index, the consumer expectations index and inflation expectations at 1 and 5 years for May. These measures offer timely information on household trust, perceived price pressures and consumer behavior, critical supplies to shape the Federal Reserve policy expectations (FED).

The FED indicates inflation risks due to structural clashes

The Federal Reserve (FED) has adopted a cautious posture in the light of the economic signals of weakening and the persistent uncertainty on the offer of the offer. Speaking after the publication of the April data on Thursday, the president of the FED, Jerome Powell, addressed the two issues of the deceleration of the impulse and the risks of inflation.

The producer price index (IPP) unexpectedly decreased 0.5% compared to the previous month, its largest fall since 2009, while retail sales only increased 0.1%, which suggests a consumer demand contained.

During his opening speech at the Second Thomas Laubach Research Conference on Thursday, Powell said: “The economy may be entering a period marked by more frequent and persistent offer clashes”, adding that the Central Bank remains “attentive to demand cooling signs” and that “inflation is moving in the right direction, although the path to be followed is still uncertain.”

Although these developments can delay any change towards a relief of politics, they also underline the delicate act of equilibrium faced by the Fed while simultaneously monitoring the risks of inflation and growth.

Banxico’s rates cut underlines internal deceleration

On the other hand of the policy spectrum, Banxico made a rate of 50 basic points on Thursday, as expected, reducing its 8.5% reference interest rate in a unanimous decision. The movement extended its relief cycle by seventh consecutive meeting while the Central Bank seeks to stimulate a weak internal economy. In his statement after the meeting, Banxico said that:

“The Board estimates that, in the face of the future, it could continue to calibrate the monetary policy position and consider adjusting it in similar magnitudes. It anticipates that the inflationary environment will allow to continue with the cycle of feat cuts, although maintaining a restrictive posture.”

With Banxico pointing more flexibility and the Federal Reserve maintaining a cautious but constant tone, the divergence of policies continues to favor the US dollar. Even so, the USD/MXN is still vulnerable to risk changes promoted by holders, and the feeling data of the University of Michigan could inject additional volatility. Developments in commercial policy and inflation expectations will also continue to be key drivers in the short -term configuration for weight.

Daily summary of the Mexican weight: Banxico warns about commercial risks for the economy

- Banxico reduced its reference interest rate at 50 basic points to 8.5%. In the statement, the bank said that similar cuts could be considered in the future.

- Banxico warned about the effects of the current commercial confrontation with the United States on the country’s economy. “The uncertainty environment and commercial tensions raises significant risks,” said the bank in its statement.

- The increase in commercial tensions between the US and Mexico threatens the economy dependent on Mexico’s exports, where more than 80% of exports go to the US, tariffs on products such as steel and aluminum could interrupt supply chains, discourage the feeling of investors and affect growth.

- Concerns about economic deceleration have weighed over Banxico. Although inflation has increased in recent months to 3.93% in April, the bank still expects inflation to return to its 3% goal in the third quarter of 2026.

- US has imposed 25% tariffs on certain Mexican imports not covered by the T-MEC, citing security concerns and application of the law against drugs, adding more uncertainty to bilateral commercial relations.

- According to Reuters, Mexico Economy Minister has proposed an early review of the T-MEC, before the deadline of 2026, to reassure investors and preserve the framework that supports more than 1.5 billion dollars in annual trade in North America.

- The US economy contracted an annualized rate of 0.3% in the first quarter, marking the first fall since 2022. This unexpected deceleration was mainly driven by an increase in imports, since companies and consumers accelerated purchases before the new tariffs introduced by the Trump administration.

Technical Analysis: The bass consolidation of the USD/MXN indicates more weakness

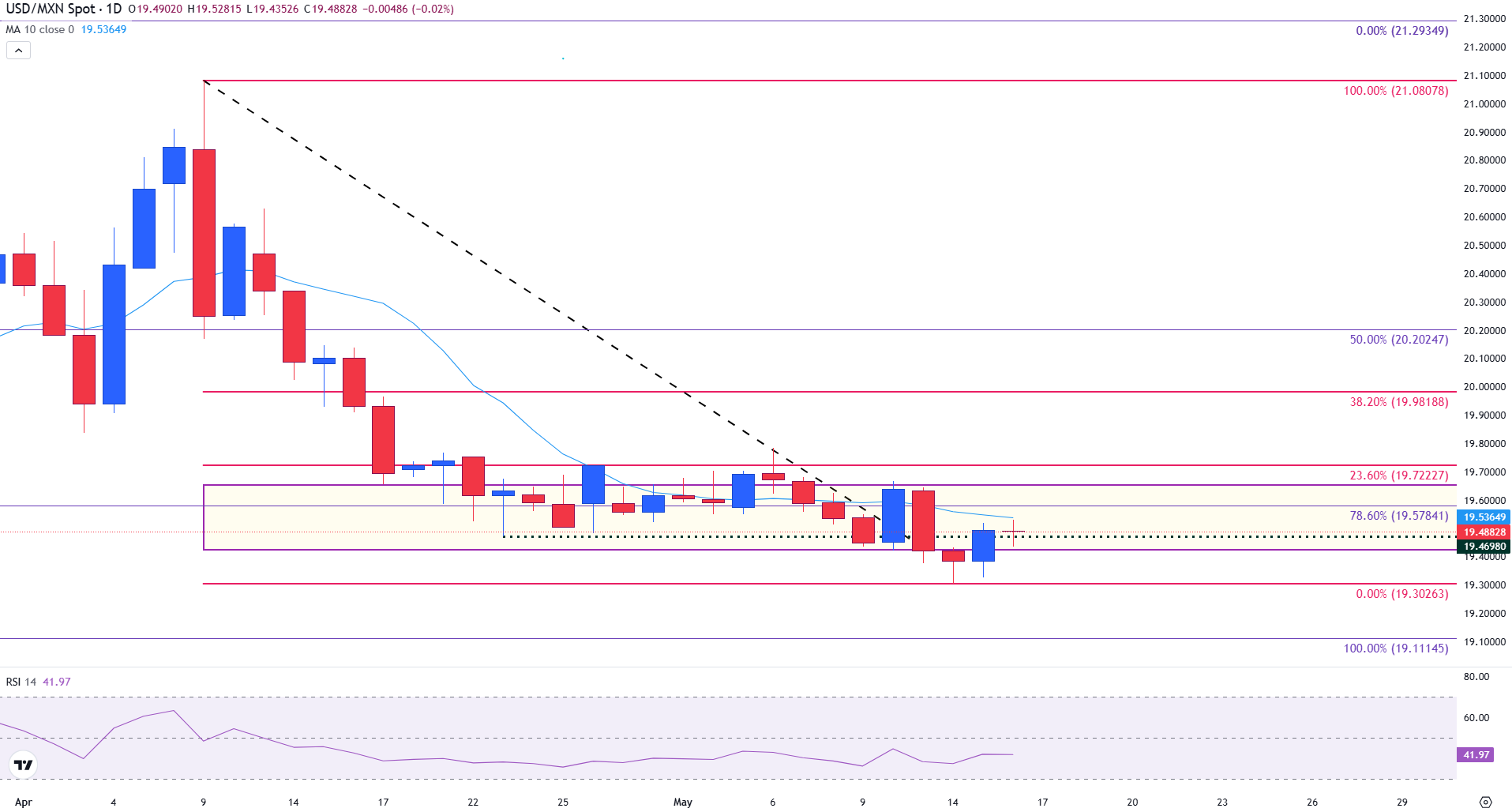

The USD/MXN remains under pressure, extending its fall below the fibonacci setback of 78.6% of the Rally from October to February in 19.57. The pair is currently quoted around 19.45, having failed to recover the key psychological level of 19.50, with 19.40 acting as immediate resistance. This reinforces the predominant bearish momentum and suggests that sellers firmly in control.

The outstanding consolidation range in the yellow box has continued containing the price action during the last weeks. However, repeated failures to break up and the predominant bearish tendency indicate that a bearish continuation remains probable. This technical configuration is in line with the persistent low pressure, since the torque struggles to gain traction over its short -term mobile socks.

The following important support is close to the minimum of October in 19.11, a critical level that could serve as a medium term objective if the bearish momentum persists. A rupture below this area would open the door to more losses, potentially exposing the psychological level of 19.00.

On the positive side, the initial resistance is seen in 19.40, followed by the fibonacci setback of 78.6% in 19.57. A sustained rupture above this area could mark the beginning of a change in feeling, bringing back the psychological area of 19.60 to attention.

USD/MXN daily graphics

The simple mobile average (SMA) of 10 days, currently in 19.53, continues to act as dynamic resistance, repeatedly limiting the upward attempts. Meanwhile, the Relative Force Index (RSI) is around 40, indicating a slight bearish momentum. Although it is not yet in over -sales territory, the RSI suggests that there is room for a greater fall before a technically driven rebound becomes more likely.

FAQS risk feeling

In the world of financial jargon, the two terms “appetite for risk (Risk-on)” and “risk aversion (risk-off)” refers to the level of risk that investors are willing to support during the reference period. In a “Risk-on” market, investors are optimistic about the future and are more willing to buy risk assets. In a “Risk-Off” market, investors begin to “go to the safe” because they are concerned about the future and, therefore, buy less risky assets that are more certain of providing profitability, even if it is relatively modest.

Normally, during periods of “appetite for risk”, stock markets rise, and most raw materials – except gold – are also revalued, since they benefit from positive growth prospects. The currencies of countries that are large exporters of raw materials are strengthened due to the increase in demand, and cryptocurrencies rise. In a market of “risk aversion”, the bonds go up -especially the main bonds of the state -, the gold shines and the refuge currencies such as the Japanese yen, the Swiss Franco and the US dollar benefit.

The Australian dollar (Aud), the Canadian dollar (CAD), the New Zealand dollar (NZD) and the minor currencies, such as the ruble (Rub) and the South African Rand (Tsar), tend to rise in the markets in which there is “appetite for risk.” This is because the economies of these currencies depend largely on exports of raw materials for their growth, and these tend to rise in price during periods of “appetite for risk.” This is because investors foresee a greater demand for raw materials in the future due to the increase in economic activity.

The main currencies that tend to rise during the periods of “risk aversion” are the US dollar (USD), the Japanese yen (JPY) and the Swiss Franco (CHF). The dollar, because it is the world reserve currency and because in times of crisis investors buy American public debt, which is considered safe because it is unlikely that the world’s largest economy between in suspension of payments. The Yen, for the increase in the demand for Japanese state bonds, since a great proportion is in the hands of national investors who probably do not get rid of them, not even in a crisis. The Swiss Franco, because the strict Swiss bank legislation offers investors greater protection of capital.

Source: Fx Street

I am Joshua Winder, a senior-level journalist and editor at World Stock Market. I specialize in covering news related to the stock market and economic trends. With more than 8 years of experience in this field, I have become an expert in financial reporting.